Ratings agency Fitch Ratings believes a sustained period of US dollar strength against emerging market (EM) currencies including Ghana could weigh on some EM sovereign credit profiles.

This would potentially soften the current positive ratings momentum for EMs.

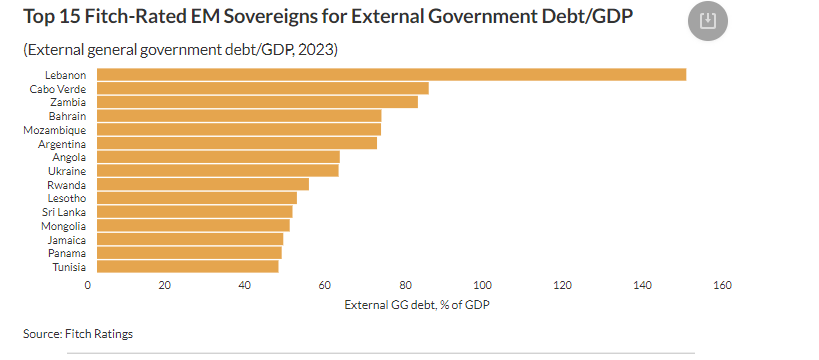

“Most at risk in such a scenario – which does not form part of our base case for 2024-2025 – would be sovereigns that experience large and durable depreciation against the dollar or large declines in official foreign reserve buffers, and that have a large share of their debt denominated in foreign currencies”, it stated in its analysis.

The nominal effective exchange rate of EM currencies against the USD has historically been strongly correlated to EM sovereign ratings, with a stronger USD being associated with weaker EM credit profiles.

Fitch said “We believe this relationship is likely to remain robust in 2024-2025 if the US dollar experiences a period of sustained strength”.

Nonetheless, it explained that the net balance of rating outlooks for Fitch’s EM sovereign portfolio as a whole is currently positive, reflecting prospects for improvement in many of the credit profiles. The picture varies regionally, with Emerging Europe and Latin America both having a relatively large number of EM sovereigns on Positive Outlook, and Asia having more sovereigns on Negative Outlook than Positive.

“Ratings of EM commodity importers and smaller and frontier EMs remain significantly weaker than before the Covid-19 pandemic, so some credit profiles may have room to improve as pandemic-related economic and fiscal scarring fades and global activity normalises. EM exchange rates, in aggregate, were also relatively stable against the USD over 4M24, compared with the USD’s stronger appreciation against some developed market currencies, including the yen and Swiss franc. We believe this contributed to the overall strength of EM prospects. Still, a number of EM currencies did weaken somewhat over 4M24, including Brazil’s real and some Asian currencies”, it pointed out.

Fitch’s baseline assumption remains that US Treasury yields will fall over 2024-2025 as the Federal Reserve begins to cut rates. This should allow more EM currencies to appreciate against the US dollar.

“Nonetheless, the resilience of the US economy and, in turn, the persistent inflationary pressure there have highlighted risks to this outlook. If US rates remain at a high plateau – or rise even further – this could result in sustained USD strength, with potential adverse consequences for some EM credit profiles”, it cautioned.

Seven EMs witnessed rapid depreciation of currencies in 2024

As of May 1, 2024, several Fitch-rated EMs had seen year-on-year deprecation against the US dollar of over 30%.

They include Angola (B-/Stable), Argentina (CC), Egypt (B-/Positive), Nigeria (B-/Positive), Turkiye (B+/Positive) and Zambia (Restricted Default).

However, there may also be considerations that mitigate the impact, for example, where depreciation is a result of broader economic adjustments that improve long-term economic prospects, or is a condition of financial support from the IMF or other lenders. Such considerations contribute to the Positive Outlooks on the ratings of Turkiye, Egypt and Nigeria.

Latest Stories

-

If religion was a factor, I would’ve stepped aside – Dr Bawumia warns against tribal politics in NPP

14 minutes -

Okada rider survives brutal machete attack in Boinso, suspect arrested

18 minutes -

Photos: Asantehene graces son’s graduation at DPS International

2 hours -

Deputy Works and Housing Minister visits Ecobank-JoyNews Habitat Fair Clinic

2 hours -

Abdul Bashiru Hussein: The unseen spark lighting up Ghana’s football future

2 hours -

2025 FIFA Club World Cup: Is European supremacy a myth?

3 hours -

Brazil express interest in hosting 2029 FIFA Club World Cup

3 hours -

TCL hosts West Africa Regional launch in Accra, showcasing innovation and strengthening partnerships

3 hours -

Lecturer advocates mandatory teaching and military training for National Service Personnel

3 hours -

Hundreds of kids and coaches undergo Tennis training in Accra

3 hours -

‘We’ll always be available’ – Roger Smith commits to long-term support for Ghana Tennis

3 hours -

Ghana has enough fuel to last over 2 months – NPA boss

3 hours -

2 dead, three injured in building collapse at Kotokuraba’s London Bridge area

4 hours -

‘It is exciting’ -Tennis star Katrina Adams poised for clinic in Ghana

4 hours -

Nigeria: Five die as bomb explosion rocks Kano

4 hours