The Executive Chairman of Comet Properties, Nana Odeneho Kyeremateng, is proposing the establishment of National Housing Fund to help address the challenges facing the affordable housing programmes in the country, particularly financing.

Mr. Kyeremateng argued that such a move will help provide the required seed funding for government to lend to real estate firms to undertake developments for category of workers with low incomes.

“It will also help the banks when it comes to the provision of mortgage for persons earning below some salary levels in the country”, he said.

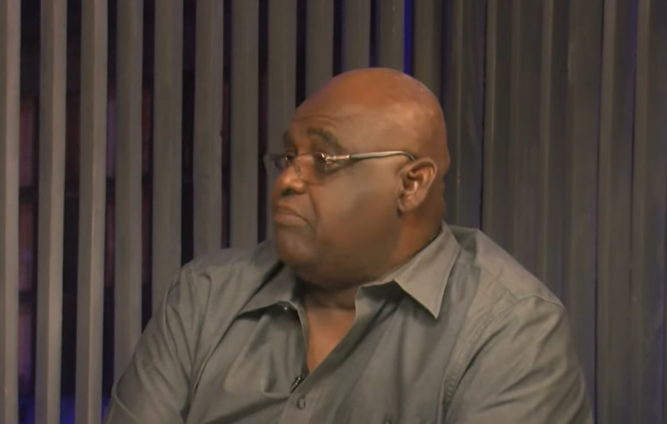

Mr. Kyeremateng was speaking on PM EXPRESS BUSINESS EDITION with host George Wiafe.

According to him, all stakeholders must show commitment to provide decent housing to workers.

“We need to find a lasting solution to the housing challenge thing, otherwise we will be going, round and round the issue and not address anything”, he stressed.

He advised that it will be prudent for the provision of affordable housing in Ghana to be led by the private sector and not government.

Financing National Housing Fund

Providing some more advice, he pointed out that government could look at revenue from the rental tax to finance the Ghana Housing Fund.

He, however, rejected arguments that introducing new taxes might be a more sustainable way of financing the proposed Fund.

He maintained that the suggestion could be a more sustainable way of providing the required financial support for the Ghana National Housing Fund.

Affordable Housing and Mortgage in Ghana

He revealed that a prospective homeowner may need about $40,000 to $50,000 to own a two-bedroom house in the non-prime areas.

On concerns about Ghana’ mortgage system, Nana Kyeremateng argued that the commercial banks cannot be blamed , because access to long term financing in the country is a major challenge for financial institutions.

“That is why mortgage is very expensive and does not favour a lot of people with low incomes in the country”.

The Executive Chairman of Comet Properties, also rejected arguments that most of the properties provided by the real estate firms in Ghana are very expensive.

Latest Stories

-

DMV Party In The Park 2025 postponed due to permit delays

8 minutes -

Galamsey: Prestea Blue Water Guards destroy 8 chanfang machines, seize 8 pumping machines

9 minutes -

10th Ghana Amateur Ladies Open tees off at Centre of the World Golf Club in Tema

24 minutes -

Prof. Peter Quartey cautions Ghanaian youth against calls for military rule

52 minutes -

Nine prison inmates receive scholarships to Jackson University College

1 hour -

Savings and loans sector records 27% growth in lending amidst low NPL rate

1 hour -

Devastating Ahodwo fire displaces over 200 slum dwellers

1 hour -

Government recapitalizes NIB with GH₵1.4bn; ADB, CBG set for 2026

1 hour -

Ghana’s Chef Abbys makes TIME’s 100 Most Influential Creators list

1 hour -

Small Scale Miners Association Chair arrested for confronting anti-galamsey taskforce in Desiri Forest

2 hours -

Stakeholders demand transparent laws to curb corruption and ease business burden

2 hours -

Six arrested over alleged ritual murder at Mafi Adidome

2 hours -

Party work must come first – Mustapha Gbande clarifies overlapping roles debate

2 hours -

GACC marks AU Anti-Corruption Day 2025 with youth campaign in 40 districts

2 hours -

Black Stars maintain 76th spot in latest FIFA ranking

2 hours