i. INTRODUCTION

Ghana has encountered significant economic challenges in recent times. These challenges have resulted from enormous strain on the country’s economy due to global geo-political developments coupled with domestic issues. The depreciation of the cedi, the dwindling of international reserves, financing pressures, the slowing down of economic activities, and soaring inflation prompted the government to seek help from the International Monetary Fund (IMF), resulting in a three-year Extended Credit Facility (ECF) of US$3 billion which is aimed at restoring macroeconomic stability and debt sustainability. One of the key reforms under this programme was the Domestic Debt Exchange Programme (DDEP). The DDEP has sought to restructure the government’s domestic debt to ensure long-term fiscal health. Even though this step was vital in the economic recovery of Ghana post covid, it profoundly impacted businesses and the financial sector, shaking investor confidence and limiting activity in the financial market.

Against this backdrop, the Ghana Stock Exchange’s (GSE) recent introduction of the Commercial Paper Market, a pivotal milestone in the 10-year strategic Capital Market Master Plan (CMMP) launched in May 2021, must be applauded. The launch demonstrates the commitment of the GSE and the Securities and Exchange Commission (SEC) to promoting the development of a vibrant and dynamic capital market ecosystem in Ghana. The setup of a formal market for this very important money market instrument stands to offer several benefits including enhanced liquidity of the securities market, diversity of investment products making it more efficient and attractive to both local and foreign investors; diversified funding options for issuers, and a robust framework for investor protection.

This article attempts to carry out an overview of the commercial paper market and the implications of the launch of a formal commercial paper market for the development of the money markets and the economy at large. The first section establishes the bedrock of this market; an explanation of what commercial paper is as a money market instrument; the second section focuses on an overview of the commercial paper market under the launched GSE’s Commercial Paper Issuance and Admission Rules 2024, its implications on the financial markets, and the economy at large; and the final section delves into the future outlook and challenges. We end the write up with a quick summary of the key features of the commercial paper market as launched by the GSE.

ii. COMMERCIAL PAPER 101

Commercial paper is a short-term unsecured (unless issued as an asset-backed commercial paper) debt instrument issued by corporate institutions to raise capital in the money market to meet working capital and other short-term needs. They typically have maturities ranging from 15 days to 270 days. However, it is not uncommon to find commercial papers that run up to 364 days in some jurisdictions.

Commercial paper, as a financial instrument, is usually issued at a discount to its face value and redeemed at par, with the difference representing the interest earned by the investor. It can also be issued as an interest-bearing note where the investor pays the face value and is paid the face value and accrued interest at maturity. Commercial paper is also an example of a promissory note, which essentially refers to a written promise by A to pay B a determinable amount of money on a certain date.

Commercial paper may be issued as a discrete issue but it is most common to find issues done under a programme. A discrete issue is a one-off issue. An issue under a programme means that once the commercial paper programme documentation is in place, the commercial paper may be issued on multiple occasions as and when required.

Currently, commercial paper in Ghana is largely issued in physical form where the obligation of the issuer is recorded on physical certificates that are issued in the name of the investor. The launch of the formal market with the necessary market infrastructure should see us move away from physical certificates unto an electronic form traded on a recognised exchange.

iii. THE COMMERCIAL PAPER MARKET AND THE GHANA STOCK EXCHANGE COMMERCIAL PAPER ISSUANCE AND ADMISSION RULES 2024

The Ghana commercial paper market and its implications

Access to funding is the lifeblood of any economy. Traditionally, companies and other corporate institutions in need of funding have relied on banks to meet their short-term financial needs. However, banks and other regulated financial institutions are subject to prudential limits when they undertake bilateral and syndicated lending. The launch of the commercial paper market is a shot in the arm of Ghana’s financial ecosystem and capital market as it offers a new and exciting alternative to meeting funding needs of small enterprises to large scale businesses. This market will act as a bridge, connecting companies and corporate institutions in need of funding with a wider pool of investors.

Corporate institutions in need will now be able to tap into a wider pool of lenders, reducing their reliance on traditional banks for short-term funding. These corporate institutions can now access funding from institutional investors such as pension funds, asset managers, insurance companies, and mutual funds seeking investment opportunities. This is expected to inject fresh capital into the economy, fueling economic growth. The diversification in the sources of capital will strengthen the financial position of these corporate institutions and open the doors to potentially lower interest rates set by the market itself (price/interest rate discovery).

Likewise, for investors, the commercial paper market has offered a fresh, short-term investment option with potentially attractive returns based on market demand while spreading their risk. This will provide the needed variety to investment portfolios, allowing investors to potentially boost their overall returns. This is key for investors looking to invest in Ghana considering the demand for alternative investment options following the recent economic downturn.

The benefits of the commercial paper market go beyond borrowing and investing. The commercial paper market guidelines are designed to facilitate the establishment of a framework for trading commercial paper, thereby helping to determine fair prices for these instruments. This transparency will benefit both issuers and investors. Over time, the commercial paper market can become a reference point for corporate interest rates. This benchmark can be a valuable tool for businesses and investors alike when making financial decisions.

The Commercial Paper market has some features that aim at the realization of the SEC’s Capital Market Master Plan objective of increasing the diversity of investment products, ensuring market liquidity, and increasing the investor base and protection. Some of the significant features are in respect of the structure, the criteria ascribed to the issuer, and the standardization and streamlining of processes.

Structure

In terms of structure, the main participants on the market are; a Sponsor, who must be a member of the Ghana Fixed Income Market (GFIM) appointed by the Issuer in connection with the admission of the commercial paper; an Issuer, being an entity that has issued or plans to issue a commercial paper; an issuing house; a paying agent, being a licensed bank appointed by the Issuer to collect and pay funds to the investors during or at the maturity of the commercial paper; a qualified investor, being a person qualified (as defined by the Securities Industry (Conduct of Business) Guidelines 2020) to transact on the market as an investor; and the Securities and Exchange Commission, the licensing authority.

A qualified investor under the SEC guidelines is a legal or natural person (emphasis supplied) who has agreed in writing to be regarded as such and meets at least one of the criteria stated. Institutional investors like pension funds, mutual funds among others general meet the criteria. For individual investors, the criteria includes demonstrating that;

- they (either alone or with any associate on a joint account) have proven liquid assets of an amount to be specified by the SEC

- they meet the criteria that has been specified by the SEC with regard to their knowledge and understanding of the capital markets

- they qualify as a qualified investor per the securities legislation of any foreign jurisdiction

- they have been declared by the SEC to be a qualified investor

Many issuers of commercial paper are not financial institutions and might therefore lack the facilities to make payments. The result is that they will need to appoint a financial institution as a paying agent to manage payments to investors on its behalf. This is what is envisaged by the guidelines which makes the appointment mandatory. Also, a paying agent may not have funds made available to it in time, in order to make payments on the day of redemption. A paying agent can offer a backstop credit facility (same-day funding) if the issuer has a good credit rating to allow the paying agent to make payments using its own funds ahead of the issuer’s funds being credited to the paying agent’s account. An issuer may also rely on a standby letter of credit or an outright guarantee by its parent company to enhance the creditworthiness of the issue.

Issuers typically engage the Issuing House, usually investment houses or brokerage firms, to manage the issuance process, including the preparation of necessary commercial paper documentation, selection of agents, and the offering or placement of the commercial paper with investors. The Issuing House may also be one of the dealers that purchases the commercial paper from the Issuer and sells on to investors unless the Issuing House is acting under a best-efforts mandate.

The Commercial Paper Market prioritizes investor protection. The introduction of the role of the rating agencies into the market will play a crucial role in ensuring its success. These agencies assess the creditworthiness of each issuer, assigning a rating that reflects the risk associated with investing in their commercial paper. This element of rating achieves four aims: investor empowerment, market transparency, risk mitigation, and the promotion of good corporate practices. Credit ratings act as a beacon for investors helping them assess the risk associated with commercial paper offerings and the health of the issuer. Also, knowing that a credit rating agency will evaluate their financial health incentivizes issuers to maintain good corporate governance practices, ultimately improving the overall quality of issuers in the market. This translates to sound business models, ultimately strengthening the overall market and economy.

The ratings act like report cards, helping the investors understand the risk associated with each investment. Credit ratings help mitigate risk for investors by providing a clear picture of the issuer’s creditworthiness. This fosters confidence in the market, encouraging broader participation from businesses and investors.

How do private placements of commercial paper compare?

compared to an issue of commercial paper in a regulated public market. The private placement is characterized by limited benchmarking, liquidity woes, time-consuming, and costly issuance. Private placements do not contribute to establishing a reliable "corporate interest rate benchmark." This benchmark is crucial for businesses and investors alike to gauge appropriate interest rates for short-term financing. Without it, price discovery becomes less transparent. Also, investors in private placements are stuck. They lack a secondary market to trade their commercial paper before maturity. This limited liquidity discourages participation and hinders the overall growth of the market. Again, the due diligence process for private placements can be lengthy and expensive. The lack of standardized documentation necessitates starting from scratch for each new issuance, leading to delays and higher costs for companies seeking funding.

The introduction of a regulated or supervised commercial paper market addresses these shortcomings head-on. The market rules enforce standardised documentation, streamlining the issuance process. This translates to faster listing times on the secondary market, the Ghana Fixed Income Market (GFIM). Also, streamlining the process minimises the overall cost of transactions for both issuers and investors. The public market also offers a secondary trading platform where investors can trade commercial paper before maturity, injecting much-needed liquidity into the market and making it more attractive to all participants.

iv. FUTURE OUTLOOK AND CHALLENGES

The growth prospects for the Ghanaian commercial paper market are promising. The formal establishment of the market by the SEC is expected to attract more issuers and investors, increasing market liquidity and depth. Continued regulatory support and market education will be key to sustaining this growth.

Despite the positive outlook, several challenges need to be addressed. These include enhancing market infrastructure, improving investor awareness and confidence, and ensuring robust regulatory oversight to prevent market abuses. Additionally, efforts to increase issuer diversity and support for smaller companies will be important for market development.

Regulatory considerations will play a crucial role in ensuring market stability. The SEC's guidelines and rules will need to be continuously reviewed and updated to reflect market developments and global best practices. Ensuring transparency, fair trading practices, and effective risk management will be essential for maintaining investor confidence and market integrity.

v. CONCLUSION

In conclusion, the launch of the commercial paper market in Ghana marks a significant step in the evolution of the country's financial markets. It provides a new avenue for companies to access short-term financing and offers investors a viable investment option with potentially higher returns. It is hoped that the launch of the formal commercial paper market will help transform the fortunes of the financial markets. It will hopefully enhance market liquidity, support corporate financing needs, and contribute to the overall development of the financial markets as envisaged in the 10-year strategic Capital Market Master Plan (CMMP). By providing a flexible and cost-effective financing option, the commercial paper market will play a crucial role in Ghana.

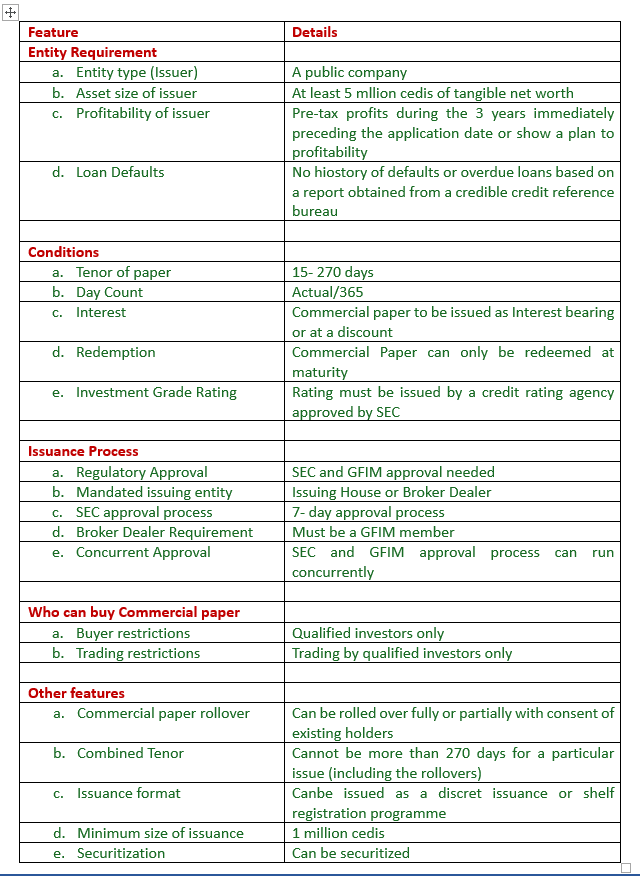

Summary of the key features of the Commercial Paper Market as launched by the GSE

Latest Stories

-

Congo, M23 rebels plan return to Qatar talks amid Trump pressure

2 hours -

US, Colombia recall their ambassadors in diplomatic tussle

2 hours -

‘It’s a joke’: Peruvians outraged after president doubles her salary

2 hours -

Putin tells Trump he won’t back down from goals in Ukraine, Kremlin says

3 hours -

Boxer Julio Cesar Chavez Jr arrested by US immigration

3 hours -

Over 100 former senior officials warn against planned staff cuts at US State Department

3 hours -

Dagbang overlord bans celebration of 2025 fire festival in Tamale

3 hours -

BBC senior staff told to ‘step back’ from duties following row

3 hours -

North Tongu DCE urges trust in gov’t as flood victims awaits compensation

3 hours -

2 arrested for murder of Lebanese national in East Legon

3 hours -

NSMQ 2025: GSTS clinch Western Regional Championship to book spot at national

4 hours -

New Supreme Court judges pledge fairness, acknowledge family support

4 hours -

Kilmar Ábrego García alleges torture and abuse in El Salvador prison

4 hours -

Gov’t sets up committee to investigate sale of state lands, including those owned by schools

4 hours -

Angélique Kidjo first black African to get Hollywood Walk of Fame star

4 hours