- Introduction

The concept of the blue economy has increasingly become a beacon of hope for sustainable development, particularly within the African continent's expansive maritime sector. With over 38 African countries bordered by oceans and seas, the blue economy holds untapped potential for propelling economic growth, enhancing food security, and fostering environmental sustainability.

This vast economic canvas encompasses not just traditional maritime activities such as fisheries, shipping, and tourism, but also emerging sectors like aquaculture, marine biotechnology, and renewable energy, presenting a holistic approach to ocean resource management.

The World Wildlife Fund estimates the value of key ocean assets at over $24 trillion, indicating the enormity of the blue economy's potential. If it were a country, the sea will be the 7th largest economy on the planet. Yet, despite this promising outlook, the African maritime industry faces significant challenges, primarily due to inadequate financing mechanisms for shipbuilding and repairs—a critical backbone for realizing the blue economy's full potential. The sector's growth is further hampered by over-exploited fisheries and underdeveloped aquaculture, despite the latter being the fastest-growing food sector globally.

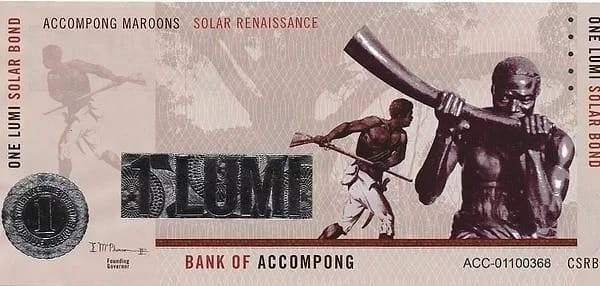

The LUMI, a digital currency underwritten by renewable energy and gold, positioned as a groundbreaking solution to these financing hurdles. The LUMI offers a stable and sustainable financing alternative, which could revolutionize funding models for shipbuilding and maritime infrastructure in Africa. By leveraging the LUMI, governments and private sectors across the continent can tap into a unified currency, fostering economic resilience and promoting intra-African trade.

The need for such innovative financing mechanisms is underscored by ambitious projects like Ghana's Blackstar Line revival and the expansion of dry-docks facilities across the continent. These endeavors not only aim to bolster Africa's maritime capabilities but also to reduce dependency on foreign shipping services, which contribute to the continent's inflated freight costs. The LUMI's potential as a financing option could provide the impetus needed to propel these projects forward, ensuring their viability and sustainability.

- The African Maritime Context

Africa's strategic positioning with an extensive coastline of over 30,500 kilometers, bordering the Atlantic and Indian Oceans, including the Mediterranean and Red Seas, presents an enormous potential for the continent's maritime industry. However, this potential remains largely untapped due to systemic challenges in shipbuilding and repair capabilities.

According to the United Nations Conference on Trade and Development (UNCTAD), maritime transport is essential for Africa, handling about 92% of its imports and exports by volume. Yet, African-owned fleets account for less than 1.2% of the world's shipping by deadweight tons, highlighting the continent's minimal stake in global maritime assets. The scarcity of shipbuilding and repair facilities further exacerbates this imbalance.

A report by the Organization for Economic Co-operation and Development (OECD) highlights that shipbuilding activities are predominantly concentrated in Asia, with countries like China, South Korea, and Japan accounting for over 90% of global shipbuilding output. In comparison, Africa's contribution is negligible, reflecting a significant gap in the continent's maritime infrastructure and technical expertise. This shortfall in local shipbuilding and repair capacity has far-reaching economic implications.

The African Development Bank (AfDB) notes that the reliance on foreign shipping services not only inflates the cost of imports and exports but also leads to a substantial outflow of foreign exchange, estimated to be billions of dollars annually. This situation undermines the continent's trade balance and hampers economic diversification efforts.

Moreover, the high freight costs associated with foreign shipping services significantly impact the price of goods in Africa, contributing to the high cost of living and doing business on the continent. A study by the United Nations Economic Commission for Africa (UNECA) estimates that reducing Africa's maritime transport costs by just 10% could increase the volume of intra-African trade by over 25%, highlighting the critical need for investment in the continent's maritime infrastructure and capabilities.

In light of these challenges, the development of a robust maritime industry, supported by sustainable and innovative financing solutions like the LUMI currency, is essential for Africa's economic transformation. Building local capacity in shipbuilding and repairs can catalyze the continent's maritime sector, reduce dependency on foreign shipping services, and unlock the immense potential of the blue economy for Africa's sustainable development.

- Challenges in Financing Shipbuilding and Repairs

The financing landscape for shipbuilding and repairs in Africa is fraught with complexities, underlined by the sector's intrinsic high capital intensity and perceived investment risks. The United Nations Conference on Trade and Development (UNCTAD) underscores the significant investment required for shipbuilding and repair infrastructure, which often runs into millions, if not billions, of dollars. Such high upfront costs, coupled with the long gestation period for returns on investment, pose a formidable challenge for potential investors and financial institutions. African maritime ventures are particularly affected by the global perception of risk associated with maritime investments on the continent.

The World Bank highlights that Africa's maritime sector is often viewed through a lens of market volatility, exacerbated by fluctuating commodity prices and geopolitical tensions, which can impact maritime trade volumes and, by extension, the profitability of shipbuilding and repair facilities. This volatility makes traditional financiers, including banks and equity investors, hesitant to allocate funds to the sector, fearing unpredictable returns.

Regulatory uncertainties further compound these financing challenges. A report by the International Maritime Organization (IMO) points to the evolving regulatory landscape in global maritime affairs, including stringent environmental standards and safety regulations, which necessitate continuous upgrades and maintenance of maritime infrastructure and vessels.

In Africa, where regulatory frameworks can vary widely across jurisdictions and may be subject to frequent changes, financiers often worry about the compliance costs and the potential for regulatory risks to derail investment returns.

The African Development Bank (AfDB) has identified that these financing gaps severely limit the continent's ability to develop its maritime infrastructure and fleet, leaving it dependent on foreign shipowners and repair yards. This dependence not only inflates the cost of maritime services but also limits the development of local maritime skills and industries, perpetuating the cycle of economic disadvantage.

Addressing these challenges requires innovative financing solutions that can mitigate perceived risks and unlock capital flows to the maritime sector. Instruments such as the LUMI, which offer stable and sustainable financing options underwritten by renewable energy and gold, could provide the assurance and stability that traditional financiers seek. By leveraging such innovative mechanisms, Africa has the potential to overcome the barriers to financing its shipbuilding and repair industry, paving the way for economic growth and the development of a resilient maritime sector.

- Economic Transformation in the Maritime Sector

The advent of the LUMI currency heralds a transformative era for Africa, ushering in a new paradigm of economic self-sufficiency and maritime prosperity. This innovative currency, backed by the tangible assets of solar energy and gold, presents an unparalleled opportunity for Africa to assert its autonomy in the global maritime domain.

By facilitating zero-interest loans to the private sector and offering stimulus packages, the LUMI enables Africa to capitalize on its strategic maritime assets, revitalizing the shipbuilding and repair industry, and reducing reliance on external shipping services. With the African Diaspora Central Bank's ambitious goal of injecting over $100 trillion by 2063 into the continent's economy, the LUMI positions Africa to lead in the global maritime industry, enhancing trade competitiveness and fostering sustainable economic growth.

Governments across Africa are encouraged to leverage this zero-interest financing mechanism to embark on ambitious maritime projects that can transform the continent's shipbuilding and repair capabilities. This massive financial injection is aimed at enhancing trade competitiveness, increasing the efficiency of maritime logistics, and ensuring sustainable economic growth. By capitalizing on its strategic maritime assets, Africa can significantly improve its position in the global trade ecosystem, benefiting from increased trade volumes, diversified export products, and enhanced shipping services. By doing so, Africa can improve its maritime infrastructure, enhance its trade capacity, and create a sustainable and self-reliant maritime industry.

- Achievements and Future Prospects

The LUMI currency, introduced by the African Diaspora Central Bank (ADCB), has emerged as a revolutionary financial tool, promising to redefine the economic landscape of Africa and its diaspora. Anchored in the dual assets of renewable solar energy and gold, the LUMI offers a stable and sustainable alternative to traditional fiat currencies, addressing the critical challenges of high capital requirements and perceived risks in the maritime investments sector.

5.1 Economic Renaissance Through LUMI

Africa's abundant solar potential, estimated by the World Bank to be up to 1,000 GW, alongside its significant gold reserves, with Ghana leading as a top producer at 142.4 tonnes in 2019, forms the bedrock of the LUMI's value. This strategic underpinning not only provides a buffer against market volatility but also aligns with sustainable development goals, making the LUMI a beacon of progress for the continent.

5.2 Financing Innovation and Sustainability

The LUMI has already catalyzed significant projects, including a landmark investment in the Mandrolli Automobile EV startup, with about $9 billion equivalent in LUMI. This initiative underscores ECO-6's commitment to eco-friendly transportation solutions and technological advancement, positioning Africa at the vanguard of the global green economy.

5.3 Interest Across Nations

The interest in adopting the LUMI extends beyond Africa, with nations such as the Birland State, Nigeria with its eNaira, South Africa, Uganda, Ghana, and Tunisia, each recognizing the LUMI's potential to transform economic fortunes. South Africa's educational institutions accepting fees in LUMI, and Uganda hosting the Swifin headquarters, highlight the digital currency's growing utility and acceptance.

5.4 International Alliances and Economic Cooperation

The Nation of Hawai'i's integration into the ECO-6 framework through a comprehensive treaty and the infusion of 16 million LUMI ($255 million equivalent) into its treasury exemplifies the tangible benefits of international cooperation under the ECO-6 umbrella. This historic alliance marks a significant stride towards enhanced economic collaboration and sustainability.

5.5 Global Engagement and Inclusivity

Ongoing discussions with Ghana, Liberia, Nigeria Turkey, India, Mauritius, Malaysia, Kailaasa nation, and Dubai to integrate the LUMI into their economic systems reflect a growing global acknowledgment of the LUMI's role as a stable, sustainable financial instrument. This expansion not only enhances LUMI's visibility but also opens up new avenues for trade, investment, and cultural exchange, fostering a network of global economic cooperation and sustainability.

- Conclusion

To truly harness the transformative potential of Africa's maritime industry, we must embrace innovative financial mechanisms that resonate with the sector's unique needs and aspirations. The LUMI currency emerges as a beacon of hope in this context, providing a robust solution that marries stability, inclusivity, and a commitment to sustainable growth. It's more than just a currency; it's a key to unlocking Africa's maritime capabilities, enabling the continent to chart a course towards self-sufficiency and leadership on the global stage. The adoption of the LUMI for financing shipbuilding and repairs is not merely an economic decision; it's a strategic move towards safeguarding the future of the African Continental Free Trade Agreement (AfCFTA).

This pivotal agreement has the power to redefine Africa's place in the world economy, but its success hinges on the continent's ability to strengthen its maritime infrastructure and services. By investing in our shipbuilding and repair sectors with the LUMI, we're not just building ships; we're building bridges—bridges of trade, opportunity, and environmental stewardship that span across our vast continent and beyond.

The time is now to leverage the LUMI's potential to fuel our maritime ambitions, propelling Africa towards a future where it doesn't just participate in the global maritime industry but leads it with innovation, resilience, and a deep-seated commitment to sustainability.

-

About the authors

Dr. David King Boison is the esteemed CEO of Knowledge Web Centre, a prominent research and consulting firm. He chairs the Ethics Review Committee at the National Health Insurance Authority, ensuring ethical conduct in health data management. Dr. Boison also serves as Track Chair at the Academy of African Business Development, fostering business scholarship in Africa. Notably, he pioneered the e-port system at GPHA, revolutionizing port operations with a seamless, paperless approach. His extensive consulting experience spans both national and international organizations. Additionally, he leads the Ethics Board at the Ghana Institute of Freight Forwarders, promoting industry integrity.

Dr. Boison's academic portfolio includes a Business Administration degree and dual MSc degrees from Coventry University, UK, in Supply Chain Management and Management Information Systems. He also holds a PhD in Business Administration, specializing in supply chain. A certified Prince2 Project Practitioner, his expertise extends to advanced project management methodologies.

Albert Derrick Fiatui, is the Executive Director at the Centre for International Maritime Affairs, Ghana (CIMAG), an Advocacy, Research and Operational Policy Think-Tank, with focus on the Maritime Industry (Blue Economy) and general Ocean Governance. He is a Maritime Policy and Ocean Governance Expert

Latest Stories

-

Bawumia joins thousands in Kumasi for burial prayers for Ashanti Regional Imam

26 minutes -

Blue Gold Bogoso Prestea Limited challenges government actions in court

52 minutes -

Patrick Atangana Fouda: ‘A hero of the fight against HIV leaves us’

2 hours -

Trinity Oil MD Gabriel Kumi elected Board Chairman of Chamber of Oil Marketing Companies

2 hours -

ORAL campaign key to NDC’s election victory – North America Dema Naa

2 hours -

US Supreme Court to hear TikTok challenge to potential ban

3 hours -

Amazon faces US strike threat ahead of Christmas

3 hours -

Jaguar Land Rover electric car whistleblower sacked

3 hours -

US makes third interest rate cut despite inflation risk

3 hours -

Fish processors call for intervention against illegal trawling activities

4 hours -

Ghana will take time to recover – Akorfa Edjeani

4 hours -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

4 hours -

Finance Minister skips mini-budget presentation for third time

4 hours -

‘ORAL’ team to work gratis – Ablakwa

5 hours -

Affirmative Action Coalition condemns lack of gender quotas in Transition, anti-corruption teams

5 hours