Manilla, a leading blockchain technology company, has announced the upcoming launch of the Manilla Ecosystem, which includes the highly anticipated Manilla Finance application and the eco-friendly mobility platform, Cabbie.

These innovative platforms aim to revolutionise digital currency payments and provide sustainable transportation solutions in Africa and beyond.

In response to the growing need for utility for digital assets and a user-friendly peer-to-peer digital currency exchange, Manilla commenced the development of the Manilla Finance app a few years ago, aiming to offer a convenient alternative for African countries. Looking ahead, the company intends to expand its innovative services to a global audience by entering the North American and European markets in the near future.

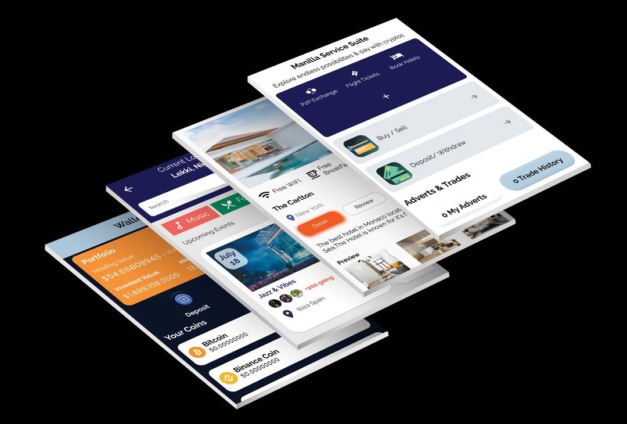

The Manilla Finance application goes beyond traditional cryptocurrency exchanges by offering a super app or omni-service platform. Users can utilize fully valued top cryptocurrencies for everyday utility bill payments, as well as settlements for various expenses such as flights, hotels, data, airtime, event tickets, and movie tickets. Notably, the application features a staking protocol that enables users to stake their MNLA tokens and stablecoins for stable high yields. By locking their MNLA tokens for a year, users can access consumer loans on the go, with their tokens serving as collateral.

To ensure seamless utility payments worldwide, Manilla Finance has established strategic partnerships with leading global technology providers and collaborated with security layer providers and web3 wallet solutions providers. The company's dedication to user protection is further demonstrated by the implementation of top-of-the-line security protocols. In addition to the Manilla Finance application, Manilla Finance has developed Cabbie, a standalone mobility application that aims to become Africa's first carbon-neutral mobility platform. Cabbie will accept cryptocurrency as payment, aligning with the company's commitment to sustainability. The platform has already been registered for pilot testing in several African countries at the forefront of reducing carbon emissions.

While both the Manilla Finance platform and Cabbie accept top cryptocurrencies as payment, the preferred token for both solutions is the MNLA token, which also serves as the native token. Utilizing the MNLA token for payments on the platform provides users with various benefits, enhancing their overall experience.

As the launch of the Manilla Ecosystem approaches, the company invites the blockchain community and cryptocurrency traders to embrace the future of digital asset payments. Manilla Finance offers a user-friendly platform with 24/7 technical support, ensuring a seamless experience for all users. The company's commitment to security ensures the safety of assets throughout the ecosystem.

Furthermore, Manilla is excited to announce the upcoming Manilla ICO, a liquidity bootstrapping event for the MNLA token. The ICO will be followed by listings on multiple high-level centralized exchanges before the official launch of the Manilla Finance application. Traders are encouraged to join Manilla Finance's social media communities on Twitter, Instagram and Telegam to stay informed about the ICO announcement and updates.

For more information about Manilla Finance and its services, please visit the official website at https://www.manilla.finance.

Latest Stories

-

CHAN 2024Q: Ghana’s Black Galaxies held by Nigeria in first-leg tie

15 minutes -

Dr Nduom hopeful defunct GN bank will be restored under Mahama administration

48 minutes -

Bridget Bonnie celebrates NDC Victory, champions hope for women and youth

56 minutes -

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

2 hours -

Akufo-Addo condemns post-election violence, blames NDC

2 hours -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

3 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

4 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

4 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

4 hours -

Syria’s minorities seek security as country charts new future

5 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

5 hours -

German police probe market attack security and warnings

5 hours -

Grief and anger in Magdeburg after Christmas market attack

5 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

6 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

6 hours