Audio By Carbonatix

More than nine banks will partner government to roll out the "commercial module" of the YouStart programme.

According to the President of the Ghana Bankers Association, John Awuah, the banks include; GCB Bank, Access Bank, Absa Bank, Consolidated Bank Ghana (CBG), Fidelity Bank, etc.

Under this module, the banks will partner government to provide support for existing youth-led businesses with between 100,000 working capital and 500,000 for those in need of capital expenditure.

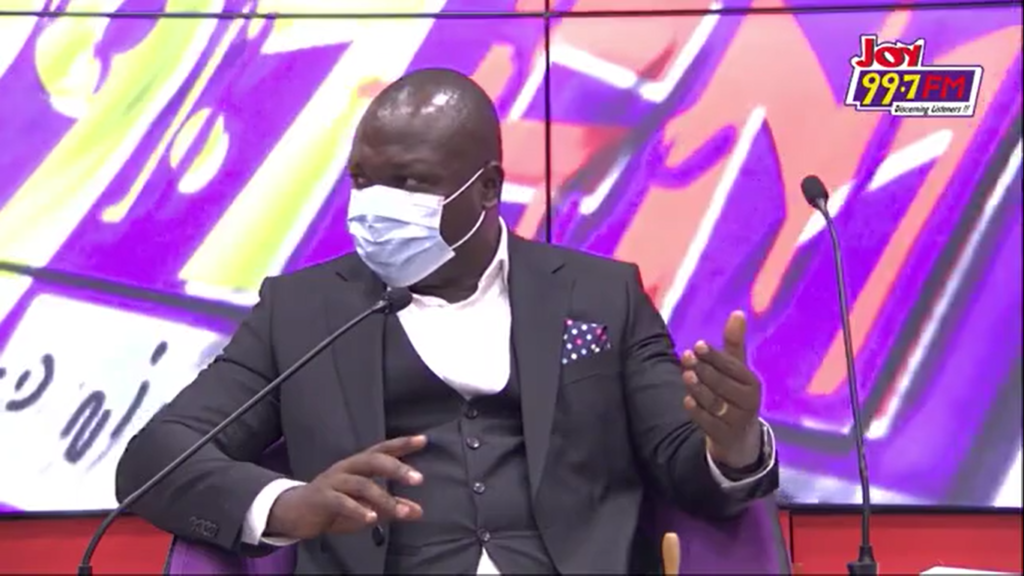

This will come at a concessionary rate of 10%, Mr Awuah revealed on the Super Morning Show on Monday, June 6, 2022.

Speaking on the rationale for this, Mr Awuah explained that “sometime last year, the banks came together and said as government is working on this, how can we be part of the solution to the problems that confront the youth of this country, particularly youth unemployment?

"So we came together and decided on how we can partner government and carve out a certain portion of the YouStart programme that we can commercialise, with very well crafted, conditions that will make it easier for businesses to access the YouStart programme.

He mentioned that the programme will be unveiled shortly.

He further noted that the community of banks is aware of the difficulties faced by entrepreneurs in accessing credit, hence its decision to be a part of the roll out of this scheme aimed at making lending conditions less stringent to enable businesses to scale up and create jobs.

"When we talk about access to credit, we are aware of the fact that, it is difficult and the inhibitions that bring about the difficulty in accessing credit. So coming out with this programme, we have looked at all the things that would make the flow from application from a business to the bank all the way to disbursement, how do we make it shorter, affordable, the conditions less stringent for the customer to meet and that is what we have packaged under the commercial module of the YouStart.

"So it’s more or less a bank product with special features that make accessibility easier for the business community," he added.

Who can apply

Mr. Awuah said the scheme is open to existing businesses whose prime movers are youths between ages 18 and 40. Entrepreneurs aged above 40 would have to prove that their employees are SSNIT contributors and that 50% of their employees are between 18 and 40. They would also have to show that their businesses when supported, will be profitable and create youth employment.

"It cuts across various sectors [but] the only activity that the YouStart commercial module would not fund is businesses that are engaged in pure trading buying and selling of finished products. If you are in manufacturing, supplies, pharmaceuticals, or hospitals, you just have to visit the portal and apply and within a short period of time, you’ll get your disbursement," he said.

Latest Stories

-

GES, NADMO move to prevent future bee attacks after Anloga school tragedy

9 minutes -

KGL does not operate or conduct 5/90 national lotto, but retails 5/90 national lotto – Razak Opoku

31 minutes -

Parliament approves renaming of C.K. Tedam University to University of Technology and Applied Sciences, Navrongo

1 hour -

Former Jasikan MCE returns to Bawumia camp

1 hour -

Daily Insight for CEOs: The CEO’s role in stakeholder engagement and relationship management

1 hour -

Streetlight theft undermining Accra’s illumination effort – Regional Minister

1 hour -

Frequent use of emergency contraceptives could affect fertility, youth warned

1 hour -

Police arrest 8 suspects in Navrongo anti-crime sweep ahead of Christmas

2 hours -

KGL Foundation commissions toilet facility for Adukrom PRESEC

2 hours -

President Mahama pushes reparations, calls for united African front at diaspora summit

2 hours -

Over 2,800 crates of eggs sold at The Multimedia Group’s X’mas Egg Market as consumers express satisfaction

2 hours -

Police to enforce ban on unauthorised use of sirens and strobe lights

2 hours -

Newsfile to discuss Kpandai rerun halt, Ofori-Atta’s extradition fight, and Bawku Mediation Report

3 hours -

Between imperialism and military rule: The choiceless political reality in West Africa

3 hours -

One killed, 13 injured in head-on collision at Ho

3 hours