Data published by the Bank of Ghana (BoG) in its annual Fraud Report has revealed that the losses from fraud cases in the financial sector increased by 7 percent 2023.

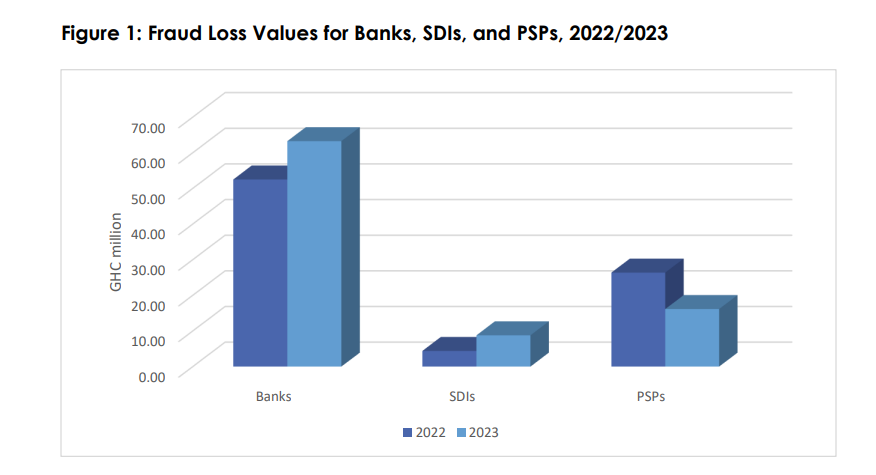

The cases corresponded to total loss value of approximately GH¢88 million in 2023 as compared to GH¢82 million in 2022.

From the three sub-sectors which include banks, Specialized Deposit-Taking Institutions (SDIs) and Payment Service Providers (PSPs), the report indicated that overall, the count of fraud cases increased to 15,865 in 2023 from 15,164 in 2022. This represents a 5 percent rise in the count of fraud cases recorded.

According to the report, an analysis of the 2023 data showed that fraud heightened in fraudulent withdrawals from victims’ accounts, cyber or email fraud, and cash theft (cash suppression).

“Another area of concern is SIM swap related fraud, where SIM numbers linked to banking accounts are fraudulently taken over and monies subsequently withdrawn from the accounts”, the report said.

The report explained that this form of fraud targets individuals who have banking applications on their mobile phones and have linked their bank accounts to mobile money wallets.

While attempted fraud cases in the banking and SDI sectors declined sharply by 59% in 2023 compared to 2022, the total loss value associated with these cases stood at approximately GH¢72 million, a 29% increase over the 2022 figure of GH¢56 million recorded.

The sharp increase in the loss value was influenced by outlier fraud cases involving foreign currencies, which when converted to Cedi, ballooned the 2023 attempted fraud value at loss. The PSP sector also recorded a loss of GH¢16 million involving 14,655 cases in 2023.

Although the loss value recorded in 2023 represented a 38% decline compared to the GH¢26 million recorded in the previous year, the incidents showed a 20% increase compared to the 12,166 cases in 2022.

Generally, bank and SDI sectors recorded increases in the loss values as a result of fraud, while the PSPs sector saw some decline.

The BoG said it will continue to engage institutions with high incidences of fraud to develop action plans to address such incidences in the industry.

The central bank assured that it has also strengthened its engagement with relevant stakeholders to enhance collaboration in the fight against cyber related fraud.

"The publication of the annual Fraud Report by the BoG seeks to create awareness of fraud occurrences and trends identified within the reporting year with the view to promote the soundness and integrity of the banking system".

The report has also highlighted some directives by BOG to banks, SDIs and PSPs which, if implemented, will help reduce the incidence of fraud in the sector.

Latest Stories

-

EPA says lead-based paints are dangerous to health, calls for safer alternatives

1 hour -

Queenmother calls on President-elect Mahama to appoint more women in his government

3 hours -

Atletico Madrid beat Barcelona to go top of La Liga

3 hours -

Usyk breaks Fury’s heart with points win in rematch

3 hours -

Ghana-Russia Centre to run Russian language courses in Ghana

9 hours -

The Hidden Costs of Hunger: How food insecurity undermines mental and physical health in the U.S.

9 hours -

18plus4NDC marks 3rd anniversary with victory celebration in Accra

12 hours -

CREMA workshop highlights collaborative efforts to sustain Akata Lagoon

12 hours -

2024/25 Ghana League: Heart of Lions remain top with win over Basake Holy Stars

13 hours -

Black Queens: Nora Hauptle shares cryptic WAFCON preparation message amid future uncertainty

14 hours -

Re-declaration of parliamentary results affront to our democracy – Joyce Bawah

14 hours -

GPL 2024/25: Vision FC score late to deny Young Apostles third home win

14 hours -

Enhancing community initiatives for coastal resilience: Insights from Keta Lagoon Complex Ramsar Site Workshop

14 hours -

Family Health University College earns a Presidential Charter

14 hours -

GPL 2024/25: Bibiani GoldStars beat Nsoatreman to keep title race alive

14 hours