....Outperforms global markets in 2022

The Minerals Income Investment Fund (MIIF) has in its performance update for 2022 said, it now has ¢3.2 billion in Assets Under Management (AUM) and is targeting ¢5 billion by the end of 2023. The fund grew assets by a whopping 87.4% from 2021 figures which stood at ¢1.7 billion. People with knowledge of the fund’s intimate workings say with Lithium and Salt investments penned for 2023, the US$500 million mark or at least ¢5 billion is very much within view.

MIIF’s performance update has been achieved on the back of innovative strategies which led to growth in royalties’ income, expansion of sources of royalties and investment income.

Growth focused Investments

In March 2022, MIIF acquired a US$20 stake in Asante Gold Corporation a Canadian and German-listed company with assets in Bibiani, Chirano, and Kubi. MIIF subscribed to 14,514,286 ordinary shares, representing 4.62% of the entity at the time.

The future-focused investment fund said at the time of the acquisition that it saw “significant upsides to the Asante asset and was confident the company which has all its assets domiciled in Ghana would do very well”.

MIIF has also closed a ¢25 million deal in a Ghana/Africa SME-focused Fund. MIIF recently announced at the 2023 Mining Indaba in South Africa that it intended to invest US$60 million in Lithium and Salt with the beneficiary companies being Atlantic Lithium and Electrochem limited, a wholly-owned Ghanaian company which is aiming to become Africa’s biggest Salt producer.

Another area of investment for 2023 is the small-scale mining incubation support program where MIIF told audiences at the South African Mining Indaba in Cape Town that it was planning to invest another US$ 60 million to formalise small-scale mining, help with traceability mechanisms for the gold produced by small-scale miners under the program and ultimately list beneficiary mining firms on the Ghana Stock Exchange (GSE).

MIIF is also developing a gold-backed Exchange Traded Fund (ETF) with the support of the Ghana Stock Exchange (GSE) for trading on the Ghanaian Bourse and possibly the Johannesburg and Toronto Stock Exchanges.

Performance of Investments of the Fund

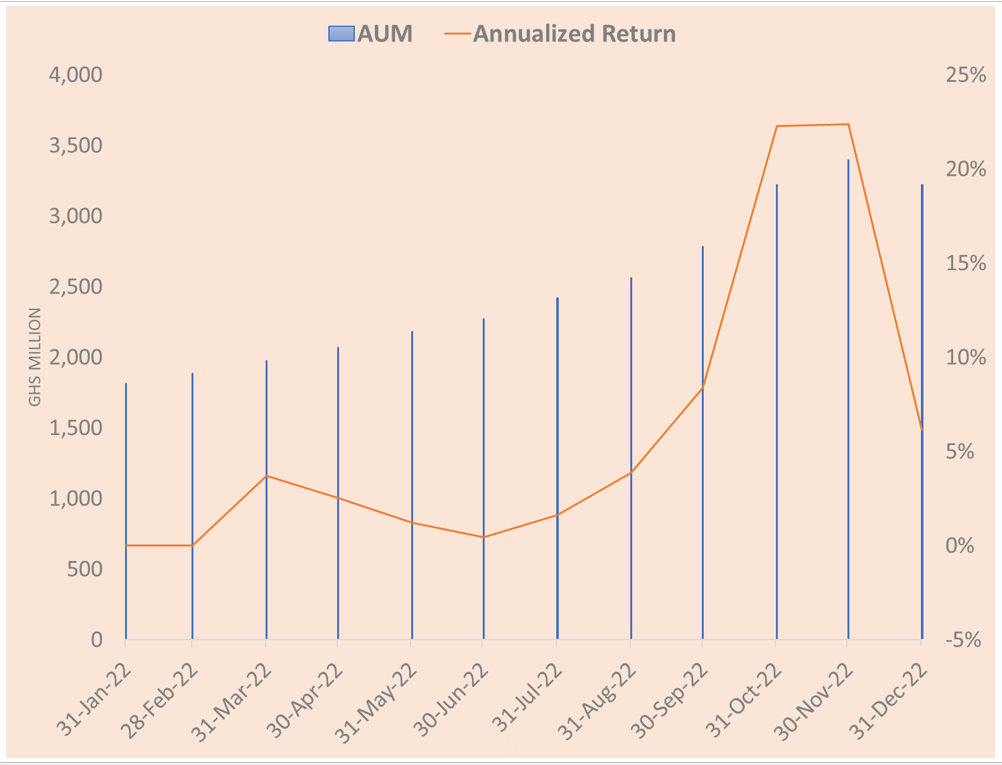

The Fund recorded an annualized end-year return of 6.13% in 2022. The return was also influenced by foreign exchange volatility and good treasury management of funds.

Edward Nana Yaw Koranteng, the Chief Executive Officer of the Fund told the Daily Graphic exclusively, “MIIF mobilized ¢1.3 billion in 2021 and GH¢1.8 billion in 2022, representing a 36% growth over the previous year. This was a major factor in growing the Fund’s AUM.

We have been able to do this because of an inter-agency framework we put in place last year which has seen us collaborating with more agencies. These agencies include the Ghana Standards Authority, the Economic and Organised Crime Office and the Minerals Commission which is the regulator of the minerals sub-sector.

We have also adopted innovative technologies such as geo-mapping all mining sites in Ghana and also creating a real-time dashboard for all royalties contribution from every mine in the country,” Mr Koranteng said.

Mr Koranteng further said, “The Fund put in measures to expand the royalties stream by adding sand-winning and salt to the list of royalties paying minerals which help with diversifying the royalties base away from gold.”

MIIF outperforms Global Benchmarked Indexes

MIIF outperformed global benchmarks with an annualised end-year return of 6.13% in 2022. The year 2022 witnessed significant market losses for equities and Fixed Income investments globally. Equities spent most of the year in a bear market, with the S&P 500, FTSE 100, and GSE-CI recording end-year returns of -19.49%, +0.91%, -12.38%, respectively. This compares to the 6.13% return achieved by MIIF.

The bond market was also hit, especially in developing economies, as the risk of defaults increased. The Russia-Ukraine conflict triggered global inflation and general market uncertainties.

MIIF as a lever for development

Mr Koranteng expressed optimism that MIIF will, in a few years, become the lever that can help Ghana through volatile economic periods and offer the stability that is needed in the economy.

“MIIF will seek to diversify its funding and investment portfolio sources, including capital market transactions, a gold trade desk which has already been set up which will definitely be a source of forex for the country, and explore risk participation in high-yielding projects with top-grade financial institutions.”

Mr Koranteng emphasised that “We are a young fund, however, we are focused on getting it right. We plan to hit the $500 million AUM by January 2024 and $1 billion by 2027. We have made investments in Asante Gold, we are targeting some gold exploratory companies, lithium and salt as well as lithium by-products such as feldspar and silica to kickstart the ceramics and fibreglass industry.”

Latest Stories

-

France to open high-security prison in Amazon jungle

8 minutes -

Gary Lineker: A sorry end to a BBC career

22 minutes -

Lineker to leave BBC sooner than planned after antisemitism row

36 minutes -

Nigerian judges endorse Ikot Ekpene Declaration to strengthen digital rights protection

39 minutes -

Call for load shedding timetable misplaced; power generation meets peak demand – Energy Ministry

42 minutes -

Cedi records 17.17% appreciation to dollar; one dollar going for GH¢13.50

1 hour -

Interplast named among Financial Times’ fastest-growing companies in Africa

1 hour -

GPRTU to reduce transport fares by 15% effective May 25

2 hours -

Ghana Alphas, Tau Alpha Lambda donate to Abeadze State College

2 hours -

I’ve closed all ECG’s bank accounts except for one single holding account at GCB Bank – Energy Minister

2 hours -

Screenwriters Guild of Ghana, Producers Guild, and National Film Authority forge alliance to elevate Ghana’s Film Industry

2 hours -

Dr. Adu Anane Antwi appointed Chairman of new SEC Board

2 hours -

Finance Minister charges new NIC board to expand insurance coverage

2 hours -

Patrick Owusu Agyei urges comprehensive port reforms in Ghana

3 hours -

Why Ghana should introduce Municipal Bonds: Unlocking local development through fiscal decentralization

3 hours