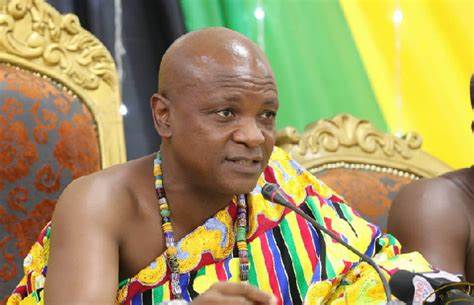

The Paramount Chief of the Asogli State, Togbe Afede XIV, has strongly criticised the recent decision made by the Bank of Ghana (BoG) to reduce the policy rate from 30% to 29%.

According to him, such a reduction will have no impact on the economy thus labelling it as nothing more than a "major mockery."

The BoG's Monetary Policy Committee (MPC) declared this reduction on January 29, 2024, with Togbe Afede expressing skepticism regarding the potential impact of this slight decrease.

In a statement issued, Togbe Afede questioned the reasoning behind the 1% reduction, stating that it is challenging to comprehend how such a minimal adjustment, transitioning from 30% to 29%, would substantially affect lending rates, inflation, exchange rates, or economic growth.

He expressed uncertainty about whether BoG officials have thoroughly evaluated the correlation between interest rates, inflation, and exchange rates within the country.

Expressing astonishment at the conservative rate adjustment, Togbe Afede criticized the Bank of Ghana's (BOG) focus on year-on-year inflation, describing their strategy as responsive; that is reacting to past price fluctuations rather than foreseeing future inflation patterns.

He contended that the policy rate reduction appears to be a response to the 3.2% decline in headline inflation observed in December 2023.

"The Bank of Ghana Monetary Policy Committee (MPC) on Monday, January 29, 2024, announced a cut in the key policy rate of 100 basis points, from 30% to 29%. This sounds like a big joke. It is hard to imagine what impact our BoG officials expect a 1% reduction from 30% to make on lending rates, inflation rate, exchange rate or economic growth, let alone what they expect to learn or observe from it. I wonder whether they have determined the correlation between interest rates, inflation, and exchange rates in our country."

"The hesitant 1% rate cut to 29% is particularly surprising given their expectation that headline inflation would “ease to 15% ± 2% by the end of 2024 and gradually trend back to within the medium-term target range of 8% ± 2% by 2025”.

"I do not see a relationship between the expected or target 15% ± 2% inflation and the high 29% monetary policy rate. It gives the impression that our top economists do not believe in themselves or their own forecasts."

Latest Stories

-

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

34 minutes -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

48 minutes -

Top 20 Ghanaian songs released in 2024

1 hour -

Beating Messi’s Inter Miami to MLS Cup feels amazing – Joseph Paintsil

1 hour -

NDC administration will reverse all ‘last-minute’ gov’t employee promotions – Asiedu Nketiah

2 hours -

Kudus sights ‘authority and kingship’ for elephant stool celebration

2 hours -

We’ll embrace cutting-edge technologies to address emerging healthcare needs – Prof. Antwi-Kusi

2 hours -

Nana Aba Anamoah, Cwesi Oteng special guests for Philip Nai and Friends’ charity event

2 hours -

Environmental protection officers receive training on how to tackle climate change

2 hours -

CLOGSAG vows to resist partisan appointments in Civil, Local Government Service

3 hours -

Peasant Farmers Association welcomes Mahama’s move to rename Agric Ministry

3 hours -

NDC grateful to chiefs, people of Bono Region -Asiedu Nketia

4 hours -

Ban on smoking in public: FDA engages food service establishments on compliance

4 hours -

Mahama’s administration to consider opening Ghana’s Mission in Budapest

4 hours -

GEPA commits to building robust systems that empower MSMEs

4 hours