“If your mother is dead but you say she is asleep, you are the one who will be hungry at dinner time.” – Ghanaian proverb.

The president’s claim in 2023 that the Ghanaian economy had “turned the corner” and that the future looked brighter than ever before appears to be at variance with data from his government and the reality on the ground. The economic crisis may be worse than what the president and his team are letting on.

They better face reality and act before it’s dinner time.

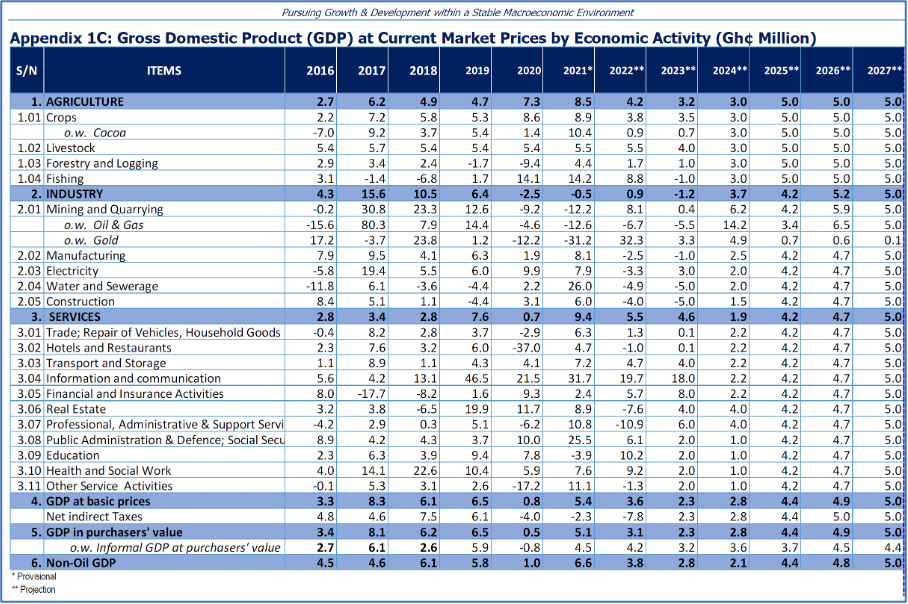

Take, for example, the projected GDP growth rates for 2024-2027 that appear in Appendix 1C of the 2024 budget statement: They are almost identical across sub-sectors in a way that doesn’t reflect the economy’s historical growth patterns or the logic of economic analysis and forecasting. For instance, the agriculture sector is projected to grow by 3.0% in 2024, the same as all its four sub-sectors – crops, livestock, forestry and logging, and fisheries; there is zero variation, despite their different structures and growth dynamics. That is abnormal. (See the appendix below).

The lack of variation in growth rates in the industrial and services sectors is equally worrying. A critical look at the comparative growth rates for the three broad sectors (agriculture, industry and services) from 2017 to 2023 suggests that the figures for 2024 might have been placeholders, or dummy data, that were not replaced with real data before the budget was released. If so, every policy decision based on them would be equally wrong. This will have serious implications for budget performance in 2024. Something needs to be done to rectify it.

The projected growth rates from 2025 to 2027 are no better. They are made up of exactly 4.2%, 4.7% and 5.0% across all the sub-sectors, except mining and quarrying (where planning and investment tend to be more professional and reliable). Such identical growth rates across structurally different sectors are only possible in a perfect world of perfect knowledge of the future. Such a world does not exist. The public deserves an explanation.

And then there are the Bank of Ghana’s latest statistics on Ghana’s public debt, as contained in its March 2024 edition of Summary of Economic and Financial Statistics. The reported debt/GDP ratios from December 2022 to December 2023 are based, strangely, on fixed nominal monthly GDP of GH¢841.6 billion throughout 2023 (and GH¢614.3 billion for December 2022), despite high and rising inflation during that period. There are two problems here: One, the Ghana Statistical Service produces only quarterly and yearly GDP data; never monthly. And two, even if the Bank found a way to estimate monthly GDP (highly unlikely, even dubious), one expects nominal GDP to increase in line with rising inflation, even as real growth (or the underlying economy) is collapsing because of the high inflation.

This means that actual debt/GDP ratios may be lower than what was reported by the Bank, although total nominal debt, as contained in the Summary, increased from GH¢446.3 billion in December 2022 to GH¢610 billion December 2023, a growth of about 37.0%. A lower debt/GDP ratio, however, isn’t necessarily good news for the government, unless the economy is growing and creating jobs, which would lead to high corporate profits, increased household incomes, a larger tax base, and, hopefully, increased government revenue to finance development.

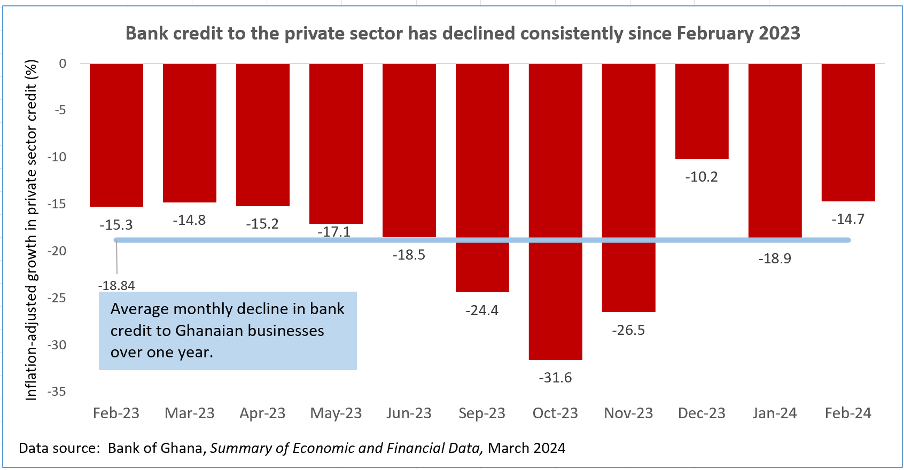

That is not what is happening. Indeed, data from the Bank on business credit, the oxygen of any economy, shows that businesses are gasping for air. Credit to the private sector, adjusted for inflation, declined consistently from February 2023 to the beginning of 2024, averaging 18.8% decline per month, with the largest decline of 31.6% occurring in October 2023 (see the graph below).

A previous report by the Bank of Ghana had suggested that banks would rather invest in T-bills, the safest government investment available, after the chaotic domestic debt exchange rip-off, than extend loans to businesses that are at risk of collapsing under the weight of a repressive tax regime, raging inflation, a weakened currency, and a directionless policy environment.

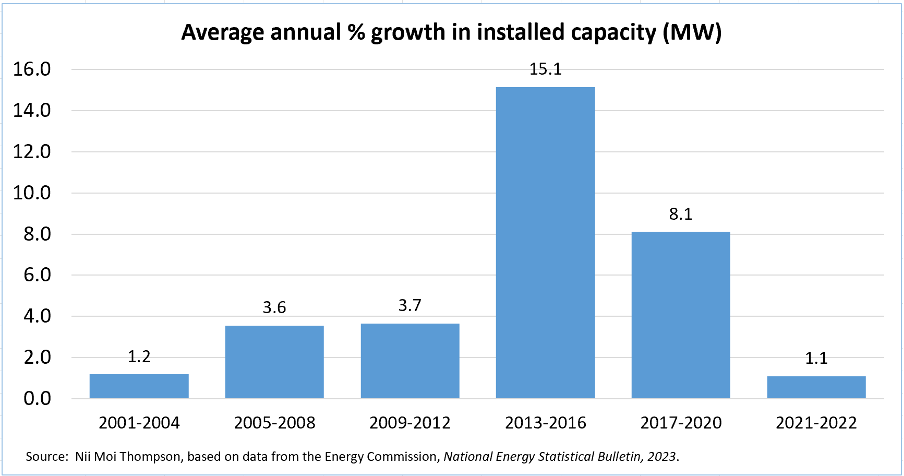

As if things aren’t bad enough, along comes a resurgence of dumsor with a vengeance (and a government in denial), the result of a steady decline in investment in the electricity sector since the last dumsor was resolved, as shown in the graph below. Money from the Energy Sector Levy Act (ESLA), introduced by the Mahama government in 2015 to pay off debt in the sector and put it on a stronger footing to prevent future dumsor, has been squandered, and technical and financial losses from electricity distribution have increased from 23.3% in 2015 to 30% in 2022, instead of being reduced to 12% by 2021 and 5% by 2029, as recommended in the 40-Year Development Plan.

Worse, more than $11 billion in Eurobonds, amounting to over 74% of all Eurobonds since 2007 and borrowed in just four years, appears to have been also squandered, with no discernable positive impact on the economy. Nor has the dramatic increase in petroleum revenue from GH¢200 million 2016 to GHc6 billion in 2022, or the $2 billion the IMF “dashed” Ghana in 2020 and 2021 to combat Covid-19, before the government went running back to the Fund in 2022 for a $3 billion bailout, after the economy bottomed out – despite all the previous resources and more.

Is our mother dead or asleep?

Latest Stories

-

Parliament amends Growth and Sustainability Levy, raises gold mining tax to 3%

2 hours -

GPHA, GRA to ensure efficient cargo clearance, trade facilitation

2 hours -

Parliament approves ¢4bn budget for Local Government Ministry

3 hours -

Ghana selects US, China as vendors for first nuclear plants

3 hours -

International development partners engage Northern Ghana for strategic collaboration

3 hours -

Defence Minister donates food Items to GAF; hopeful it’ll boost morale of the troops

3 hours -

Bar owners arrested over assaults on 41 women in Belgium

3 hours -

Starmer accuses Putin of ‘playing games’ over Ukraine peace deal

4 hours -

Trump targets ‘anti-American ideology’ at Smithsonian museums

4 hours -

2Baba goes shopping again with new lover Natasha Osawaru

4 hours -

Macron urges Algeria to free writer jailed for Morocco comments

4 hours -

Real Madrid quartet probed for alleged indecent conduct

4 hours -

Premier League to have two summer transfer windows due to Club World Cup

5 hours -

Barcelona beat Osasuna in rearranged La Liga game

5 hours -

Djokovic into last four with ‘great’ win over Korda

5 hours