Africa’s wealthiest people shed a combined $3.1 billion in the past 12 months. As a group, the continent’s 19 billionaires are worth an estimated $81.5 billion – down from $84.9 billion a year ago, despite one more billionaire in the ranks.

The 4% dip follows a 15% jump last year on the back of soaring stock prices across the region. These tycoons’ fortunes faded in sync with equity values around the world, with the S&P All Africa index dropping more than 20% in the first nine months of 2022, before starting a late-year rally that left the index down just 3% through January 13, the day Forbes locked in stock prices and exchange rates for the list.

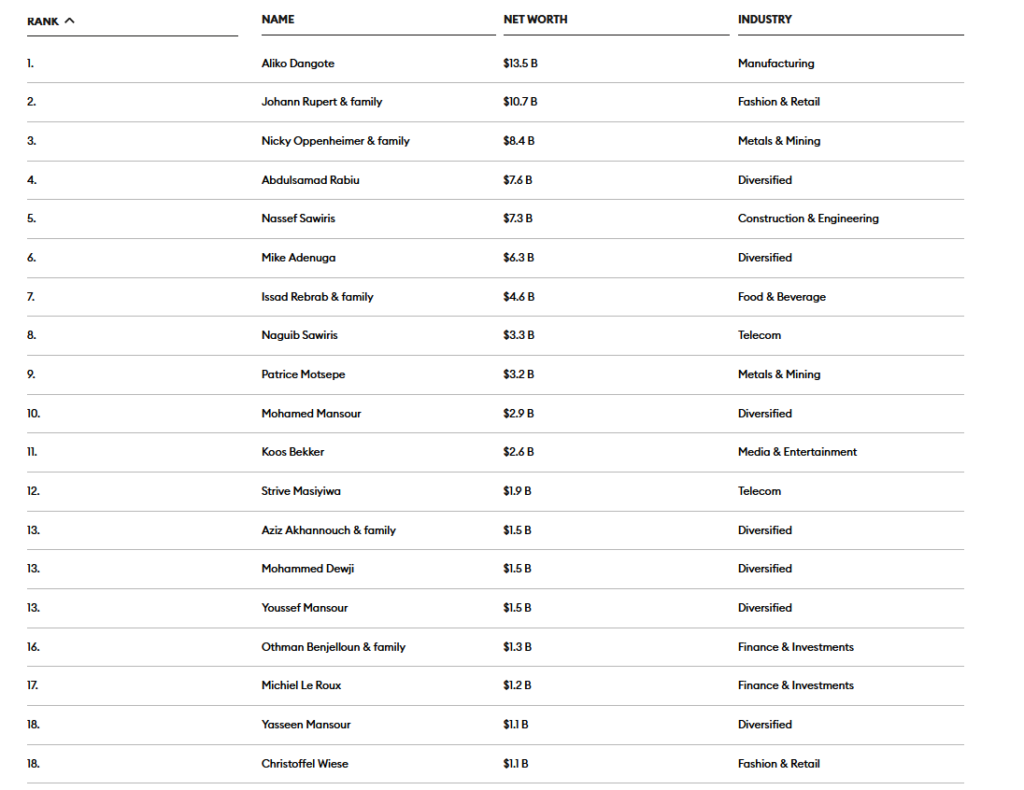

Billionaires from just seven of Africa’s 54 countries made the ranks. Nigerian industrialist Aliko Dangote, whose fortune dropped $400 million to $13.5 billion, is the richest person for the 12th year in a row, and South African luxury goods magnate Johann Rupert held onto no. 2 for a second year, despite falling $300 million to $10.7 billion.

South African Christo Wiese, who dropped out of the ranks amid an accounting scandal in 2018, returns after successfully suing retailer Steinhoff.

Additional editing by Chase Peterson-Withron and reporting by John Hyatt, Jemima McEvoy, Segun Olakoyenikan, David de Jong and Igor Bosilkovski.

METHODOLOGY

Our list tracks the wealth of African billionaires who reside in Africa or have their primary business there, thus excluding Sudanese-born billionaire Mo Ibrahim, who is a U.K. citizen, South African Nathan Kirsh, who operates out of London and another billionaire London resident, Mohamed Al-Fayed, an Egyptian citizen. Strive Masiyiwa, a citizen of Zimbabwe and a London resident, appears on the list due to his telecom holdings in Africa.

Net worths were calculated using stock prices and currency exchange rates from the close of business on Friday, January 13, 2023. To value privately held businesses, we start with estimates of revenues or profits and apply prevailing price-to-sale or price-to-earnings ratios for similar public companies. Some list members grow richer or poorer within weeks-or days-of our measurement date.

Latest Stories

-

GSA boss raises alarm over uncalibrated ECG meters, warns of billing inaccuracies

2 minutes -

Mahama charges NDPC to create unified and inclusive development blueprint

17 minutes -

NSROMAmusic: A star that shone brighter over darkness

32 minutes -

Ghana’s Adam Bonaa appointed Chair of UN Arms Control Forum

34 minutes -

Effective national plan needed to break free from economic stagnation

39 minutes -

Sky Train scandal: Prof Ameyaw-Akumfi fails to appear in court over medical emergency

47 minutes -

The task before you is immense – Mahama to newly sworn-in NDPC members

47 minutes -

Lali x Lola appeals to Communication Minister over Boomplay issues

51 minutes -

Open the doors to dignity: It is backward to keep public washrooms under lock and key

53 minutes -

Armwrestling Board meets CGI Basintale, sets roadmap towards sports development

56 minutes -

Greater Accra Market Association endorses AMA’s decongestion drive in Central Business District

1 hour -

Tullow restarts oil drilling in Ghana

1 hour -

Curttix reflects the hustle of life in new song titled ‘Paa o Paa’

1 hour -

EXPLAINED: Thermal output rises, but $2.5bn debt to IPPs and fuel suppliers mounts

1 hour -

EGL announces “gargantuan” price reduction dubbed “Cedis Apicki” promotion

2 hours