The unveiling of the LUMI currency marks a pivotal moment in Africa's journey towards financial inclusivity and economic empowerment, particularly in regions historically sidelined by conventional banking systems. In Sub-Saharan Africa, where an estimated 66% of the population is unbanked, the LUMI offers a groundbreaking solution, bridging the gap between modern financial services and the vast, untapped potential of the continent's informal economy.

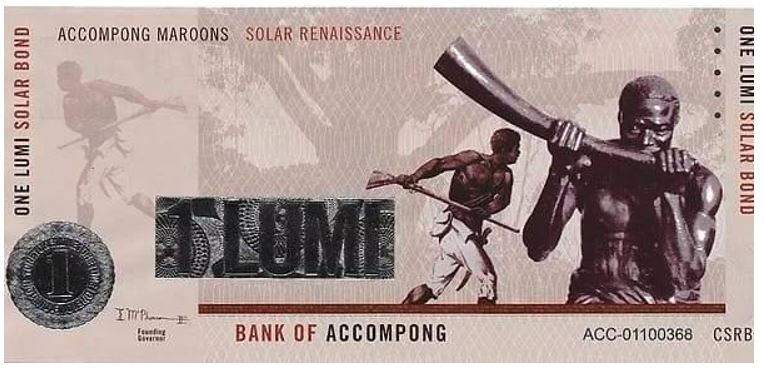

As Africa witnesses an unprecedented digital economic boom, the LUMI currency emerges as a key player, enabling millions to engage with the digital economy through platforms such as "Swiffin Transact." This initiative not only democratizes access to financial services but also champions environmental sustainability. Each LUMI unit, backed by 100kWh of solar energy, underscores Africa's leadership in adopting green economic models, despite its minimal contribution to global carbon emissions.

The currency embodies the aspirations of the African Union's Agenda 2063, aiming for a continent that is fully integrated, prosperous, and sustainably developed. The LUMI's introduction is a testament to Africa's commitment to innovation, unity, and sustainable growth, aligning with the foundational goals of the 1963 Charter of the Organization of African Unity and the 1991 Abuja Treaty. It represents a significant step forward in realizing a cohesive economic strategy for Africa and its diaspora, promising a future where financial inclusion and environmental stewardship go hand in hand.

Historic Perspective

Tracing back through the corridors of history, the shadow of colonialism and the scourge of slavery indelibly marked the African Diaspora, profoundly influencing its economic trajectory. Against this backdrop, the inception of the African Diaspora Central Bank (ADCB) stands as a beacon of hope and a catalyst for economic renewal across Africa and its global diaspora.

The bank's launch of the LUMI currency is a testament to its visionary approach towards creating a resilient and sustainable economic future. Anchored in the dual pillars of renewable energy and tangible gold reserves, the LUMI represents a bold step towards rectifying the financial marginalization that afflicts 66% of adults in Sub-Saharan Africa (World Bank, 2014) by ushering them into the realm of financial inclusion and empowerment.

The LUMI's global acceptance in 190 countries not only signifies its appeal beyond the African continent but also heralds the dawn of a new economic era, characterized by inclusivity and sustainability. This innovative currency seamlessly aligns with the ambitions of the African Continental Free Trade Area (AfCFTA), embodying the spirit of economic unity and integration espoused by the ECO-6 initiatives.

The transformative impact of the LUMI is underscored by its pivotal role in facilitating over 80 million transactions, amounting to a staggering 74.97 billion AKL in 2021 alone. Such figures not only highlight the currency's utility and acceptance but also underscore its vital contribution to the economic resurgence and empowerment of the African Diaspora.

As the LUMI steers through the complexities of global finance, it redefines the contours of economic participation for millions, bridging historical divides and fostering a future where prosperity is shared and sustainable.

In doing so, the LUMI currency emerges not merely as a medium of exchange but as a symbol of Africa's resilience, innovation, and enduring quest for economic sovereignty. This narrative arc, from the chains of the past to the liberation of economic futures, encapsulates the essence of the LUMI's contribution to the African Diaspora's economic renaissance, setting the stage for a legacy of growth, unity, and empowerment that transcends generations.

Treaty Signings and Global Collaborations

The ADCB's landmark treaty signings and global collaborations have ushered in an era of unprecedented economic and cultural synergy. The peace and friendship treaty, a tripartite agreement between the Nation of Hawai’i, ECO-6, and the Republic of Vanuatu, signed on January 15, 2024, heralds a new chapter in fostering global unity, sustainable development, and economic empowerment across indigenous territories worldwide. By hosting the World Indigenous Bank, the Nation of Hawai'i Central Bank signifies a concrete step towards actualizing a shared vision of prosperity, peace, and environmental stewardship.

The ADCB's strategic launch of the World Indigenous Bank (WIB) and the endorsement of the LUMI as the official currency mark a bold leap towards integrating eco-friendly financial mechanisms that are both innovative and sustainable. With its value pegged to solar energy and gold, the LUMI transcends traditional currency models, embodying hope, resilience, and a commitment to sustainable economic practices. This initiative aligns perfectly with the African Union's Agenda 2063, which envisions a prosperous Africa that leverages its own resources to drive its development in a sustainable and environmentally conscious manner.

The treaty embodies a multi-dimensional approach to collaboration, covering essential sectors such as trade, investment, tourism, culture, and friendship. It underscores a collective determination to honor indigenous wisdom and traditions while fostering modern economic practices that are inclusive and environmentally sustainable. The ADCB, through this treaty, demonstrates its dedication to enhancing commercial trade and development in a manner that respects cultural heritage and prioritizes climate action.

Moreover, the treaty's recognition of the invaluable role of indigenous cultures sets a precedent for future economic models that integrate traditional knowledge with contemporary financial practices. This comprehensive framework for collaboration and development represents a hopeful vision for the future, where technological advancements and ancient wisdom converge to create a more equitable and sustainable world.

Expanding beyond this foundational agreement, the ADCB and Vanuatu Trade Commission's ongoing discussions with nations like Dubai, Turkey, India, Mauritius, Kailaasa nation and Malaysia to incorporate the LUMI into their economic systems exemplify the currency's growing influence and potential for global integration. The positive feedback from these discussions signals a growing consensus on the value and utility of the LUMI as a tool for fostering global economic inclusion, sustainability, and development.

This network of treaties and collaborations not only facilitates a broader acceptance and use of the LUMI but also places Africa and its diaspora at the forefront of a global movement towards sustainable and inclusive economic development. The ADCB's efforts in pioneering such initiatives are evidence to Africa's leadership in crafting a future where economic growth and environmental sustainability are not mutually exclusive but are instead intertwined goals achieved through global partnership and innovation.

Case Studies: Ghana and ECOWAS

In a strategic move towards economic revitalization, Ghana stands at the point of a transformative financial era with the phased implementation of the LUMI currency within the Economic Community of West African States (ECOWAS). With Liberia leading the charge, Ghana, alongside Nigeria, Sierra Leone, and The Gambia is slated for the integration of this innovative currency, signaling a new chapter in West Africa's economic narrative.

This initiative, marked by the historic visit of the Vanuatu Trade Commission to Ghana's President Nana Addo Dankwa Akufo-Addo, underscores the global confidence in the LUMI's potential to fortify economies.

The LUMI, underwritten by renewable energy and pegged to gold, offers a unique opportunity for Ghana and its ECOWAS counterparts to bolster trade, enhance financial inclusivity, and foster sustainable development. This aligns seamlessly with Ghana's green energy commitments and its pursuit of economic diversification. As the region grapples with economic challenges, the LUMI emerges as a beacon of hope, promising to mitigate currency fluctuation costs, streamline cross-border transactions, and inject a new vitality into the local and regional markets.

Moreover, the global collaboration with nations such as Dubai, India, Turkey, and Malaysia on the LUMI integration heralds an unprecedented opportunity for ECOWAS to position itself as a dynamic participant in the global economy. This partnership not only amplifies the economic benefits of the LUMI but also enhances its viability as a stable and sustainable currency option.

Ghana's engagement with the LUMI, catalyzed by discussions between President Akufo-Addo and the Vanuatu Trade Commission, reflects a strategic foresight to harness the currency's potential for economic empowerment and regional solidarity. Embracing the LUMI, Ghana and ECOWAS are not just adopting a currency; they are endorsing a vision for an economically unified Africa that is resilient, self-reliant, and globally competitive.

As the LUMI paves the way for economic innovation, Ghana's proactive stance, coupled with the support and collaboration of its West African neighbors and global partners, sets a precedent for the transformative power of financial inclusion and sustainable development. The LUMI's integration into Ghana and ECOWAS is more than a financial shift; it is a demonstration to the power of unity, vision, and collaborative effort towards achieving economic prosperity and empowerment.

Financial Inclusion Facilitated by the LUMI

The LUMI currency emerges as a transformative force in advancing financial inclusion across Sub-Saharan Africa, where traditional banking infrastructures have left a significant portion of the population on the margins. According to World Bank data, approximately 350 million individuals in this region are excluded from conventional financial services, underscoring a critical gap in economic empowerment and access. The deployment of the LUMI through digital platforms such as Swifin and HanyPay represents a significant leap forward in bridging this divide.

This innovative approach leverages the LUMI's stability and broad accessibility to address the challenges of financial exclusion. Integrating with platforms specifically designed to cater to those without formal bank accounts, the LUMI facilitates a range of financial transactions, from savings to payments, that were previously out of reach for many. This inclusivity is critical in a region where the World Bank highlights that only 43% of adults have a bank account, leaving the majority without the means to engage in the formal economy effectively. The LUMI's design, underwritten by renewable energy and pegged to tangible assets like gold, offers a reliable alternative to volatile local currencies.

This stability is paramount in countries where inflation can erode savings and deter individuals from using traditional financial services. Moreover, the LUMI's alignment with digital platforms caters to the rapidly growing mobile phone penetration in Africa, which GSMA Intelligence reports at over 44% in Sub-Saharan Africa, providing a ready infrastructure for its adoption and use.

Environmental Impact of the LUMI

The LUMI currency, underpinned by solar energy, heralds a new era of environmental sustainability within the economic landscape. As the global solar energy market continues to experience unprecedented growth—from $94.6 billion in 2022 to a projected $300.3 billion by 2032, according to Solar Energy Market Research—this innovative currency firmly positions itself at the intersection of economic development and renewable energy adoption. With a compound annual growth rate (CAGR) of 12.3% from 2023 to 2032, the solar energy sector embodies the dynamism and potential for a sustainable future, making it an ideal backbone for the LUMI.

This strategic alignment with solar energy not only amplifies the LUMI's role in fostering a green economy but also ensures its resilience against the volatilities associated with fossil fuel-dependent economic systems.

The reliance on renewable energy sources for its underwriting establishes the LUMI as a currency that promotes not just economic stability but also environmental stewardship. As the world grapples with the challenges of climate change and the urgent need for sustainable solutions, the LUMI offers a blueprint for integrating renewable energy into the very fabric of financial transactions.

Furthermore, the global shift towards renewable energy, particularly solar power, is driven by a combination of escalating energy demands and the imperative for sustainable resources. Governments worldwide are enacting regulations to reduce dependency on fossil fuels, thereby bolstering the growth of renewables.

This regulatory landscape, coupled with advancements in solar technology and a decrease in the cost of solar systems, presents a fertile ground for the LUMI's integration and acceptance. However, challenges such as the initial high cost of solar installations and efficiency constraints of solar modules do exist. Yet, the trajectory towards lower costs and improved technology promises to mitigate these hurdles, enhancing the viability and attractiveness of solar energy—and by extension, the LUMI—as a cornerstone for sustainable economic development.

Economic Stimulus Through the LUMI

The LUMI currency's economic stimulus initiative has significantly impacted the economies of Ghana, Nigeria, Liberia, Sierra Leone, and The Gambia, marking a pivotal moment for economic enhancement and stability across these regions. This program, which addresses the critical $330 billion financing gap faced by African SMEs as of 2022, embodies hope and empowerment for many, heralding a new era of economic development. Spearheaded by the African Diaspora Central Bank (ADCB), this ambitious plan aims to channel a staggering $6 trillion, underwritten by 100KWh of solar energy and valued at 4 grains of gold per LUMI, into these nations' economies.

Already underway on a preliminary basis since October 1, 2020, the initiative is set for a full-scale launch in 2024. Despite this phased approach, a multitude of individuals and kingdoms within the aforementioned countries have started experiencing the LUMI's transformative effects. Beneficiaries, including adults over 18, receive monthly support of LUMI 6.26, equivalent to $100, initiating a wave of economic relief and potential growth across vital sectors such as entrepreneurship, skill development, healthcare, and infrastructure.

The stimulus package is designed to provide comprehensive support, encompassing individual financial aid, startup funding, corporate assistance, and investments in skill enhancement and research. This broad spectrum approach aims to stimulate sustainable growth and diversify the economic landscape, reinforcing ECO-6's commitment to fostering a resilient and innovative African economy and its diaspora.

Incorporating kingdoms within the beneficiary countries underscores the initiative's inclusive and culturally respectful design. This strategy ensures that traditional governance structures play a central role in the economic rejuvenation efforts, enhancing the stimulus's effectiveness through localized distribution and community-centric execution.

The kingdom's inclusion within the five beneficiary countries highlights the package's inclusive design, ensuring that traditional governance structures are integral to the economic revitalization process. This approach not only respects the cultural and political fabric of the participating nations but also amplifies the impact of the stimulus through localized distribution channels and community-based implementation strategies.

As the anticipation for the 2024 full-scale implementation grows, the initial disbursements lay a solid foundation for extensive economic transformation. With ECO-6's strategic vision guiding the way, the LUMI stimulus package is poised to uplift the economies of Ghana, Nigeria, Liberia, Sierra Leone, and The Gambia, marking a significant advance in Africa's quest for sustainable development and financial inclusiveness.

Conclusions

The successful implementation of the LUMI currency stands as a transformative opportunity for economic empowerment and financial inclusion across Africa, demanding concerted efforts from all stakeholders, including governments, financial institutions, and communities. As we stand on the brink of a new era of economic development, it is imperative that mechanisms are put in place to ensure the effective integration and utilization of the LUMI currency.

Governments must lead the charge by fostering regulatory environments that encourage innovation, protect consumers, and support the seamless transition to this new financial system. Financial institutions should collaborate closely with the African Diaspora Central Bank, leveraging technology to integrate the LUMI into existing financial ecosystems, thereby expanding access to banking services for millions of unbanked individuals.

Communities and local businesses must be educated and empowered to understand and embrace the benefits of the LUMI, ensuring that this initiative achieves its full potential in driving sustainable economic growth, reducing poverty, and enhancing the livelihoods of people across the continent. The collective action and commitment of all stakeholders are crucial in turning the vision of the LUMI currency into a reality, marking a significant milestone in Africa's quest for self-reliance and prosperity.

-

About the authors

Notably, he pioneered the e-port system at GPHA, revolutionizing port operations with a seamless, paperless approach. His extensive consulting experience spans both national and international organizations.

Additionally, he leads the Ethics Board at the Ghana Institute of Freight Forwarders, promoting industry integrity. Dr. Boison's academic portfolio includes a Business Administration degree and dual MSc degrees from Coventry University, UK, in Supply Chain Management and Management Information Systems. He also holds a PhD in Business Administration, specializing in supply chain. A certified Prince2 Project Practitioner, his expertise extends to advanced project management methodologies.

Latest Stories

-

Pakistan to nominate Trump for Nobel Peace Prize

58 minutes -

Suicide bombing at Damascus church kills 22, Syrian authorities say

1 hour -

Bellingham scores as 10-man Real Madrid beat Pachuca

1 hour -

Three fans die in Algeria football stadium fall

2 hours -

South African engineers freed after two years in Equatorial Guinea jail

2 hours -

FedEx founder and former boss Fred Smith dies aged 80

2 hours -

Bride shot dead in attack on French wedding party

2 hours -

Legon Cities handed transfer ban over unpaid GHC 29,000 compensation to Francis Addo

2 hours -

Alonso says FIFA investigating racial abuse against Rudiger

3 hours -

Rashford would like to play at Barcelona with Yamal

3 hours -

Garnacho posts picture wearing Aston Villa shirt

3 hours -

Premier League contacts Chelsea over Boehly ticket website

3 hours -

Liverpool agree £40m deal to sign Kerkez from Bournemouth

3 hours -

Everton close on deal for Fulham right-back Tete

4 hours -

Africa World Airlines to reduce air fares by end of June 2025

5 hours