Finance Ministry says payment of coupons and principals in respect of the Domestic Debt Exchange Programme (DDEP) will start on March 13, 2023.

According to a release issued by the Ministry, this only applies to old bondholders who did not sign up for the DDEP.

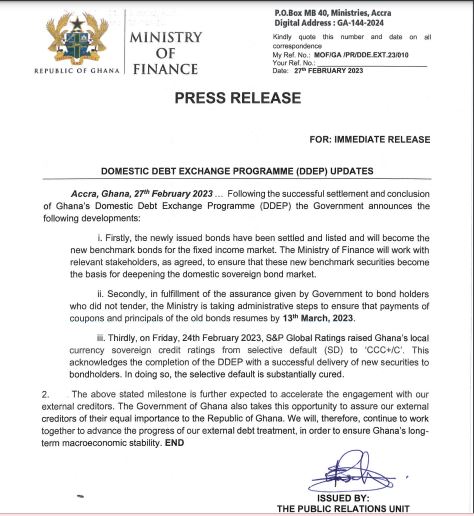

“Secondly, in fulfillment of the assurance given by Government to bondholders who did not tender, the Ministry is taking administrative steps to ensure that payments of coupons and principals of the old bonds resume by 13th March, 2023,” part of the statement reads.

The assurance comes against the backdrop of three bondholder groups marching to the Finance Ministry on Monday to demand the immediate payment of coupons and principals which matured on February 6th and 20th February, 2023.

They are the Coalition of Individual Bondholders Groups made up of Pensioner Bondholders Forum, Individual Bondholders Association of Ghana and Individual Bondholders Forum.

The group gathered at the Finance Ministry on Monday, February 27, to check on the payment of coupons and principal for bondholders whose bonds had matured but whose payment had not been honoured despite government's promise.

Also, the Finance Minister, Ken Ofori-Atta promised that outstanding bonds which matured on February 6 for which government defaulted will be honoured after February 21.

“Settlements will be made after Tuesday, February 21 and then we can begin to look at processing everybody’s [bonds],” the Finance Minister assured the pensioner individual bondholders when they met to thank him for exempting them from the Debt Exchange Programme.

But in an interview with JoyNews’ Joseph Ackay Blay, the convener of the Pensioner Bondholders Forum, Dr. Adu Anane Antwi said the group wants to know what is causing the delay in payment.

According to him, the individual bondholders are worried.

“We are here to find out why coupons the Minister said will be paid on the 21st after the settlement day, we haven’t heard any information from the Ministry and therefore, we have come to find out why the payment has not been made yet,” he said.

Meanwhile, the release further noted that the newly issued bonds have been settled and listed and will become the new benchmark bonds for the fixed-income market.

The Ministry of Finance noted that it will work with “relevant stakeholders, as agreed, to ensure that these new benchmark securities become the basis for deepening the domestic sovereign bond market.”

Latest Stories

-

Thomas Partey crowned 2025 Ghana Footballer of the Year

20 minutes -

IGP orders major raids on illegal mining sites along River Ankobra: 61 arrested

27 minutes -

Iran missiles cause multiple casualties in Israel as Israeli strikes hit Tehran oil depot

34 minutes -

Parliament lauds nurses and midwives for calling off strike

1 hour -

12 out of 14 districts suffering from illegal mining – Western Regional Minister

1 hour -

Ghana ready for assembling combustion vehicles, production of electric vehicles – Energy Ministry

1 hour -

Don’t buy contaminated food – Environmental director advises

1 hour -

Ghana exposed to global fuel shocks amid empty oil buffers – COPEC

1 hour -

Energy Ministry says suspension of fuel levy due to Iran-Israel tensions, soaring oil prices

2 hours -

Mahama commends Yaa Naa for peace in Dagbon

2 hours -

Father’s Day: Husbands must adapt to changing roles – Ebo Whyte

2 hours -

Ghana validates first National E-Commerce Strategy

2 hours -

Did Israel-Iran tensions prompt Ghana to rethink GH¢1 Fuel Levy implementation?

3 hours -

MP for Weija-Gbawe demands immediate completion of storm drain to end flood nightmare

4 hours -

Fuel tax U-turn reveals ‘trial-and-error governance’ – Minority

5 hours