“There will be no haircuts, so I urge all of you to ignore the false rumours”. President Akufo-Addo on 30th October 2022 in a nationally televised address, emphatically assured investors not to panic.

He added, “I want to assure all Ghanaians, no individual or institutional investor, including pension funds, in Government treasury bills or instruments will lose their money, as a result of our ongoing IMF negotiations.”

CLAIM: No individual or institutional investor, including pension funds, in Government treasury bills or instruments will lose their money, as a result of our ongoing IMF negotiations.

The term “haircut” is not literal, in the context of debt restructuring, it simply means lowering of accrued interest or a portion of a bond payable that will not be serviced.

This circumstance might happen if a sovereign state or business decides to restructure its debt and bargains new terms with existing bondholders. In simple terms, a reduction in an investor's accrued interest or principal as a result of debt operation exercise can be classified as a ‘haircut’.

After the speech on TV, the President also sent a tweet and it attracted 944 likes, 197 retweets and 248 comments.

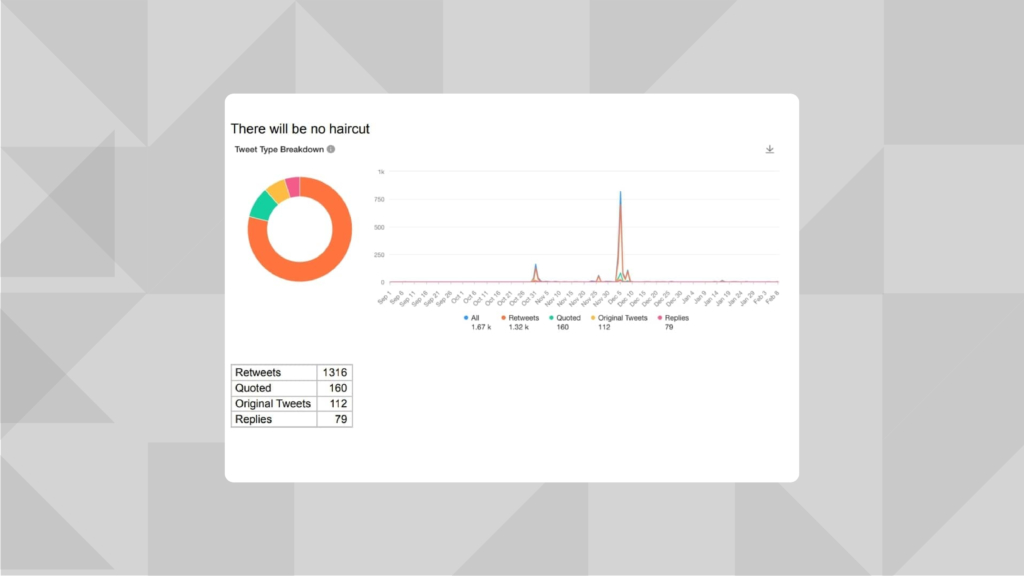

Although there was no hashtag, the phrase "there will be no haircut" was used or retweeted 1316 times, quoted 160 times and the replies were 79 times while the original tweets carried the phrase 112 times.

Member of Parliament for Sekondi, Andrew Agyapa Mercer, felt reassured and tweeted shortly after the President tweeted: "Contrary to the fear-mongering peddled by the NDC, there will be no 'haircut' on investor funds. Reassuring…”

Others who were assured by the President’s statement urged the media to publish the President’s assurance. Twitter user @GhanabaYawAdofo tweeted: “I hope the media who magnified the haircut propaganda will equally magnify the assurance by Mr. President that there will be no haircut."

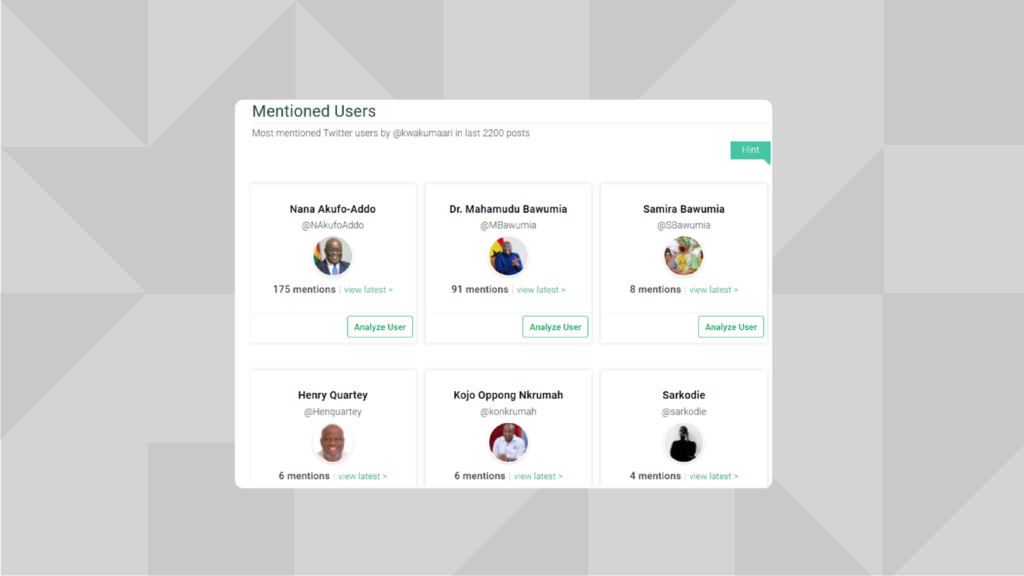

Another user @KwakuMaari mentioned people who are largely personalities in the ruling government in his tweets; “There will be no haircut on your investments and again your treasury bills are fully protected. All individual domestic bondholders, including pensioners who buy bonds to supplement their pension, are also safe."

President Akufo-Addo’s big assurance of no ‘haircut’ brought enormous relief to the investor community. Larry Jiagge, a 65-year-old pensioner and bondholder told JOYNews he felt reassured when the President spoke. He said: “I was like, this is the right thing to do and it made me calm.”

Roberta Sittie also a bondholder said, “it was reassuring at that time when the President said there will be no haircut”. Little did they know that they were in for the biggest shock of their lives.

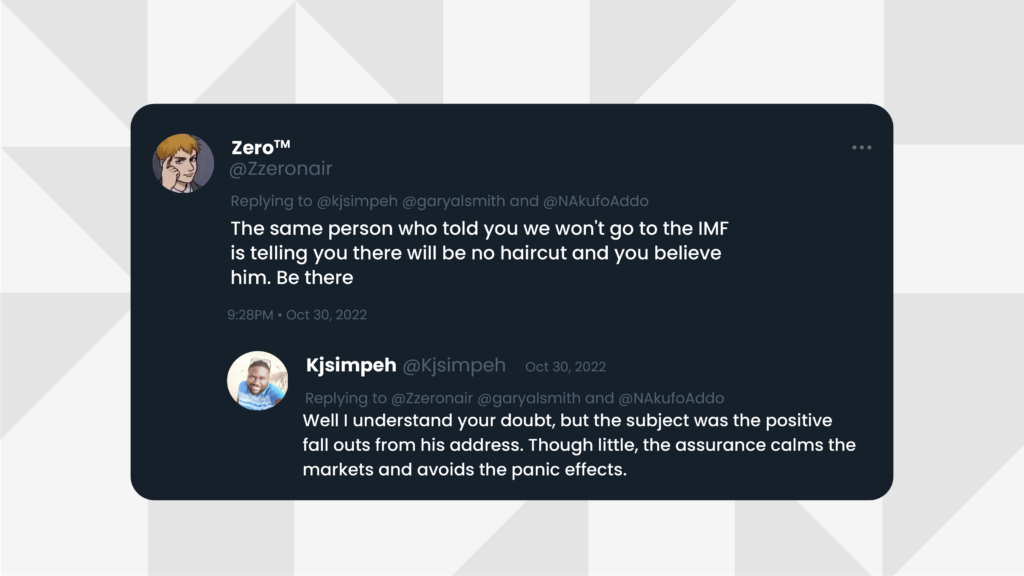

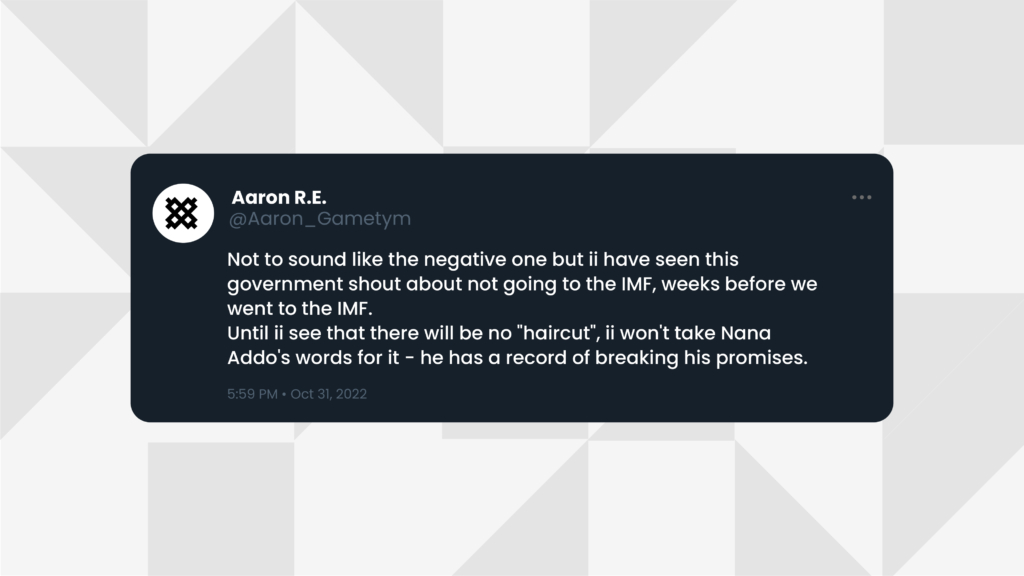

A Ranking Member of the Parliament Finance Committee Dr. Casiel Ato Forson disagreed with the President and tweeted: “Folks this same government told us not to go to IMF and did a U-turn. Today @NAkufoAddo is telling the world there will be no haircut for individual and institutional investors. Mark my words, another U-turn is bound to happen!”

The President’s assurance was subjected to different interpretations by government officials on the true meaning of "no haircut." First was Minister for Information, Kojo Oppong Nkrumah. In his attempt to explain what the President meant, he indicated that in his understanding “no principals will be touched. No principals will have a haircut." In other words, your principal may remain, however, you may lose out or suffer haircuts on the interest. This is interest rightfully due you for investing in government security, which is meant to be risk-free (one of the safest investment instruments around).

Gabby Otchere-Darko, the President’s cousin also tweeted: “Akufo-Addo’s assurance of no 'haircuts' covers just principal," referencing an article published on myjoyonline.com.

Kojo Oppong Nkrumah played the linguist by clarifying what the President said by insisting “there will no haircut on principals." But it created a ball of confusion. Many did not know whom to believe, the President or the Information Minister.

Then came the biggest revelation in November 2022, less than a month after the President had urged investors to ignore any information of a possible 'haircut’.

In delivering the much-anticipated 2023 budget, Finance Minister, Ken Ofori-Atta confirmed the obvious. He officially unmasked the nature of Ghana’s debt portfolio. According to him, an analysis of Ghana’s debt shows a “moderate” rated debt carrying capacity and an overall risk rating of “high risk of debt distress” and "unsustainable due to the negative effects of exogenous shocks on the economy which worsened existing vulnerabilities.”

In simple terms, the government could face difficulties in carrying a debt burden worth GHS467.4 billion [$48.9 billion] (as of September 2022), and may not be able to service its loans as planned. Default was imminent as predicted by some international credit ratings agencies.

After being kicked out of the international capital market, the Ghana government’s only option was to turn to the IMF for a $3.00 billion bailout package. But unlike our sixteenth enrolment in 2015, Ghana’s current unsustainable debt levels were certainly a huge obstacle in obtaining a deal. A lot of conditions must be met!

According to the fund “in cases where a country’s debt is assessed as unsustainable, the IMF is precluded from providing financing unless the member takes steps to restore debt sustainability, including by seeking a debt restructuring from its creditors. The IMF and World Bank still need to conduct a thorough update of the debt situation through a new Debt Sustainability Analysis (DSA), which will then be presented to our Executive Board when it considers the authorities’ programme request.”. IMF’s message was lucid; restructure your debt or no bailout package.

After considering all the conditions and the precarious nature of the country’s debt portfolio, Ken Ofori-Atta in the 2023 budget hinted government was planning to carry out a debt operation exercise – default. This was to create enough fiscal space for a $3 billion Extended Credit Facility programmed from the Bretton Woods Institution.

Investors began to doubt the earlier assurance given by the President. Subsequent happenings heightened their fears.

Barely five days after the embattled Finance Minister confirmed the country’s decision to carry out a debt operation exercise, an international credit rating agency, Moody’s dropped Ghana’s long-term sovereign bonds ratings to deeper junk territories.

According to Moody’s, its ‘Ca’ rating reflects their expectation that “private creditors will likely incur substantial losses in the restructuring of both local and foreign currencies debts planned by the government as part of its 2023 budget proposed to Parliament on 24 November, 2022.”

On 4th December 2022, the government fulfilled its sovereign component of the bargain; it finally announced a debt operation exercise called “Domestic Debt Exchange” which outlined the nature of debt restructuring for domestic creditors.

Finance Minister Ken Ofori-Atta revealed the programme was “to invite holders of domestic debt to voluntarily exchange approximately GH¢137 billion of the domestic notes and bonds of the Republic, including E.S.L.A. and Daakye bonds, for a package of New Bonds to be issued by the Republic.”

He further disclosed that “under the programme, domestic bondholders will be asked to exchange their instruments for new ones. Existing domestic bonds as of 1st December 2022 will be exchanged for a set of four new bonds maturing in 2027, 2029, 2032 and 2037. The annual coupon on all of these new bonds will be set at 0% in 2023, 5% in 2024 and 10% from 2025 until maturity. Coupon payments will be semi-annual.”

The Minister however emphasized that “the Government of Ghana has been working hard to minimize the impact of the domestic debt exchange on investors holding government bonds, particularly small investors, individuals, and other vulnerable groups.”

As a result, “Treasury Bills are completely exempted and all holders will be paid the full value of their investments on maturity.” The Finance Minister announced that “there will be NO haircut” on the principal of bonds and that individual holders of bonds will not be affected.

There was an upsurge in tweets on “haircuts”. Data obtained from Meltwater showed that after the announcement over 750 tweets captured the phrase “there will be no haircut”.

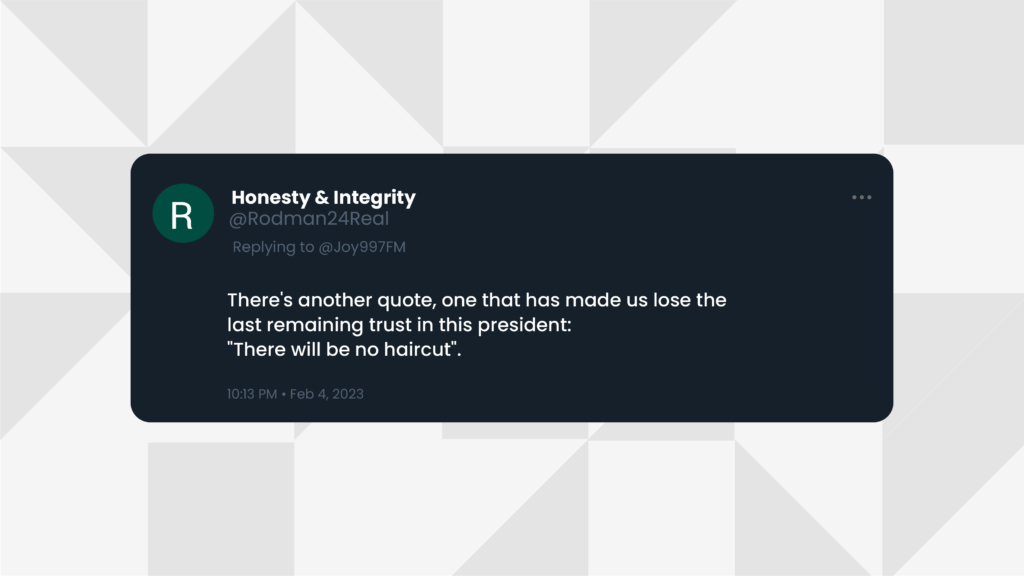

Many people were largely contrasting the President’s “there will be no haircuts” with the Finance Ministers “there will be no haircut on principals of bonds."

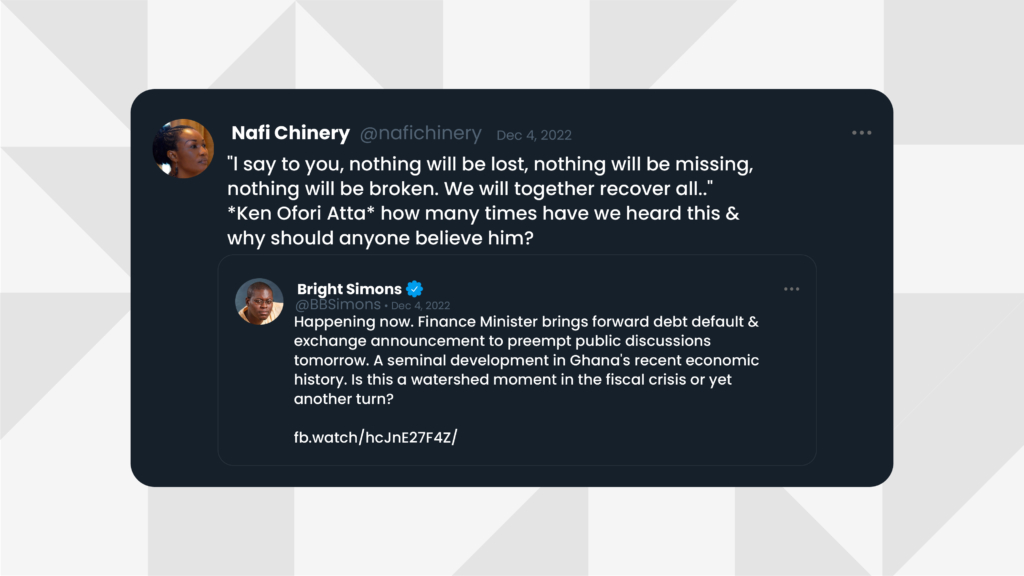

Some Twitter users were not happy with the ever-changing stance of the government. One user @nafichinery tweeted: “I say to you, nothing will be lost, nothing will be missing, nothing will be broken. We will together recover all. Ken Ofori-Atta how many times have we heard this & why should anyone believe him?”

The tweets above clearly show people’s distrust of the President and the government because of the flip-flopping stance.

Was the promise of “there will be no haircut” just a way of calming nerves or another clever way to swindle investors? President Akufo-Addo has information at his beck and call. He has speech writers and researchers who have the responsibility of helping him deliver accurate information. The President read from a prepared speech so why would he get it blatantly wrong?

Economist and Professor of Finance Godfred Bokpin told JoyNews: “If you again look at the time the President made the statement and how the market reacted to it - it didn't change much. So, what that tells you is that instantly the market knew the President wasn't speaking the truth”.

The first group to taste the ‘pill of disappointment’ was Organised Labour. Government had decided to include pension funds in the debt operation exercise; the group had to fight government for weeks to exempt them from the programme.

Other government assurances to investors couldn’t stand the test of time as it made a sharp U-turn on December 23, 2022 putting the hopes of individual bondholders into disarray. It had revised its decision to exclude individual bondholders from the Debt Exchange Programme.

An amended clause contained in the legal document governing the programme revealed that the type of investors that can participate in the Invitation to Exchange had been expanded to now include Individual Investors. This came as a big shock to these natural persons holding government securities in the form of bonds. Like most investors, they had relied on both President Akufo-Addo and Finance Minister, Ken Ofori-Atta’s assurance of an exemption.

FLIP-FLOPPING STANCES

First, President Akufo-Addo assured all investors that "there will be no haircuts." Twenty-four days later, Deputy Finance Minister, John Kumah, disclosed that “for foreign bondholders, government is proposing a 30% haircut on both principal and interests.”

Second, was Ken Ofori-Atta’s assurance that the current “domestic debt exchange programme will not affect individual bondholders." This lifeline could not stay long on the exemption list as government reversed this decision barely eighteen days after.

Without any condition, government also indicated that “treasury bills are completely exempted and all holders will be paid the full value of their investments on maturity.” However, page 13 of the Amended and Restated Exchange Memorandum states “treasury bills issued by the Republic and certain non-marketable securities issued by the Republic are not subject to this Invitation to Exchange. Such treasury bills and non-marketable securities may, however, be the subject of other exchanges and purchases by the Government of Ghana from time to time.”

With this condition in full swing, experts say the government may make a U-turn to include treasury bills in their quest to slash domestic debt to a sustainable level. For this and many other reasons, a group called Individual Bondholders Forum (IBF) has called on all individual holders of government securities in the form of bonds to reject and refrain from complying with the mandatory deadline imposed under the Domestic Debt Exchange programme.

For domestic creditors, the information on the Domestic Debt Exchange Programme continues to swing like a pendulum and investors have been left at the mercy of disinformation at such a crucial moment.

Misinformation is simply false information that is not deliberate. Disinformation is false information deliberately spread to deceive people. On this score, did the President misinform the public or disinform the public?

VERDICT: Per this analysis, there is enough evidence to show that President Akufo-Addo's claim that no individual or institutional investor, including pension funds, in Government treasury bills or instruments will lose their money, as a result of our ongoing IMF negotiations was misleading.

Till date, individual holders of government's bonds who decided not to participate in government's Domestic Debt Exchange Programme have not been paid their coupons nor principals.

Latest Stories

-

BoG acted within labour law terminating employment of some persons – Austin Gamey

17 minutes -

‘Work to make NPP attractive’ – Former Constituency Chairman charges

25 minutes -

NPP no longer upholds its tradition of firm leadership – Patrick Boamah observes

28 minutes -

Initially, I didn’t want to show my face, but I do now – Arathejay

35 minutes -

Today’s Front pages: Tuesday, June 24, 2025

38 minutes -

GTBank Ghana changes corporate logo

1 hour -

Patrick Boamah appeals to Kufuor and Akufo-Addo to rein in NPP leadership

2 hours -

Deputy Trade Minister reaffirms gov’t’s commitment to local textile, garment industry growth

2 hours -

Trump says Iran-Israel ceasefire now in effect

2 hours -

Ghanaians made their choice with clarity in 2024 – Okaikwei Central MP

2 hours -

Ex-President Kufuor alarmed by NPP’s internal turmoil – Patrick Boamah claims

2 hours -

Gov’t to make disability inclusion legal obligation – Deputy Education Minister

2 hours -

Mahama appoints renowned Turkish-trained humanitarian as Ghana’s ambassador to Turkey

2 hours -

Spektra Global puts sustainability and safety first in new GIA headquarters

2 hours -

76 officers pass-out from GAFCSC Junior Staff Course

2 hours