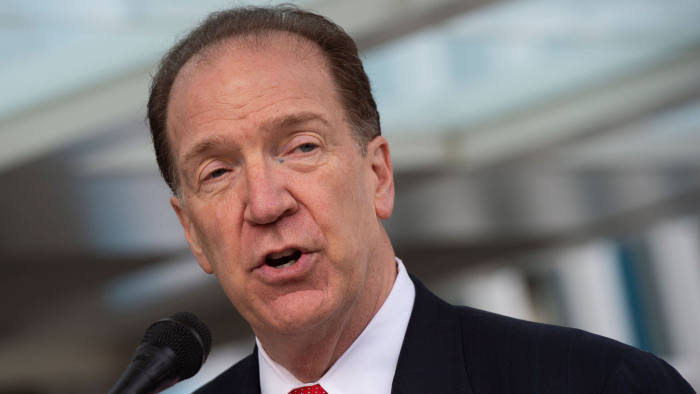

World Bank President, David Malpass, is urging the Bank of Ghana and other financial regulators around the world to use all available tools to help check the rising inflation rate.

The general price levels of good and services in the country hit a record level of 19.4% in March 2022.

The same can be said for other countries, such as the USA and UK, which has seen inflation rate reaching historic levels and threating economic stability.

But speaking from Washington D.C, Mr. Malpass, said the situation calls for some though regulatory measures to help minimise the impact of this development especially on the poor.

“The Central Banks can use tools that add to supply and that allows capital accumulation to improve”. “They’ve been talking about not just interest rates, but also shrinking the balance sheet which I think will have a simulative effect on the global investment climate. This is because it will occupy lesser capital of Central Banks from the current situation”, Mr. Malpass said.

He further said the Central Bank has regulatory policies that can be used to encourage more investments in small and new businesses to expand and create jobs.

“Also, they [Central Banks] have regulatory policies that can be used to encourage more investments in small businesses, in new businesses that will be the dynamic portion of a new economy.”

“Again I stressed market forward looking programmes. So announcements on currency stability having impact, announcement on capital accumulation having positive impact as the world tries to control these crisis [COVID-19 pandemic, Russia/Ukraine war]”, he added.

The Bank of Ghana recently increased the policy rate by 250 basis points to 17% to help fight inflation, reduce the free fall of the cedi then and overall help address the challenges within the economy.

Latest Stories

-

Twifo ’34’ school building collapses, BECE candidates’ study under trees

14 mins -

Court denies man who shot soldier in Kasoa bail

15 mins -

Strategic investor process in final stages, not yet concluded – SSNIT clarifies to Ablakwa

26 mins -

Iran president’s crash: Search teams locate wreckage site

59 mins -

Man accused of robbing widow of former Vice-President Amissah-Arthur denied bail

2 hours -

Hindsight: Dear GFA, where is the DNA?

2 hours -

Mass wedding for Nigeria orphans sparks outcry

3 hours -

Iran’s Ebrahim Raisi: The hardline cleric who became president

3 hours -

Limited Voters Registration: EC corrects error on infographics

3 hours -

US troops to leave Niger by mid-September

3 hours -

SSNIT explains decision to sell 60% stake in 4 hotels to Agric Minister’s firm

4 hours -

SLOPSA celebrates Prof Grace Nkansa Asante as first female Ghana professor of economics

4 hours -

DR Congo army says it has thwarted attempted coup

4 hours -

GPL 2023/24: Aduana beat Hearts to go third; Samartex close in on title

5 hours -

Tipper truck crushes one to death at Kasoa

5 hours