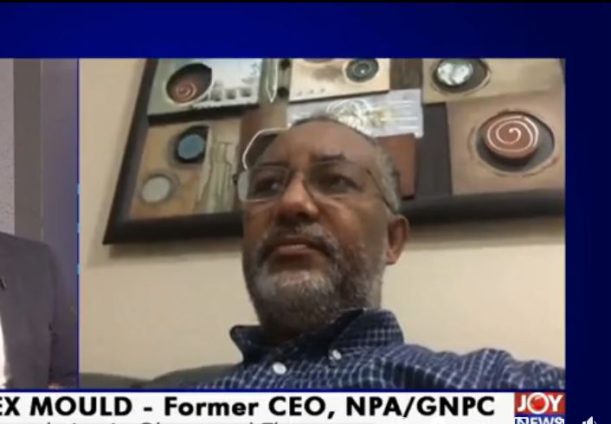

Former Chief Executive of the Ghana National Petroleum Corporation (GNPC), Alex Mould has called for the removal of Special Petroleum Taxes on fuel products.

Speaking on the Business Edition of PM Express, he explained that the reason for the tax implementation does not exist anymore hence the push to get it removed.

He said certain taxes of petroleum cannot be removed due to the binding force against bonds that have been issued from the Esla but special tax does not fall in that category.

He indicated that although “government has reduced the price stabilization levy; he believes that Ghanaians are being taxed too much.”

“…. the question is, are we taxed too much and the answer is yes. I know that government has reduced the price stabilization levy which was 16 pesewas since November but we still have a special tax of about 46 pesewas which is still lingering on the price build-up,” he said on Thursday.

He added that if the government indeed wants the consumer to benefit from a reduction in petroleum then it should consider has to forgo some of these imposed taxes.

He, however, mentioned that he does not see the reduction anytime soon because “there are revenue challenges” therefore government is not going to remove the special petroleum tax.

Mr Mould also called for the specialization of forex regime for imports and distributors in the country.

This, he said, was because “Bank of Ghana is supposed to ensure that we have dollars for petroleum imports which is a mandate for Bank of Ghana.”

“Bank of Ghana when you go on their rate now it’s about 6.10 whereas the price buildup, they are using something close to 6.45 and that is a lot of money that we can save the consumer and people will say that, that is going to the oil marketing company. But the oil marketing company will also complain that when they go to their banks, their banks give them rates that are close to 6.4 or something like that.

"That means that the Bank of Ghana is actually lying to us about what the exchange rate is in the market… because the exchange rate at the market now is about 6.35 against 6.1 that Bank of Ghana is showing,” he stressed.

Latest Stories

-

CLOGSAG vows to resist partisan appointments in Civil, Local Government Service

34 minutes -

Peasant Farmers Association welcomes Mahama’s move to rename Agric Ministry

36 minutes -

NDC grateful to chiefs, people of Bono Region -Asiedu Nketia

38 minutes -

Ban on smoking in public: FDA engages food service establishments on compliance

39 minutes -

Mahama’s administration to consider opening Ghana’s Mission in Budapest

40 minutes -

GEPA commits to building robust systems that empower MSMEs

43 minutes -

Twifo Atti-Morkwa poultry farmers in distress due to high cost of feed

45 minutes -

Central Region PURC assures residents of constant water, power supply during yuletide

46 minutes -

Election victory not licence to misbehave – Police to youth

48 minutes -

GPL 2024/2025: Nations thrash struggling Legon Cities

51 minutes -

Electoral offences have no expiry date, accountability is inevitable – Fifi Kwetey

51 minutes -

Ghanaians to enjoy reliable electricity this Christmas – ECG promises

58 minutes -

Police deny reports of election-related violence in Nsawam Adoagyiri

1 hour -

‘We’re not brothers; we’ll show you where power lies’ – Dafeamekpor to Afenyo-Markin

1 hour -

EPA says lead-based paints are dangerous to health, calls for safer alternatives

3 hours