Audio By Carbonatix

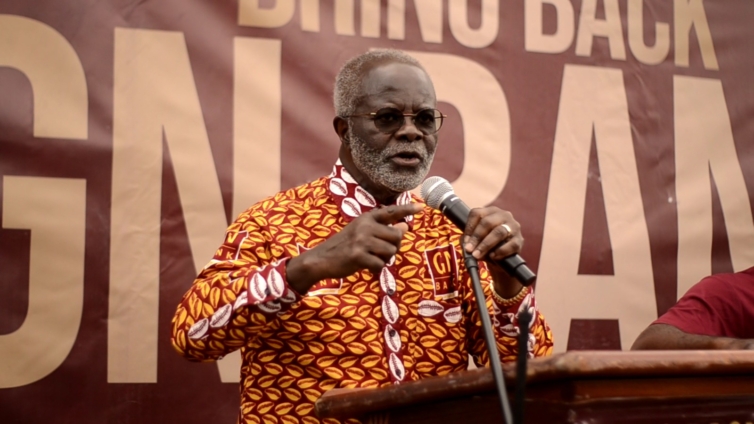

Barring any unforeseen circumstances, the Chairman of Groupe Nduom, Dr Papa Kwesi Nduom will today address Ghanaians on Facebook as part of media activities to resume the nationwide Bring Back GN Bank campaign

The broadcast which will start at 5:00 p.m will be live on Amansan Television (ATV) in Accra, Ocean 1 TV/Ahomka FM, all in Elmina in the Central region and all other GN media platforms including social media.

Dr Nduom on his Facebook has announced that the 3rd stage of #BringBackGNBank campaign which will involve media activities will bring out more facts, more evidence and more reasons for the reinstatement of the bank’s licence which was revoked by the central bank of Ghana.

It will be recalled that, the GN Bank nationwide campaign led by Dr Nduom started in July this year where the team toured ten (10) regions including Upper East, Upper West and Northern regions.

The campaign has been purposeful, peaceful and very effective in educating the public about the circumstances that led to the revocation of the GN Savings license.

This, Today understands has caused many citizens to call for the reinstatement of what became known as “the People’s Bank”.

Traditional leaders, religious men and women, traders, workers of types, politicians, teachers, health workers, market women and others have heard the messages and want the bank’s licence reinstated.

Economists have concluded that the haste with which such a bank with nationwide operations was abruptly collapsed has contributed to micro level economic challenges throughout the country.

Today investigations show that in the Ghanaian hinterland, no licensed national financial institution has stepped up to support the local economies the way GN Bank did.

Many small businesses have collapsed and others have downsized their operations.

The Chairman of Groupe Nduom has said that the campaign is to set the records straight and explain to the general public the history of GN Bank; the impact it was making in expanding access to banking nationwide; the challenges it faced; and the need to restore the licence.

According to him, repeated attempts to engage the current Administration (particularly the former Minister of Finance Ken Ofori- Atta) and the Bank of Ghana (BoG) among others such as the House of Chiefs and religious bodies has not yielded positive results. Hence the need to go public with the facts.

The BoG on August 16, 2019 revoked the licences of twenty-three (23) savings and loans companies and finance house companies.

This included GN Savings, a company BoG had issued a licence to only in January 2019 following the reclassification of GN Bank, a universal bank. Dr. Nduom has explained that he wants to get back to the universal banking rank due to the significant investments made in technology, geographic footprint and human capital.

GN has maintained all along that its companies are owed substantial sums of money by government and its agencies that when paid would have recapitalized and provided a solution to real and perceived challenges.

The company has presented a demand letter to the Akufo-Addo Administration months ago for amount now exceeding GHS7.5 billion.

The administration and its agencies have not given the courtesy of responses even though they have acknowledged receiving the demand letter.

Latest Stories

-

‘Adom FM’s Strictly Highlife’ lights up La Palm with a night of rhythm and nostalgia

3 minutes -

Ghana is rising again – Mahama declares

5 hours -

Firefighters subdue blaze at Accra’s Tudu, officials warn of busy fire season ahead

5 hours -

New Year’s Luv FM Family Party in the park ends in grand style at Rattray park

5 hours -

Mahama targets digital schools, universal healthcare, and food self-sufficiency in 2026

6 hours -

Ghana’s global image boosted by our world-acclaimed reset agenda – Mahama

6 hours -

Full text: Mahama’s New Year message to the nation

6 hours -

The foundation is laid; now we accelerate and expand in 2026 – Mahama

6 hours -

There is no NPP, CPP nor NDC Ghana, only one Ghana – Mahama

6 hours -

Eduwatch praises education financing gains but warns delays, teacher gaps could derail reforms

6 hours -

Kusaal Wikimedians take local language online in 14-day digital campaign

7 hours -

Stop interfering in each other’s roles – Bole-Bamboi MP appeals to traditional rulers for peace

8 hours -

Playback: President Mahama addresses the nation in New Year message

8 hours -

Industrial and Commercial Workers’ Union call for strong work ethics, economic participation in 2026 new year message

10 hours -

Crossover Joy: Churches in Ghana welcome 2026 with fire and faith

10 hours