Ratings agency, Fitch has pointed out that Nigerian banks are making significant progress in raising core capital to meet new paid-in capital requirements and are meeting the first quarter 2026 deadline,

According to the UK-based firm, this is supporting a recovery in capitalisation from the impact of naira devaluation, providing fuel for business growth.

It again reduces the likelihood of significant banking sector consolidation.

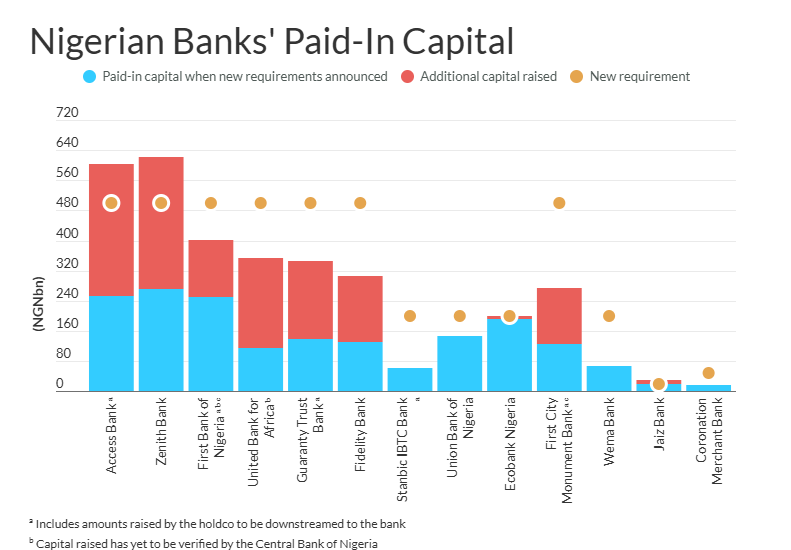

In a report, it said the two largest banks, Access Holdings and Zenith Bank, are the first to secure enough fresh capital to meet the Naira 500 billion requirement for an international licence.

First HoldCo, United Bank for Africa and Guaranty Trust Holding Company are also taking a phased approach. They have recently raised capital and have shareholder approval to begin raising more to meet the Naira 500 billion requirement. First HoldCo’s and United Bank for Africa’s recent rights issues are awaiting final regulatory approval.

Fidelity Bank and FCMB Group have completed initial capital raisings but Fitch said they will need to raise more to maintain their international licences. “As second-tier banks, they must raise significantly more capital relative to their balance sheets than larger banks. They have extraordinary general meeting approval for this, although they could consider downgrading to a national licence as they each have just one foreign subsidiary”.

Ecobank Nigeria Limited (ENG) and Jaiz Bank also needed only small capital injections to meet their requirements and have already achieved compliance.

“We estimate that ENG is still in breach of its total capital adequacy ratio (CAR) requirement of 10% but it has further capital-raising plans to restore compliance”.

Stanbic IBTC Holdings also has launched a rights issue to raise capital to maintain its national licence.

In March 2024, the Central Bank of Nigeria announced a significant increase in paid-in capital requirements (share capital plus share premium) for commercial, merchant and non-interest banks. Banks have three ways to comply – through equity injections, Mergers and Acquisitions and downgrading their licence authorisation.

Fitch-rated banks have also made notable progress towards compliance. Almost all have raised capital or formally launched the process to do so.

Latest Stories

-

GoldBod revolution: Over 300 new trading licenses issued – Sammy Gyamfi

49 seconds -

UEW Dean gives back to hometown, supports classroom project in Northern Ghana

1 minute -

24-Hour Economy Secretariat unnecessary – Trade Expert

6 minutes -

Thomas Partey: The key questions about midfielder charged with five counts of rape and one count of sexual assault

15 minutes -

It’s time for Ghanaians to own gold mines – President Mahama

18 minutes -

GoldBod Taskforce launch: Mahama promises 10% reward for whistleblowers

22 minutes -

WAFCON 2024: Four things we learnt from Black Queens defeat to South Africa

26 minutes -

International Trade expert calls for rigorous monitoring of 24-Hour Economy programme

35 minutes -

Mahama launches GoldBod taskforce with stringent oversight measures

42 minutes -

Equatorial Coca-Cola Bottling Company to acquire Voltic (GH) Limited and West African Refreshments Ltd.

45 minutes -

Volta can be a $10 billion economy

57 minutes -

We’ll deal ruthlessly with any abuse of power – Sammy Gyamfi warns GoldBod taskforce

1 hour -

Springfield refutes $100m fraud claims by Petraco

1 hour -

Manhyia South MP eulogises Ernest Yaw Kumi

1 hour -

Activist demands ‘rescue shelter’ for street children in Bono

1 hour