Introduction

“Meeting today's needs without compromising the future's ability to do is to sustainable development" Gro Harlem Brundtland

Environment, Social and Governance (ESG) has become a significant topic of discussion in the modern business landscape. ESG describes the framework used by stakeholders to assess how sustainability factors impact business operations. ESG issues have gained widespread attention across all sectors and are increasingly being integrated into various aspects of business, social and political activities globally. Countries are actively promoting ESG, leading to the implementation of policies and regulations to advance these objectives.

This article is the first in a series that explores ESG financing opportunities in Ghana and highlights the latest developments in ESG regulations, policies, and initiatives in the country. We further explore and focus on how companies that are embarking on Environmental and Social driven projects and implementing ESG into their corporate governance framework can attract ESG funding to start or scale up their businesses in our second series of this article.

Recent Developments Promoting ESG Financing in Ghana

In line with the Sustainable Development Goals (SDGs), Ghana has undertaken policy and regulatory initiatives to achieve its sustainability goals. Currently, the Environmental Protection Bill 2023 which seeks to establish the Environmental Protection Authority and empowers it to oversee all matters that relate to the environment and climate. The Bill also reenacts the EPA Act 1994, Act 490 and the Electronic Waste Control Management Act 2016, Act 917. The Pesticide Management Fund has also been introduced with the passing of the bill. Aside from the legislation, policies such as the National Energy Transition Framework and the Energy Transition Investment Plan have been launched to unlock finance for African countries.

The Ghana Sustainable Banking Principles (GSBP) was launched in November 2019 as an important step towards promoting sustainable financing in Ghana. The Bank of Ghana issued Guidelines and Principles for sustainable banking covering the following.

- Environmental and Social Risk Management (“ESRM”)

- Internal Environment Social and Governance (“ESG”) in banks operation

- Corporate Governance and Ethical Standard

- Gender Equality

- Financial Inclusion

- Resource efficiency, Sustainable Production and Consumption; and

- Reporting

Consequently, financial institutions in Ghana are increasingly considering ESG and sustainability factors when deciding where to allocate funding. Some banks and financial institutions such as Ecobank Ghana Limited have created special departments for ESG. Some of these banks are seeking funding support from the Green Climate Fund (GCF) to finance ESG projects in Ghana.

In May 2021, the Securities and Exchange Commission (SEC) inaugurated its Capital Market Master Plan (CMMP) to act as the guideline for developing the capital markets in Ghana over the next ten years. The CMMP constitutes four key pillars. Under the first key pillar, the CMMP facilitates the issuance of green bonds, “as a way to mitigate the effects of climate change and environmental degradation”.

In 2021, the International Finance Corporation (IFC) partnered with the SEC to support the development of green bonds guidelines under the initiative of the IFC’s Green Bond Market Development Program which was launched in 2010.

In March 2024, this partnership gave birth to the Securities Industry (Green Bond) Guidelines 2024 which is expected to improve the diversity of financial instruments available on the capital markets for both local and foreign investors and unlock funding for green buildings, sustainable water management, clean transportation, renewable energy, and other climate-friendly projects in the long run.

Barely a year after IFC announced its partnership with SEC, the Government announced the opening of the green bond exchange (“The Green Exchange”) in 2022. “The Green Exchange, to be based in Ghana’s capital Accra, aims to enable companies to issue billions in green bonds and for investors to trade the debt in a secondary market,” said Orla Enright, the exchange’s CEO, according to information relayed by Bloombergii. The Green Exchange seeks to help local businesses issue green bonds at between 4% and 6% in contrast to the traditional 16-21% interest rates for raising debt in hard currency.

The National Pension Regulatory Authority (NPRA) gazetted its Guidelines on Investment of Tier 2 and 3 Pension Scheme Funds on 14 September 2021.

One of the objectives under the Responsible Investing Principles is for Pension Schemes to incorporate ESG factors in the investment decision-making process. Per the Guidelines on Investment of Tiers 2 & 3 Pension Scheme Funds, pension funds have been given waivers to their investment limits to invest in Green Bonds. Based on their Assets Under Management (AUM), the following shall apply:

- Investment in Government of Ghana Green Bonds of up to 5% of AUM shall not count towards the maximum attainment of 75% allocation in Government of Ghana securities.

- Investment in Corporate Debt Securities designated as Green Bonds, up to 5% of AUM by pension scheme operators towards these bonds shall not count towards the attainment of 35% maximum allocation in Corporate Debt Securities.

The Ghana Fixed Income Market (GFIM) which is under the auspices of the Ghana Stock Exchange (GSE) where it facilitates trading of fixed-income instruments, has gone green by declaring a positive stance towards issuing sustainable bonds to the investor public. In April 2022, requirements and guidance on how to issue sustainable bonds requirements were added to the GFIM listing rules, enabling issuers (corporates and government) to refine their green, social, and sustainability growth strategies and tap into increasing investor demand for such instruments.

Now through the GFIM and the Green Exchange, projects relating to education, green energy, food and water security, gender equality, and women empowerment can alternative sources of debt funding. Sustainable bonds can be issued in the form of social bonds, gender bonds, and Sustainability-Linked Bonds (SLBs). Issuers of sustainable bonds are viewed as ESG-compliant and contributors to sustainable financing in Ghana.

In July 2024, the Chartered Institute of Bankers (CIB) Ghana in collaboration with the IFC and Environmental Protection Agency (EPA) and the Swiss State Secretariat for Economic Affairs (SECO) launched the ESG Certification Programme to promote ESG financing and responsible investment in Ghana. The programme aims to embed sustainability principles into financial decision-making to align Ghana’s banking practices with global standards.

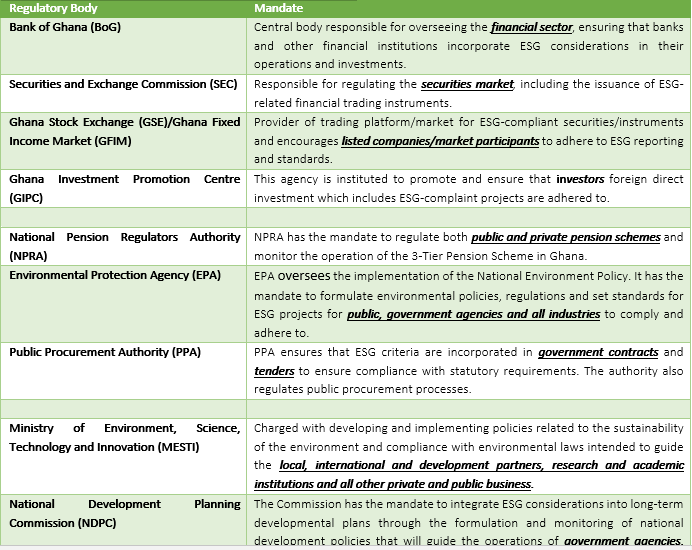

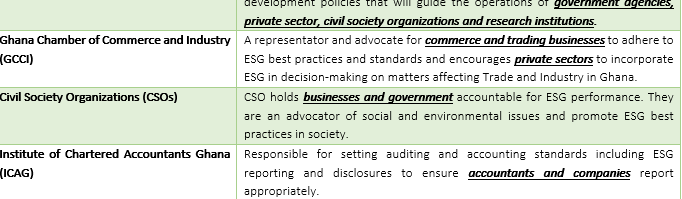

Regulatory Institutions responsible for the development of Ghana’s ESG Landscape and their mandates

Keeping up with ESG trends and developments in Ghana lately has been a challenge as global ESG regulations evolve rapidly. Below is a list of key regulatory institutions responsible for the development of Ghana’s ESG Landscape and their mandates in promoting ESG driven businesses and projects.

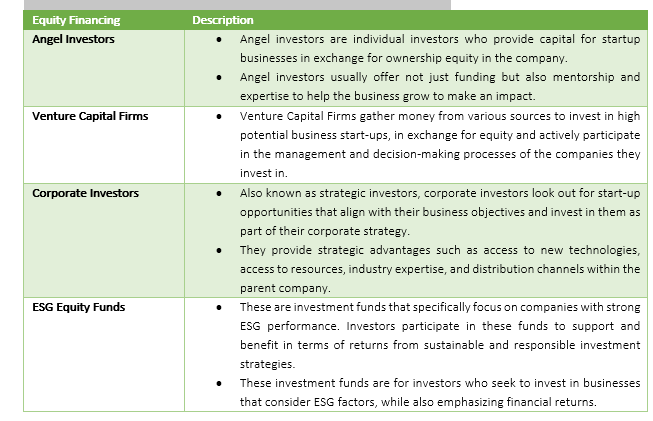

Equity Financing for ESG-Driven Projects and Businesses

ESG financing through equity involves investing in a company’s stock to support its ESG goals and initiatives by actively participating on corporate boards. This can be done through common or preferred shares.

Equity financing for ESG-driven projects and businesses can be raised through:

Benefits of ESG related Equity Investments to projects and businesses include but are not limited to the following:

- Improves long-term returns from the use of long-term equity capital.

- Promotes board or shareholder activism and investor pressure towards ESG-related projects or goals.

- External stakeholder or regulatory requirement to have a diversified or impact-oriented board.

- Decreases investment risk through capital diversification.

- Improves corporate brand image and reputation.

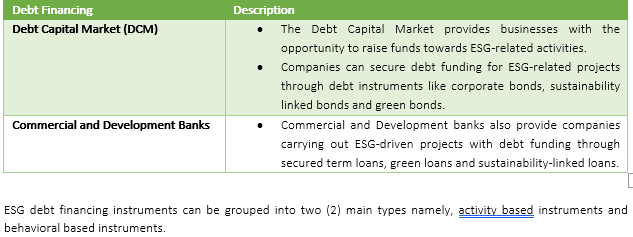

Debt Financing for ESG Driven Projects and Businesses

Usually, debt financing is sourced by businesses at later stages of development of the company to raise funds for its sustainable, environmental, and social projects.

Debt financing for ESG-driven projects and businesses can be raised through the Debt Capital Market and Commercial and Development Banks.

ESG debt financing instruments can be grouped into two (2) main types namely, activity based instruments and behavioral based instruments.

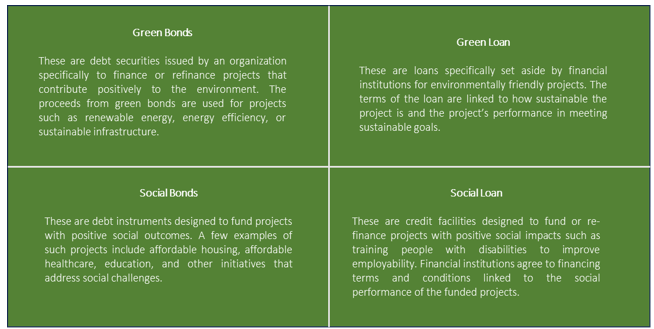

- Activity Based Instruments:

With this type of instruments,the financing goal of the instrument must be declared to know the category of projects being financed with debt proceeds. We highlight four (4) unique activity-based instruments below, namely, Green bonds, Green loans, Social bonds and Social loans. Under these types of financing, the category and nature of the project must be defined.

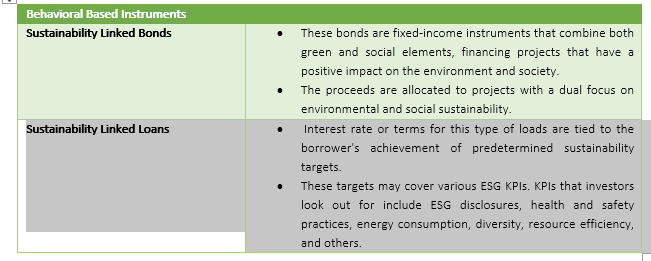

- Behavioral Based Instruments:

With this group of instruments, the goal of the financing must be declared before the sustainability loan agreement is signed, or the bond is issued. It is required that the borrower stipulates a sustainability performance target that would be achieved during the life of a loan. The targets will be measured using Key Performance Indicators (KPIs) and if these targets are not met, a penalty is charged based on a margin on the loan or a coupon adjustment to the bond i.e., a form of punishment mechanism where the cost of capital is increased for the issuer or borrower if the predefined sustainability related goals are not met.

Benefits of ESG Debt Financing to Businesses include but are not limited to the following:

- Retention of company ownership and control.

- Companies benefit from tax deductible and lower interest payments.

- Provides flexible credit conditions from sustainable debt providers.

- Access to market opportunities for businesses to tap into funding from international financiers such as Africa Development Bank Group (AFDB), The ECOWAS Bank for Investment and Development (EBID) etc.

- ESG debt financing adds value to a business, by enhancing the value of its loan portfolio.

Conclusion

In today’s business environment, ESG is a major driver of growth and investor attraction. There are several funding options available to businesses that are ESG inclined. Businesses can tap into the equity market or debt capital market to seek funding. These funds are linked to meeting the set environmental and social requirements.

For businesses to unlock these opportunities, businesses should make a conscious effort to be ESG compliant by adhering to ESG regulations established by regulatory bodies within Ghana’s ESG landscape and engage these bodies to create the needed environmental to tap into ESG financing opportunities in Ghana.

How Deloitte Can Help

- Deloitte provides corporate finance advisory services, and we help clients navigate the ever-changing financial markets to raise equity and debt funding for their businesses.

- Our financial advisory unit provides a wide range of services from feasibility studies to Transaction Advisory, Due Diligence, Reporting Accounting, Restructuring, Valuation and Financial Modelling services, Infrastructure & Capital Projects, Real Estate and Economic Advisory services, and Forensic services.

- Deloitte provides confidence and value to clients through high-caliber staff, robust project management, effective working methods, innovation, security, and strong working relationships.

Latest Stories

-

Ashaiman NDC in shock as chairman Shaddad Jallo dies

25 seconds -

Mahama converts Daboya College into public Teacher Training Institution, revives Doli project

18 minutes -

Prioritise prudence, not foreign debt – Deputy Ahafo Regional Imam implores African leaders

20 minutes -

Mahama promises STEM School and TVET Centre for Savannah Region

21 minutes -

Mahama announces new public university for Savannah Region

22 minutes -

Ahiagbah demands Health Minister’s dismissal over handling of nurses’ strike

23 minutes -

Mahama’s clemency for radio stations was pure gimmick – Egyapa Mercer

24 minutes -

GRA postpones implementation of Energy Sector Levy

26 minutes -

GES urges supervisors and invigilators to uphold integrity and honesty

3 hours -

Don’t let your parents down – Omane Boamah to Pope John SHS students

3 hours -

Prof Sharif Khalid defends gov’t’s record on health workers, questions comparisons with UK

3 hours -

Razak Opoku: KGL-NLA contract the best since establishment of NLA in 1958

4 hours -

Daily insight for CEOs: Customer-centric innovation – Designing for relevance and growth

4 hours -

36 Prison inmates write BECE, 2 candidates die, 16 more invigilators arrested

5 hours -

GII boss commends AG’s anti-corruption approach

5 hours