Some commercial banks are raising concerns about the Bank of Ghana’s directive regarding the abolishment of the Over-the-Counter withdrawal charge.

The Central Bank recently issued a notice to banks and specialized deposit-taking institutions to abolish what it calls unfair fees, charges and other practices in the banking sector.

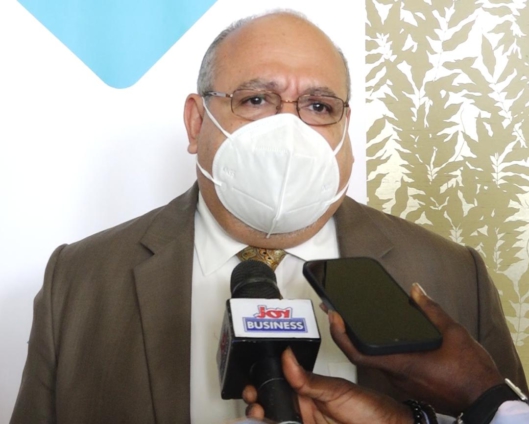

But in an interview with Joy Business at a Digital Conference organised by his outfit, Managing Director of Republic Bank Ghana, Farid Antar said the over the counter withdrawal charge was meant to serve as disincentive for customers to use the ATMs.

“The one that may be a little bit problematic for the banks is that we charge a fee for customers coming into the bank to withdraw cash when they have an avenue external to the bank so it’s not so much of a fee but a disincentive to change your behavior to use electronic which is the ultimate goal” said Mr. Antar.

History

The over-the-counter withdrawal fee is one of seven charges the central bank has warned commercial banks to do away with.

The Bank of Ghana noted that some banks and specialized deposit-taking institutions impose penal charges on customers who withdraw their own funds from banking halls and the reason the Republic Bank MD attributed to the practice was to encourage customers to use digital platforms provided to reduce congestion at the banking halls.

Digital Conference

The digital conference jointly organized by the bank and the Business and Financial Times was themed: digitization, artificial intelligence and the future of things; the impact and immense opportunities for Ghanaian Businesses.

Mr. Antar has underscored the need for Ghanaian businesses to take advantage of the opportunities provided by the African Continental Free Trade Area (AfCFTA) through the adoption of technology to expand their operations.

According to him, local businesses must begin to look beyond the country and network with other countries across the continent to reach a larger market.

The conference offered insight into how stakeholders, particularly business owners and their financiers could harness the recent gains from increased digitisation.

Latest Stories

-

Justice Ackaah-Boafo: Ghana needs more lawyers to match justice system’s demand

2 seconds -

Six new Adinkra symbols unveiled to signify Asantehene’s unparalleled leadership

2 minutes -

GOIL delivers a robust performance in 2024

5 minutes -

Bolt partners with Fido Credit to offer loans to drivers in Ghana

5 minutes -

Ghana Data Science Summit 2025: Empowering the use of data and AI skills for impact.

17 minutes -

Mastercard, Access Bank introduce innovative card to empower Ghanaians

17 minutes -

Republic Bank Ghana and SLCB sign landmark technical support agreement to drive regional banking excellence

28 minutes -

Afenyo-Markin slams petition against Supreme Court nominee as “frivolous and dangerous precedent”

37 minutes -

Striking gold or sinking fast? A deep dive into Ghana’s Gold Coin and cedi strength

39 minutes -

‘Frivolous and vexatious’ – Committee cites constitutional immunity in quashing petition against Justice Ackaah-Boafo

54 minutes -

Nii Adama Latse II wins appeal: Court orders House of Chiefs to restore him to register – But Ga Mantse office says King Teiko Tsuru II remains Chief

58 minutes -

Black Queens in line for friendlies against Nigeria and two others before WAFCON 2024 opener

1 hour -

Gov’t won’t shield anyone in galamsey fight – Environment Minister

1 hour -

Ghana to face Benin and Nigeria in WAFU B U-20 Boys’ Cup

1 hour -

NPP is not acting contrary to the party’s constitution – Tiah Kabiru

1 hour