Finance Minister, Ken Ofori-Atta, has expressed confidence that government would reach a Staff-Level Agreement with the International Monetary Fund soon for a programme aimed at restoring macroeconomic stability and protecting the most vulnerable.

To this end, it is determined to implement a wide-ranging structural and fiscal reforms to restore fiscal and debt sustainability and support growth.

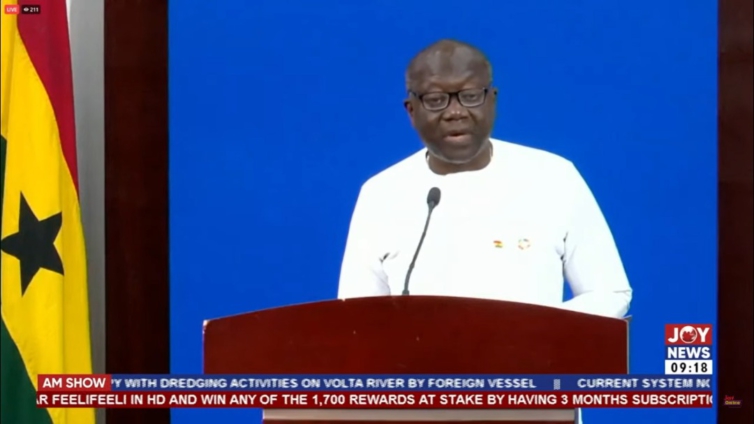

Speaking at the launch of the Debt Exchange Programme, Mr. Ofori Atta said the objective of the programme is to alleviate the debt burden in a most transparent, efficient, and expedited manner.

“In this context, by means of an exchange offer, the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government

bonds”.

The Finance Minister noted that the domestic debt exchange is part of a more comprehensive agenda to restore debt and financial sustainability, adding “we are also working towards a restructuring of our external indebtedness, which we will announce in due course”.

“This is a key requirement to allow Ghana’s economy to recover as fast as possible from this crisis. This is also a key requirement to secure an IMF support”, he explained.

Mr. Ofori-Atta also expressed optimism that the measures put in place, including those outlined in the 2023 Budget Statement and underpinned by a successful IM programme will witness a stable and thriving economy for Ghana from 2023.

Accordingly, he said there is an anticipation that inflation will be returned to single digit, ensuring that real returns on these new bonds will be protected.

The domestic debt operation involves an exchange for new Ghana bonds with a coupon that steps up to 10% as soon as 2025 (with a first interest payment in 2024) and longer average maturity.

Existing domestic bonds as of December 1, 2022, will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037.

The predetermined allocation ratio includes 17% for short bonds, 17% for the intermediate bond, 25% for the medium-term bond and 41% for the long-term bond.

The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi- annual.

Latest Stories

-

Patrick Atangana Fouda: ‘A hero of the fight against HIV leaves us’

29 minutes -

Trinity Oil MD Gabriel Kumi elected Board Chairman of Chamber of Oil Marketing Companies

1 hour -

ORAL campaign key to NDC’s election victory – North America Dema Naa

1 hour -

US Supreme Court to hear TikTok challenge to potential ban

1 hour -

Amazon faces US strike threat ahead of Christmas

2 hours -

Jaguar Land Rover electric car whistleblower sacked

2 hours -

US makes third interest rate cut despite inflation risk

2 hours -

Fish processors call for intervention against illegal trawling activities

2 hours -

Ghana will take time to recover – Akorfa Edjeani

3 hours -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

3 hours -

Finance Minister skips mini-budget presentation for third time

3 hours -

‘ORAL’ team to work gratis – Ablakwa

3 hours -

Affirmative Action Coalition condemns lack of gender quotas in Transition, anti-corruption teams

4 hours -

December 7 election was a battle for the ‘soul of Ghana’ against NPP – Fifi Kwetey

4 hours -

Social media buzzing ahead of Black Sherif’s ‘Zaama Disco’ on December 21

4 hours