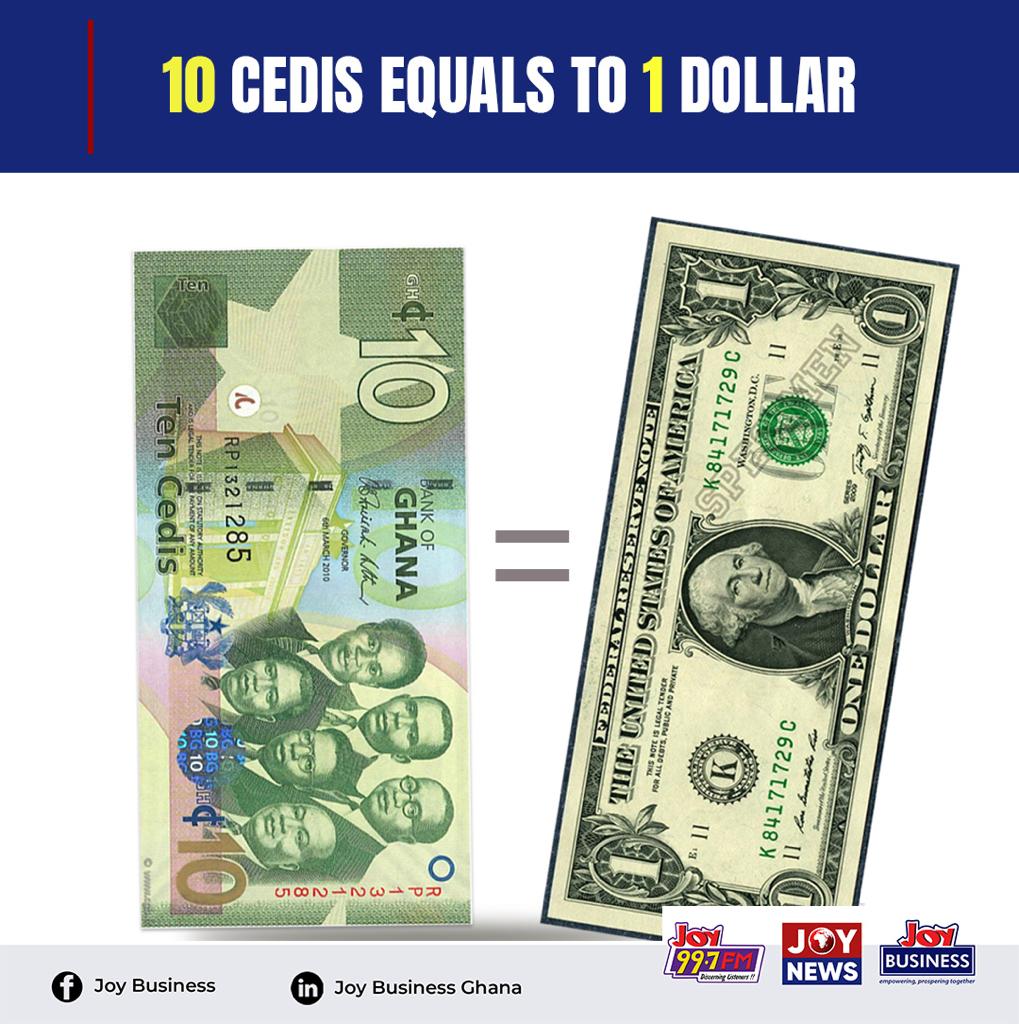

The President of the African Investment Group, Dr. Sam Ankrah has entreated Bank of Ghana (BoG) to peg the value of the cedi to the dollar at 10 cedis.

“We need to peg it, we have to peg our cedi against the dollar at one to 10,” he said.

This is the current retail price for a dollar,

The Ghana cedi hit the ¢10 mark as it traded at ¢10.01 in the retail market on August 18th, 2022. This makes the dollar value relative to the cedi the highest in the country's history.

At the same time, the cedi went for ¢10 to a euro

The cedi’s situation has become a major worry to businesses and household consumers, as its continuous depreciation is expected to be halted by the recent measures announced by the Bank of Ghana and the expected $750 million syndicated loan.

In an interview on JoyNews' PM Express on Thursday, Economist and President of the African Investment Group Dr. Sam Ankrah suggested that the government should consider homegrown policies to address the depreciating cedi and restore its value.

He also proposed that to restore the value of the cedi, an enabling environment needs to be created.

“People have seen intrinsic value in storing the dollar so as long as we keep doing the cosmetic work, the value is still there in the dollar so how do you now try to shift the demand from the dollar to the cedi?

“How do we get people’s interest in the cedi? It is only when we have value. So these measures when you peg it, people know at least for the next five years it is one to 10. Psychologically, you are saying that people can’t keep the dollar,” he explained.

Meanwhile, the Bank of Ghana has introduced measures including working collaboratively with the mining firms, international oil companies, and their bankers to purchase all foreign exchange arising from the voluntary repatriation of export proceeds from mining, and oil and gas companies.

This, it believes will strengthen the central bank’s foreign exchange auctions, and consequently the cedi.

The inflows of the expected $750 million syndicated loan may also halt the rapid fall of the cedi in the short term.

However, days after the Bank of Ghana announced various measures including increasing the policy rate to stem the tide, the Association of Ghana Industries fears getting access to loans to do business will now be tougher.

According to the CEO, Seth Twum Akwaboah, when the policy rate rises, banks will begin to reflect the changes by reviewing and revising their policy rates upward, posing a problem for them.

“Cost of credit has always been an issue for businesses, especially the manufacturers. Because you are borrowing to do business, because it is part of your cost of operation. Therefore, when the policy rate is raised, normally it implies that cost of credit is going to go up and for our SMEs who do not have a choice but constantly go to the banks and get overdraft and other forms of credit, it is really an issue,” he stated.

Latest Stories

-

Video: Hitz FM’s Rep Ur Jersey ends in style as fans jam to afterparty beats

4 hours -

Hitz FM’s Rep Ur Jersey turns electric as PSG thrashes Inter 5–0 in Champions League showdown

4 hours -

PSG thrash Inter Milan to win first-ever Champions League title

4 hours -

Aviation Social Centre packed as UCL Finale kicks off at Hitz FM’s Rep Ur Jersey

6 hours -

Photos: Fans win big at ‘Rep Ur Jersey’ as sponsors reward game participants with exciting prizes

6 hours -

Australia to increase contribution to UN Peacebuilding Fund to $15m annually – High Commissioner

6 hours -

Dr. Angela Dwamena-Aboagye named MTN Hero of Change for championing women and children’s rights

6 hours -

From Morocco to Botswana – Africans turn to trusted media and experts for climate change information

7 hours -

Mahama announces Labour Export Programme

7 hours -

Prof. Peter Atudiwe Atupare appointed Dean of University of Ghana School of Law

7 hours -

Goldbod is already doing wonders – Mahama praises CEO Sammy Gyamfi

8 hours -

Mahama promises attractive cocoa price in August, pledges 200,000 hectare boost to sector

8 hours -

UHAS Council Chairman Prof. Kodzo Gavua urges graduates to serve with passion, integrity, and innovation

9 hours -

Dr. Charisa Ogbogbo becomes first female professor in Mathematical Sciences at UG

9 hours -

Communication Ministry assures data price cuts as TELCOS prepare to reduce costs soon

10 hours