Despite projections that the policy rate of the Bank of Ghana will go down by the end of the first half of this year to ease cost of borrowing, it does not look so because of some perceived risks in the economy.

This is coming at a time that the Monetary Policy Committee begins its 100th quarterly meeting, from today 26th May, 2020 to review the state of the Ghanaian economy.

Prior to the end of the year, there were high expectations that the policy rate – the rate at which commercial banks borrow from the Bank of Ghana - will fall to lower the borrowing costs of household and business consumers.

Fitch Solutions and Moody’s Analytics have all projected about 1.0 percentage point drop in the policy rate by May this year. Their forecast were based on expected lower inflation and improve growth rate in the first quarter of this year.

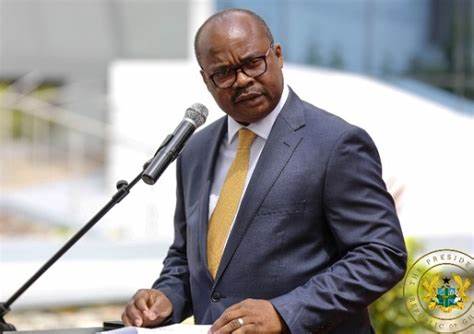

However, the large financing gap and debt which possess some threat to the economy could compel the MPC of the Bank of Ghana chaired by Governor Dr. Ernest Addison to maintain the policy rate at 14.5% for the 7th consecutive time since March last year.

Banking Consultant Dr. Richmond Atuahene told Joy Business that the policy rate will remain unchanged because of developments within the economy in the last couple of months, which does not support a reduction in the base lending rate.

“Looking at the various things that have happened over the last few months, including the announcement of taxes and taxes on fuel and others, and also looking at crude oil prices rising up to US$68 per barrel and other exigencies in the economy, I don’t think the policy rate can come down just in the near future. It has to stay there for some time.”

“And don’t forget that the policy rate level will also have something to do with interest rate, so we are in a dichotomy; we either keep the policy rate where it is and let the private sector not get access to cheap credit to expand the economy”, he further said.

The MPC will also assess the Bank of Ghana’s Composite Index of Economic Activity, the Business and Consumer Confidence indicator and make forecast for inflation and exchange rate, as well as proffer advise to the central government on measures to tackle the nation’s rising debt.

Latest Stories

-

US Travel Ban stifles African Nations’ World Cup and Olympic ambitions

2 minutes -

GH¢12.9 bn recovery: PAC Chair Abena Osei-Asare defends committee’s impact

16 minutes -

Ghana faces EU ban on fish importation if space not sanitised

17 minutes -

We’re open to dialogue, but not to renegotiating terms – GRNMA to Health Minister

18 minutes -

Hero’s Ride – Baby Thief film to hit screens soon

27 minutes -

Defeat to Vision FC ‘wake up’ call for Asante Kotoko – Karim Zito

43 minutes -

Galamsey fight ‘not a lost cause’ – Abena Osei Asare

46 minutes -

GPL 2024/25: Frimpong Manso ecstatic after leading Bibiani GoldStars to historic title

49 minutes -

OSP must remain professional in Ken Ofori-Atta probe – Abena Osei-Asare

1 hour -

Sports Creates Memories and Serie A side Como join forces for U-12 Elite tournament

1 hour -

GH₵1 fuel levy undermines the Cedi gains Ghanaians should enjoy – Abena Osei-Asare

1 hour -

Pay our book and research allowance now or face our wrath – Teacher unions warn government

1 hour -

This is not the time to impose more taxes – Ernesto Yeboah slams government

2 hours -

Mustapha Gbande slams Minority over dumsor levy criticism

2 hours -

Gospel music is a tool for transformation, not entertainment – Esther Godwyll

2 hours