The National Pensions Regulatory Authority (NPRA) has marked what they call 'Pension Sunday'—a special day devoted to enlightening church congregations and the broader public about the significance of investing in their future through pension schemes.

In recent years, the NPRA, the regulatory body overseeing Ghana's three-tier pension system, has significantly intensified its advocacy efforts, particularly targeting the informal sector.

"Our goal is simple," stressed Mr. John Mbroh, Chief Executive Officer of the NPRA, "we want everyone, especially those in the informal economy, to recognize that pension investment is essential for a secure and dignified retirement."

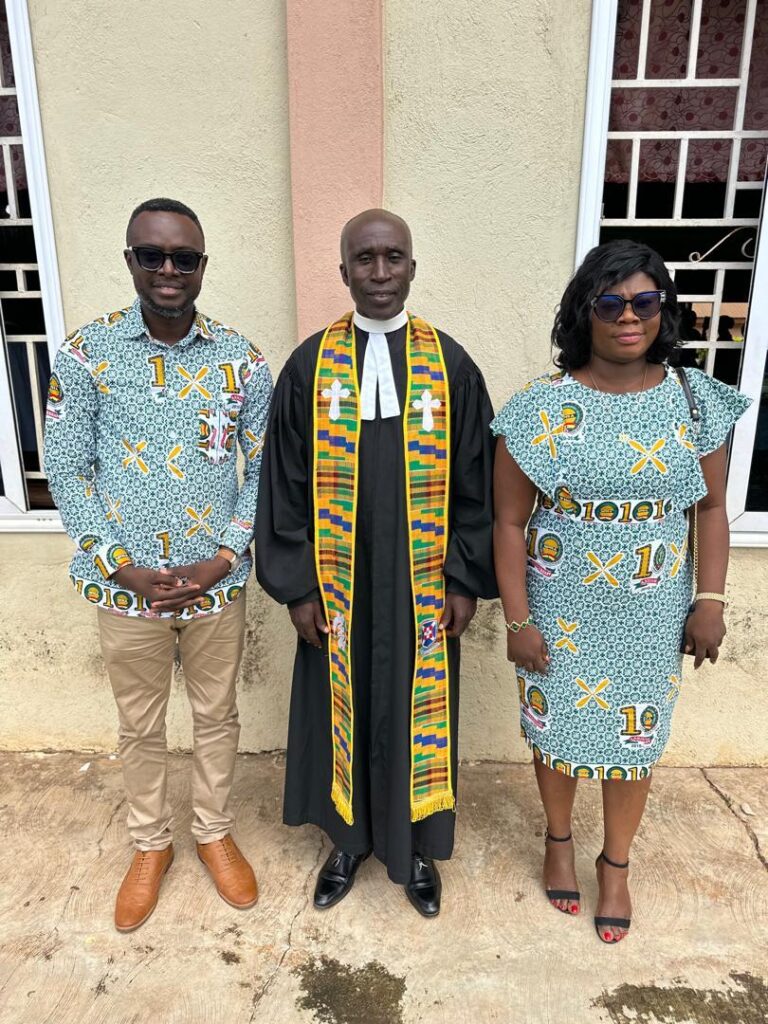

To make sure this crucial message resonates far and wide, several specialized teams from the Authority were dispatched to Presbyterian churches across the country, engaging congregations in lively and informative discussions on the long-term benefits of pensions.

"We want to break the myth that pensions are only for formal workers," Mr Mbroh who worshipped with the Ebenezer Presbyterian Church in Cape Coast added.

"Pensions are a necessity for everyone—no matter your profession."

The Deputy CEO of the Authority, David Abbey, explained that the NPA was transforming Pensions Sunday into more than just an awareness event, but a fully-fledged movement dedicated to ensuring that every worker, in every sector, has the means to secure a future of dignity.

Statistics paint a stark picture: approximately 76% of Ghana's working population is employed in the informal sector, yet only around 9% of these workers are enrolled in any kind of pension scheme.

This worrying disparity suggests that, without intervention, many may face old age poverty and the associated challenges of financial insecurity in the years to come.

To prevent this grim outcome, Mr. Abbey who worshipped with the Adabraka Presby Church says, the NPRA is encouraging church members in the formal sector to routinely request their pension statements from service providers, ensuring any discrepancies are swiftly corrected, and to keep track of their contributions being remitted promptly.

Such vigilance, he says can help alleviate future stress and uncertainty.

Moreover, the Authority called on the self-employed and other informal sector workers to join pension schemes, which not only promise a decent standard of living in retirement but also lessen the burden on the church of caring for those who could have otherwise secured their future.

"We are here to support," Mr. Abbey reiterated. "For those who are part of other groups beyond the church, the NPRA is ready to educate and assist them in joining a pension scheme. No one should be left behind."

The NPRA, established by the National Pensions Act 2008 (Act 766), is tasked with the regulation and effective administration of pensions in Ghana. It supervises both the Social Security and National Insurance Trust (SSNIT) and private pension trustees, ensuring compliance and proper governance across all pension service providers in the country.

The Authority also undertakes public education on pension schemes, issues licenses, and resolves complaints from contributors and stakeholders.

"Pension Sunday," as envisioned by the NPRA, is not just a day on the calendar; it is a promise of change—a pledge to build awareness, bridge gaps, and ensure every Ghanaian worker, formal or informal, can look forward to a future of security and dignity.

Latest Stories

-

Angélique Kidjo first black African to get Hollywood Walk of Fame star

1 minute -

Reservoir Dogs actor Michael Madsen dies aged 67

14 minutes -

Death of Liverpool forward Jota leaves football world in shock

23 minutes -

Asamoah-Boateng eyes NPP Chairmanship position

26 minutes -

Amakye Dede’s ‘Sufre Wo Nyame’ is a gospel song – Mabel Okyere

39 minutes -

Climate Change office at presidency to coordinate national response to climate – Technical Advisor

39 minutes -

Police Security withdrawn from EC Chair Jean Mensa’s residence

55 minutes -

GoldBod to transact only at Interbank Forex Rates – Sammy Gyamfi

1 hour -

KNUST attracts and partners over 40 industry giants in hold career fair

1 hour -

GWL to interrupt water supply in north-eastern Accra on Friday

1 hour -

Struggling with sex in marriage? Uncle Ebo Whyte offers practical solutions

2 hours -

Is Hon. Johnson Kwadwo Asiedu Nketia the General who knows the Battlefield?

2 hours -

Burna Boy makes Executive Producing Debut with Pan‑African Thriller “3 Cold Dishes”

2 hours -

UPSA condemns staff misconduct in viral altercation with student

2 hours -

Mahama demands strong and independent judiciary

2 hours