Audio By Carbonatix

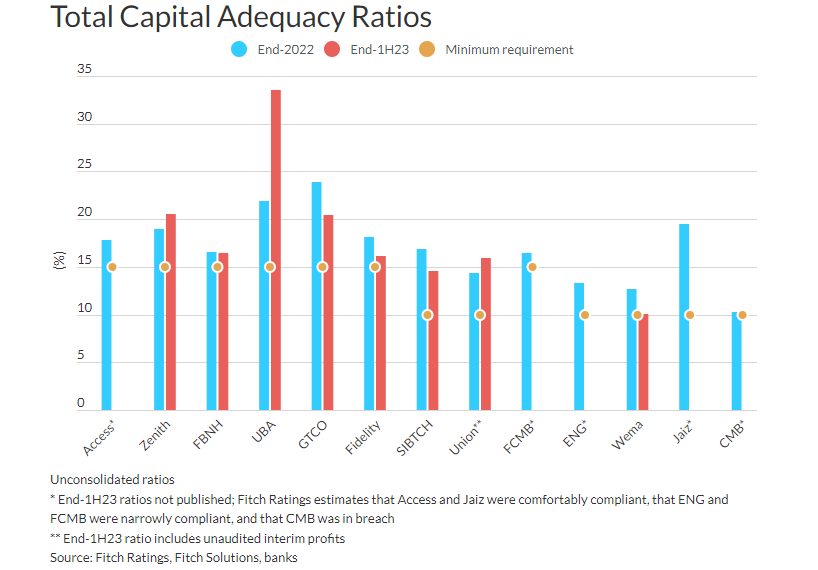

Nigerian banks’ balance-sheet structures have helped to ensure continued compliance with minimum capital requirements despite the devaluation of the Nigerian naira by about 40% since June 2023, Fitch Ratings has disclosed.

According to the UK-based firm, the risks to capital from further currency devaluation and loan quality pressures should not affect ratings for most banks.

However, the Rating Watch Negatives (RWNs) on the three banks most at risk of breaching minimum total capital adequacy ratio (CAR) requirements remain in place given these risks.

The sharp devaluation of the official exchange rate led to large FX revaluation gains in the first half year due to banks’ long net open positions in foreign currency (FC), it explained.

“FC risk-weighted asset inflation was limited by small FC loan books and low risk-weights on non-loan FC assets, helping banks to remain compliant with CAR requirements. Loan impairment charges increased significantly in 1H23 due to the weaker macroeconomic setting and the increased provisions needed for FC loans, but they were comfortably absorbed by the FX revaluation gains”, it added.

It further said banks with foreign subsidiaries, in particular United Bank for Africa (B-/Stable), also experienced large FC translation gains through other comprehensive income, while the CARs of banks with FC-denominated capital-qualifying debt instruments, notably Access Bank (B-/Stable), benefitted from these instruments inflating in naira terms.

Several banks, it pointed out have had their interim financials audited so that they can incorporate their interim profits into regulatory capital. FBN Holdings, Fidelity Bank, Wema Bank and Jaiz Bank (all rated ‘B-’/Stable) plan to raise core capital to strengthen buffers over CAR requirements.

Latest Stories

-

An open letter to H.E. John Dramani Mahama: The audacity of the third shift

12 minutes -

A new era of healthcare dawns in Kintampo: Mary Queen of Love Medical Hospital opens its doors

55 minutes -

NDC gov’t has demonstrated strong fiscal discipline – Abdulai Alhassan

1 hour -

Heavily armed Burkinabè soldiers arrested in Ghana

1 hour -

Tamale Chief commends IGP Special Operations Team for crime reduction efforts

2 hours -

None of NPP’s 5 flagbearer aspirants is credible – Abdulai Alhassan

2 hours -

Police arrest suspect for unlawful possession and attempted sale of firearm

3 hours -

3 arrested in connection with Tema robberies

3 hours -

Your mouth on weed is nothing to smile about

4 hours -

25% university fees hike, what was the plan all along? — Kristy Sakyi queries

5 hours -

Some OMCs reduce fuel prices; petrol going for GH¢10.86, diesel GH¢11.96

6 hours -

Trump says health is ‘perfect’ amid ageing concerns

6 hours -

China’s BYD set to overtake Tesla as world’s top EV seller

6 hours -

Joy FM’s iconic 90’s Jam returns tonight: Bigger, better, and packed with nostalgia

7 hours -

Uproar as UG fees skyrocket by over 25% for 2025/2026 academic year

8 hours