Let the People have the Phones!

The Vice President (Veep) of the Republic of Ghana is also the ruling party’s candidate for the upcoming general elections on 7th December, 2024.

Much of the campaign season this year has been dominated by the Veep’s talent for the theatrical. His latest offer is to rain smartphones on the poor by introducing a novel credit scoring system.

Since low or no income is often the barrier to owning a nice smartphone, credit is obviously essential. In Ghana, interest rates are scraping at 30% in the premium banks and often exceed 60% in the lower rungs of the financial system. Consumer credit, in particular, is normally out of reach of the common citizen, even if they are willing to pay such high interest rates.

To the Veep, all these issues are immediately surmountable because he is introducing a “credit scoring system” backed by the omnipotent “Ghana Card“. (The Ghana Card is the country’s digital national identification system, which has been made mandatory for citizens seeking to access various services such as banking and vehicle licensing.) In sum: 1. Credit Scoring will make smartphones affordable. 2. Ghana Card will make Credit Scoring feasible.

Neither proposition is very lucid. Both propositions are driven by something other than a genuine interest in national credit policy improvement, by something more…self-serving. In this short essay, we will tell you why, but you have to read to the end.

Ghana’s Credit Scoring Situation

Countries around the world have different approaches to ensuring that credit is priced fairly. How much a person pays for borrowing money or buying something now and paying later – i.e. the interest charged on their loans, hire purchases, and other forms of credit – should be accurately and fairly commensurate with the true risk of their likelihood to default. But this is not always so.

Many people that can and are willing to pay back are often slapped with punitive interest rates (or risk premium) just because the person offering the loan or item being purchased on credit doesn’t know them well, or doesn’t trust them.

Credit information systems have developed over many decades to reduce this information asymmetry and level the playing field. When they work well, most lenders know enough about the borrowing and repaying habits of prospective customers to charge the right interest rate reflective of the true risk premium.

Ghana too has been on the road of creating such credit information systems.

Worldwide, such systems usually start with laws and policies to allow the sharing of information about a person’s borrowing habits, their repayment history, and other related factors that can help guide someone intending to provide credit (such as a loan or hire-purchased item) to determine the right level of risk and therefore the right interest rate to charge.

Some jurisdictions then move on to allow for the establishment of so-called “credit reference bureaus” to serve as clearing hubs for this information sharing.

When such hubs emerge, it becomes easier for models, formulas, algorithms, and processes used to make the information held on an individual more comparable with what is known about other individuals. Doing so greatly simplifies the process of charging the right interest rate. You can group borrowers with similar background information into categories and apply simple and complex analysis to those categories collectively.

One approach to such stratification is the generation of standardised credit scores for each borrower group. A person falling within a certain credit score band is then similar to all others in that band and is expected to behave in roughly similar ways when you lend them money or sell an item to them on credit.

Ghana’s Experience

Ghana passed the Credit Reporting Act in 2007 (Act 726) and issued additional regulations in 2020 (LI 2394). The initial stage of ensuring that the laws and policies align with credit scoring therefore started nearly two decades ago. In previous essays (here, and here), I have catalogued this evolution extensively so I will not bore the reader by being repetitive.

The second phase of establishing credit bureaus actually began before the law was ready. The first Credit Bureau, XDS Data, was incorporated in 2003 and became operational in 2004. Since then, others such as Hudson and Dun & Bradstreet have also incorporated and commenced operations (even though Hudson’s license was revoked in 2022). Hudson found it difficult to generate enough revenue to operate.

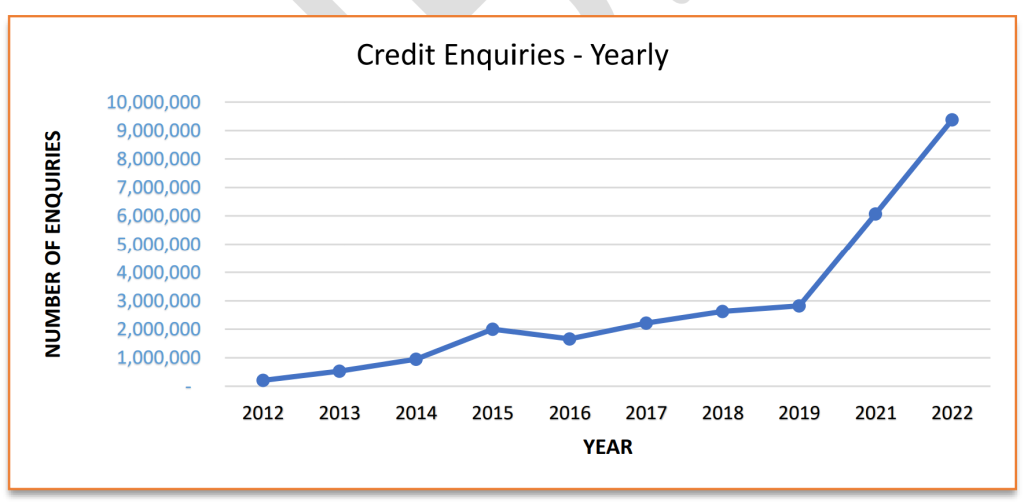

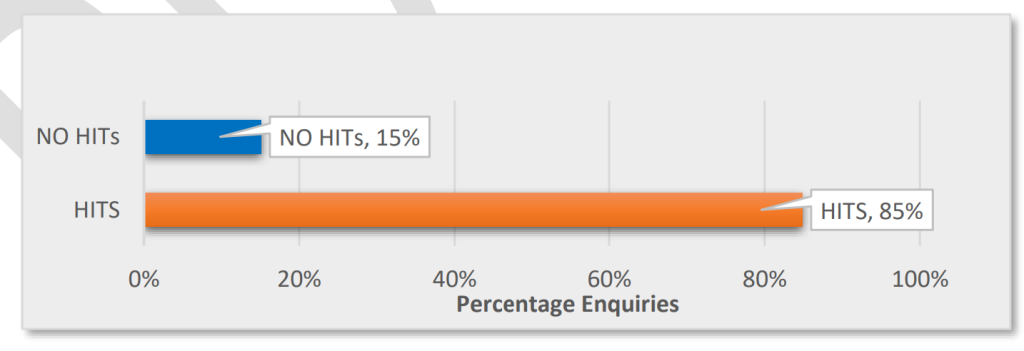

The Bank of Ghana regularly reports about the state of credit referencing in Ghana. The reader can find one such recent report here. In this report, the reader will see that in 2022 nearly 10 million credit checks were performed in Ghana using the existing system.

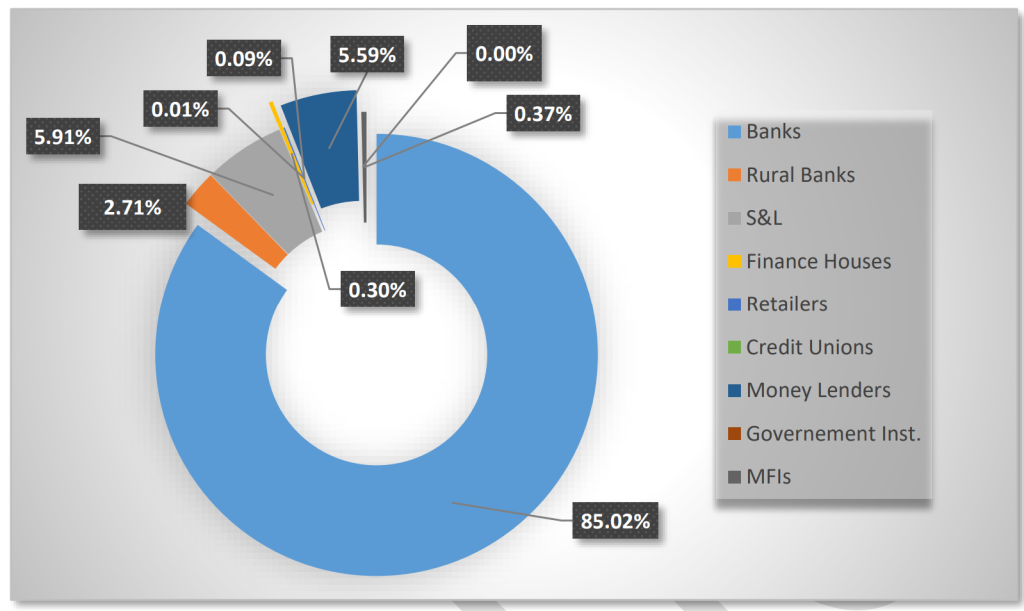

For the lenders that subscribe to the services of Ghana’s credit bureaus, they had an 85% chance of getting the necessary credit intel on prospective borrowers when they run a search.

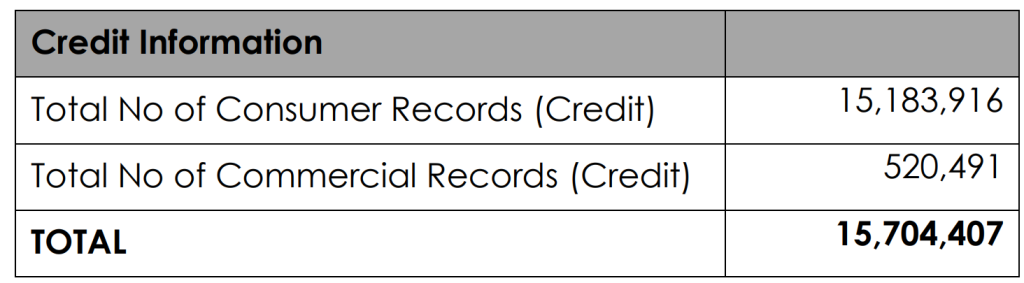

Nearly 15.2 million individual Ghanaians were captured in the system, as well as more than 520,000 businesses.

So, what exactly is the Veep promising to introduce?

Here is where it gets interesting. In previous debates about this subject, the argument has turned on whether credit scores are indeed all that different from credit reports.

The supporters of the Veep claim that the absence of credit scores, a single number that summarises a borrower’s credit report (“credit report” being all the valid, relevant, information held on an individual by a credit bureau), is what is making it hard for citizens to buy phones on credit in Ghana. The introduction of their new credit scoring system will thus address this through the magical intervention of the Ghana Card.

Let’s probe this.

How Credit Scoring Works

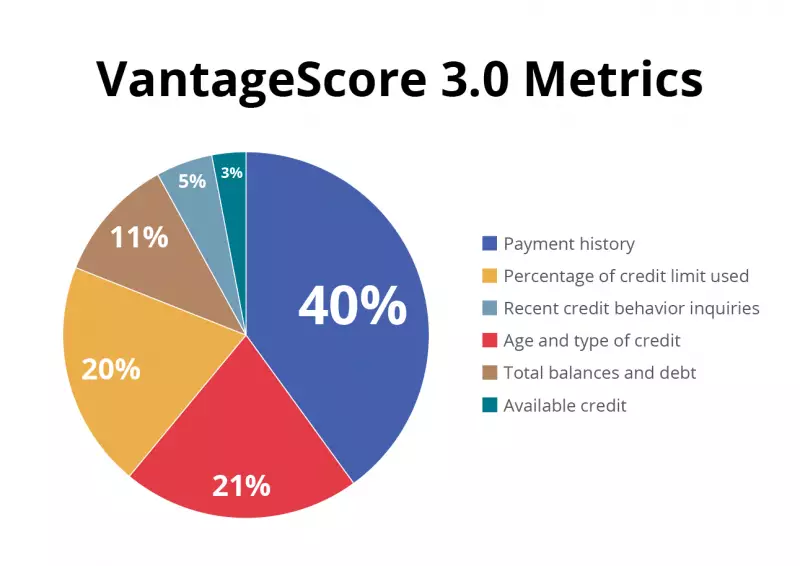

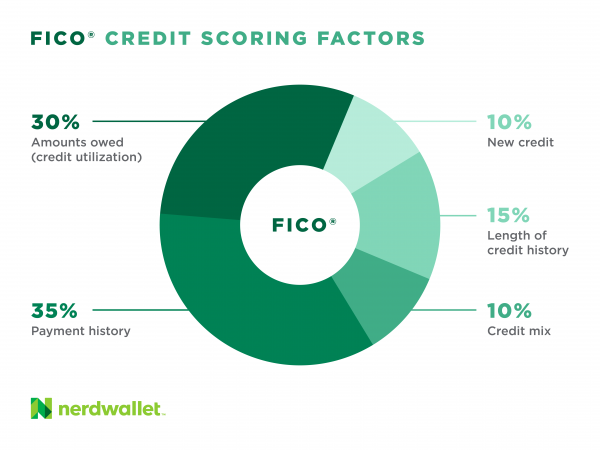

In the United States, credit scoring was invented by two mathematicians, Earl Isaac and Bill Fair, who set up a company called Fair Isaac (now known as FICO) in 1956 with an investment of $400. The FICO model is today the most widely used method in the United States for synthesizing and distilling credit reports into credit scores. In 2006, in order to challenge the near-monopoly of FICO (a situation that, by the way, has triggered more than 10 antitrust investigations), three of the four credit bureaus in the US came together to create a competing model called VantageScore.

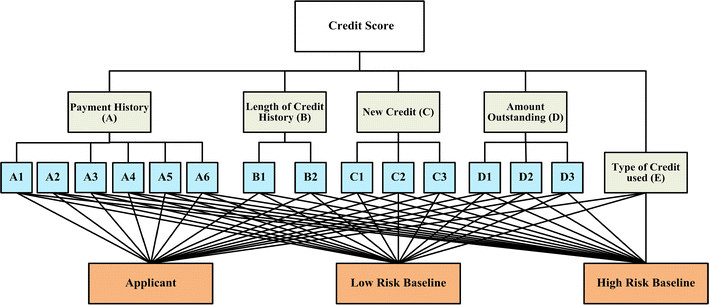

The FICO model has evolved (it is now in its 10th iteration). The 8th version is the most widely used across the United States, and perhaps the world, and can be summed up along the lines below.

In short, FICO has a complex mathematical formula/algorithm embedded in a software suite, that allows information held by credit bureaus on an individual or business to be condensed into a single number by applying different weights to different data points. That software is what generates the score and all one needs is to license it and feed it with data of the requisite scope and quality.

Credit Scoring in Ghana

Let’s reapply this experience to Ghana. Ghana has a law that requires lenders to report information on everyone. If you are a Ghanaian who has ever borrowed money from a licensed lender, it is about 85% likely that such information is held on you. There are two existing credit bureaus – XDS Data and Duns & Bradstreet (D&B). D&B is a big multinational and XDS is a regional multinational with roots in South Africa and operations in Nigeria.

The logic being forced on all of us is that somehow D&B and XDS cannot source software to reduce their reports to a credit score even though they have done so in other markets such as Nigeria and South Africa. How does this make sense?

In the heat of the last controversy, XDS issued a statement. They claimed that there are data quality issues that have stopped them from generating scores in Ghana. They also mentioned that they have hopes of the Ghana Card helping them clean up some of the data issues.

The statement was curious because it contradicted information on the website of the company, which suggested that the company was already offering credit scores in Ghana, at least to some customers, notwithstanding these data issues. Clearly, XDS capitulated under political duress. An unfortunate development since by their statement they gave ammo to political spinmeisters. Worse, they enabled conduct likely to be detrimental to their own industry, as I explain later on.

Nevertheless, and more importantly, the XDS statement confirmed beyond doubt that Ghana Card data is already being reported to the credit bureaus. Whatever Ghana Card can do, it should already be doing in the existing system.

So, the question is: if Ghana has credit bureaus collecting information on millions of Ghanaians already, and these bureaus have been using the Ghana Card already, then why is there a need for the Vice President to set up a new credit scoring system backed by the same Ghana Card?

Credit Scoring formats can vary in place and time

It is important to clarify for the record that a credit information system can work even without credit bureaus and credit scoring, per se. This is the case in France and Japan, where the banks and retailers have followed a different pathway in assessing credit risk.

Anyone who believes that, without a North American style credit-scoring system, making phones available on credit would be impossible is thus patently wrong. Despite not following the North American route, Japan has joined the consumer credit boom sweeping Asia. Credit card networks and financial intel organisations have proved capable of filling any vacuum that may exist.

In the case of France, policy is actually antagonistic to North American style credit reporting due to privacy concerns. Remember that in countries like the US, Ghana, Mexico, Canada, and the UK, there are a bunch of faceless organisations called credit bureaus that get informed by your bank every time you take out a loan or miss a payment. The pesky French would have none of that. They prefer risk management to be siloed at the bank level and pooled within the Central Bank itself. As with many things, there are many ways to kill a cat, and the wise learn from different experiences.

The real challenge in Ghana

But back to the main question. Why hasn’t Ghana’s existing credit information system allowed people to buy phones on credit and pay “1 cedi, 2 cedi” every month? Or cars as earlier promised by the Veep, for that matter?

If you look at the data carefully, the answer is pretty simple. Retailers, the kinds of entities that would normally sell cars and phones on credit in partnership with telcos and the like, are not using the existing credit information system much. Of the 10 million checks conducted in 2022, less than 8000 were by retailers.

Apart from poor awareness, there are other constraints. The credit bureaus, for instance, complain about lax enforcement of the reporting obligation leading to noncompliance on the parts of companies like ECG and Ghana Water, which holds interesting data on consumers. Whilst these companies are meant to share data on their customers with all the licensed credit bureaus, they often don’t.

Without thorough and consistent data, it becomes a challenge to build credit scoring models because, as you might remember, these models aim to predict whether a category of persons will repay their debt or not. To do so requires enough information about each individual in the pool and enough information across enough individuals within a certain clustering pool. A major statistical burden.

It would seem that too many individuals in the current credit data pools in Ghana don’t have enough data across the important dimensions for an ethical credit bureau to attempt to use software from FICO or someone else to generate a predictive credit score. There is a fear of spurious correlations leading to credit scores that are not sufficiently predictive.

Ghana doesn’t face such challenges alone

First, it bears mention that there are countries with even more advanced credit information systems where similar challenges have prevented the most efficient use of credit scoring even when all the preconditions and capabilities exist for credit scores to be generated.

For example, in Indonesia, credit bureau coverage is still in the low 20% range. In China 70% of the population have no credit score. In Thailand, existing credit bureaus are accused of facilitating “blacklists” rather than leveling the playing ground. In Malaysia, courts are sparring with credit bureaus about their power to even create credit scores after inaccuracies in credit reports led to lawsuits.

In simple terms, the credit scoring hurdle is not one that any politician can scale by waving a magic wand. The idea that a simple national ID will brush away complex statistical, sociological, financial, and operational challenges is completely preposterous. More so when the countries that have embraced the credit score system most enthusiastically – the US, Canada and the UK – don’t even have mandatory national ID systems like the Ghana Card.

So, then, what REALLY is driving the Veep

Many Ghanaians have taken the Veep’s promises as standard “campaign platform talk”. Some have tried to dismiss it as gimmickry, whilst his supporters lament the lack of vision of his opponents. Sadly, the entire debate is misplaced.

In recent times, I have resorted to the term, “state enchantment“, to describe situations where politicians invest massive energy in Public Relations (PR) to spin a narrative of “national glory, success or advancement” as justifying particular projects when in fact the projects are being pursued purely to advance the commercial interests of their friends. That is exactly what is happening in this “buy smartphones for credit” initiative.

The whole effort to “create a credit scoring system” backed by the Ghana Card when one already exists in Ghana and utilises Ghana Card data is driven by a desire to see a mushroom credit bureau succeed. Why? Because it is owned by close associates.

This mushroom entity, called MyCredit Score Limited, was set up in February 2023, twenty years after the first bureau in Ghana, XDS, and just after the Vice President started his campaign to make it possible for people to buy cars on credit using the Ghana Card.

MyCredit Score has seven Directors including Ernest Apenteng of Hubtel, Francis Blay of Omni Strategies/Akofis Group, and Aisha Yuuni of Datrix Tech. All these individuals have tight business associations with other initiatives involving Ghana’s Veep, such as the Tap n Go transport digitalisation project, Ghana.gov, and the ECG electricity retailing system and mobile app. In fact, in a bout of coordinated PR, ECG announced right after the Veep’s campaign speech that it has launched its pay on credit scheme.

Francis Blay is the ultimate beneficial owner of MyCredit Score even though he controls 50% of the shares. The others holding the remaining shares, presumably on his behalf, are the CEO and Sales Director of Hubtel.

There is something curious about how Francis Blay, a one-time Maryland US resident, does business. Ownership of his other companies is often vested in relatively junior employees such as Joshua Maxwellson, Emmanuel Opei-Kumi, and Eric Takyi. Their roles in Blay’s organisations are often described by titles such as “procurement executive” and “monitoring officer”.

That Francis Blay is a close associate of Ghana’s Veep is beyond doubt given the extent to which the Veep has gone to impose his mushroom entity on the credit scoring landscape.

Blay’s relatives include politicians in the ruling party, NPP, and senior officials at the Vice Presidency of Ghana.

The passion of the Vice President for extending credit to the poor so that they too may taste the goodness of smartphones (after first arming them with Ghana Cards, of course) cannot be fully explained until these pieces are put together.

This is a developing story.

Latest Stories

-

CHAN 2024Q: Ghana’s Black Galaxies held by Nigeria in first-leg tie

32 minutes -

Dr Nduom hopeful defunct GN bank will be restored under Mahama administration

1 hour -

Bridget Bonnie celebrates NDC Victory, champions hope for women and youth

1 hour -

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

2 hours -

Akufo-Addo condemns post-election violence, blames NDC

2 hours -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

4 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

4 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

4 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

4 hours -

Syria’s minorities seek security as country charts new future

5 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

5 hours -

German police probe market attack security and warnings

5 hours -

Grief and anger in Magdeburg after Christmas market attack

5 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

6 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

6 hours