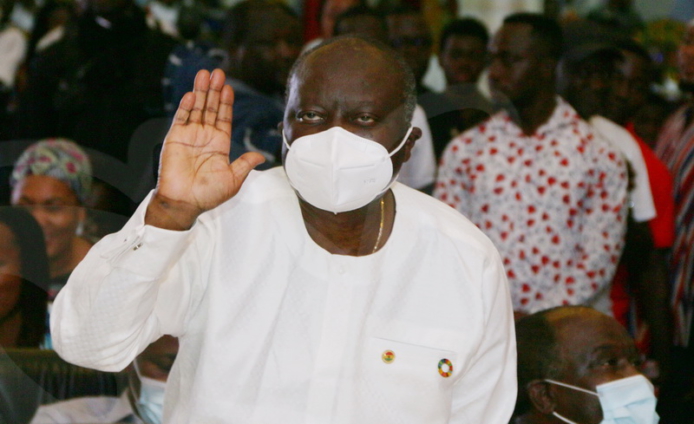

Finance Minister, Ken Ofori-Atta has ruled out any move to conduct another round of the Domestic Debt Exchange Programme (DDEP) targeted at pension funds.

He made the statement in reaction to reports suggesting that the Finance Ministry has assured Eurobond investors of another round of DDEP during a virtual engagement.

“We are not planning a second round of the Domestic Debt Exchange Programme for pension funds. I think it was a misunderstanding”, he explained at a News Conference in Washington DC, USA.

Mr Ofori-Atta stated that the presentation was taken out of context when he proffered an explanation to the investors.

He recalled that the government has already reached an agreement with organised labour not to include pension funds, a situation that remains same.

“We reached an agreement with organised labour association that pension funds were exempted. That has not changed”.

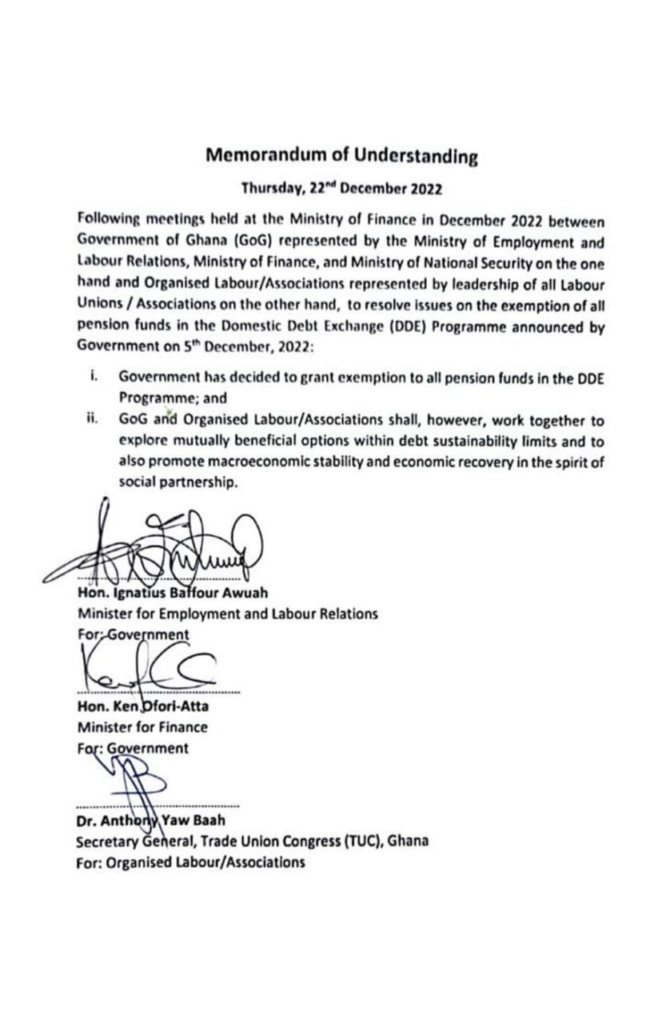

Furthermore, he said "there will be NO second round of the DDEP targeting pensions. In the GoG Memorandum with Organised Labour dated December 22, 2022, it was agreed that pensions were exempt and that remains the case".

The Finance Minister added that it is therefore NOT correct to state that government is planning a second round of Domestic Debt Exchange Programme targeting pension funds.

"What we are doing is working with stakeholders on how they can further help government reduce debt servicing obligations, to support Ghana’s economic recovery programme.

Per the MoU, "GoG and organised labour/associations shall, however, work together to explore mutually beneficial options within debt sustainability limits and to also promote macroeconomic stability and economic recovery in the spirit of social partnership.”

Government secures ¢82.9bn in DDEP

In February, the Ministry of Finance announced that approximately 85% of bondholders participated in the DDEP.

This amounted to ¢82,994,510,128 (¢82.99 billion)

“The government is pleased with the results, as a substantial majority of the Eligible Holders have tendered,” a statement from the Ministry said.

It added that the result is a significant achievement for the government to implement fully the economic strategies in the post-COVID-19 Programme for Economic Growth (PC-PEG) during the current economic crisis.

To provide sufficient time to settle the New Bonds in an efficient manner, the statement explained that government is extending the Settlement Date of the exchange from the previously announced February 14, 2023, to February 21, 2023.

“This Settlement Date extension is, however, only to process the settlement of the New Bonds. The issue date, interest accrual schedules and payment schedules for the New Bonds will be adjusted to reflect the actual Settlement Date”.

It added that as the exchange period has expired, no new tenders will be accepted, and no revocations or withdrawals will be permitted

Latest Stories

-

Kwabena Adu Boahene, wife sue Attorney General for defamation

34 minutes -

Ag. CJ directs registrars to submit all new cases, applications for court assignment, hearing dates

39 minutes -

Farmers commend COCOBOD for decision to announce new prices in August

54 minutes -

President Mahama rolls out initiative to prevent girls from dropping out of school due to menstruation

58 minutes -

DAAD launches regional office in Accra to boost West Africa–Germany academic ties

1 hour -

I’ll develop Tano South with teamwork, transparency and a people-centred approach – MCE

1 hour -

Vice President Naana Opoku-Agyemang is very well and recuperating – Mahama

2 hours -

Offer good governance and improved development – Ahafo Minister tells MMDCEs

2 hours -

Daily Insight for CEOs: Customer-centric transformation – Competing on experience, not just product

2 hours -

University of Cape Coast Lecturer praises government’s ‘One Million Coders’ Initiative

2 hours -

Ghana’s Free Sanitary Pad Programme: 6 lessons from Kenya

2 hours -

SHS 2 students to choose a foreign language in new curricula – Education Minister reveals

2 hours -

Tema Traditional Council expresses displeasure over non-indigenous MCE nominations

2 hours -

NACOC intercepts 73 slabs of suspected cocaine bound for the Netherlands, 4 arrested

2 hours -

34-year-old taxi driver arrested for allegedly killing his 23-year-old girlfriend

3 hours