The pound has fallen to its lowest level for nine months after UK government borrowing costs continued to rise.

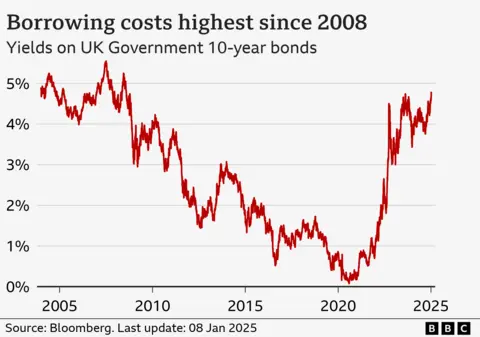

The drop came as UK 10-year borrowing costs surged to their highest level since the 2008 financial crisis when bank borrowing almost ground to a halt.

Economists have warned the rising costs could lead to further tax rises or cuts to spending plans as the government tries to meet its self-imposed borrowing target.

According to several media reports, a spokesperson for the Treasury said: "No one should be under any doubt that meeting the fiscal rules is non-negotiable and the government will have an iron grip on the public finances."

It added that the chancellor would "leave no stone unturned in her determination to deliver economic growth and fight for working people".

The BBC has contacted the Treasury for comment.

Earlier, the government said it would not say anything ahead of the official borrowing forecast from its independent forecaster due in March.

"I'm obviously not going to get ahead... it's up to the OBR (Office for Budget Responsibility) to make their forecasts."

"Having stability in the public finances is precursor to having economic stability and economic growth," the Prime Minister's official spokesman said.

Shadow chancellor Mel Stride claimed that the Chancellor's significant spending and borrowing plans from the Budget are "making it more expensive for the government to borrow".

"We should be building a more resilient economy, not raising taxes to pay for fiscal incompetence," he said in a post on X.

The warning comes after the cost of borrowing over 30 years hit its highest level for 27 years on Tuesday.

Meanwhile, the pound dropped by as much as 1.1% to $1.233 against the dollar, marking its lowest level since April last year.

The government generally spends more than it raises in taxes. To fill this gap it borrows money, but that has to be paid back - with interest.

One of the ways it can borrow money is by selling financial products called bonds.

Gabriel McKeown, head of macroeconomics at Sad Rabbit Investments, said the rise in borrowing costs "has effectively eviscerated Reeves' fiscal headroom, threatening to derail Labour's investment promises and potentially necessitate a painful re-calibration of spending plans."

Globally, there has been a rise in the cost of government borrowing in recent months sparked by investor concerns that US President-elect Donald Trump's plans to impose new tariffs on goods entering the US from Canada, Mexico and China would push up inflation.

The prospect of those policies is colliding with separate concerns about growing US debt and persistent inflation, which could also keep borrowing costs high. In the US, interest rates on 10-year government bonds also surged on Wednesday,in part reflecting new data on prices,before dropping back at mid-day to more than 4.7%, still the highest level since April.

As investors respond to changes in the US bond market, the effects are being felt globally, including in the UK.

Danni Hewson, head of financial analysis at AJ Bell, said the UK rises were similar to those in the US.

"US Treasury 10-year yields have jumped to the highest level since April, whilst in the UK 10-year borrowing costs have soared to their highest levels since the financial crisis," she said.

Adding: "It may be a global sell-off, but it creates a singular headache for the UK chancellor looking to spend more on public services without raising taxes again or breaking her self-imposed fiscal rules."

Ms Hewson said that with less than two weeks before Donald Trump returns to the Oval Office, "uncertainty about his tariff plans are already rattling investor nerves."

The official forecaster, the Office for Budget Responsibility (OBR), will start the process of updating its forecast on government borrowing next month to be presented to parliament in late March.

Latest Stories

-

GPL 2024/25: Aduana Stars demolish Legon Cities 4-0

10 minutes -

GPL 2024/25: Vision FC clinch crucial win over Karela United

26 minutes -

AfroCuration Ghana 2025 unites 7 Ghanaian languages to promote African identity on Wikipedia

45 minutes -

GPL 2024/205: Bechem United held to goalless draw by Basake Holy Stars

54 minutes -

GPL 2024/25: Bibiani GoldStars hold Asante Kotoko in goalless stalemate

57 minutes -

Africa Day: Injustice and inequalities affect Africans, people of black descent – UN Secretary-General

1 hour -

Western Regional Minister orders action to halt encroachment on Ghana Water Company lands at Daboase

2 hours -

Free speech should not be criminalised – GJA urges

2 hours -

Ghana to export nurses and teachers to work in Jamaica under new agreement

3 hours -

Sky Agro, Intraco train poultry farmers on feed use to curb losses

4 hours -

Playback: The Law discusses “The False News Crime”

4 hours -

Ashanti Presbytery holds 15 synod with renewed call for care for environment

4 hours -

NGO Today for Tomorrow hands over 7-classroom block to Sakasaka Cluster of Schools in Tamale

4 hours -

FDA confiscates illicit tobacco products in Accra

4 hours -

Dr. Apaak welcomes Canadian International Development Scholarships team

4 hours