Domestic bondholders in Ghana have just 10 days to take perhaps the most crucial decision ever in their investment portfolio.

The clock is winding down to December 19 by which date they are allowed to exchange their investment instrument to the new modalities set by government under the Domestic Debt Exchange programme.

One would imagine that being a modality, which the Finance Minister says was the outcome of discussions with key stakeholders, it would have been a touch-and-go process.

But what has ensued since Ken Ofori-Atta’s announcement of the initiative on December 4 has been everything but smooth.

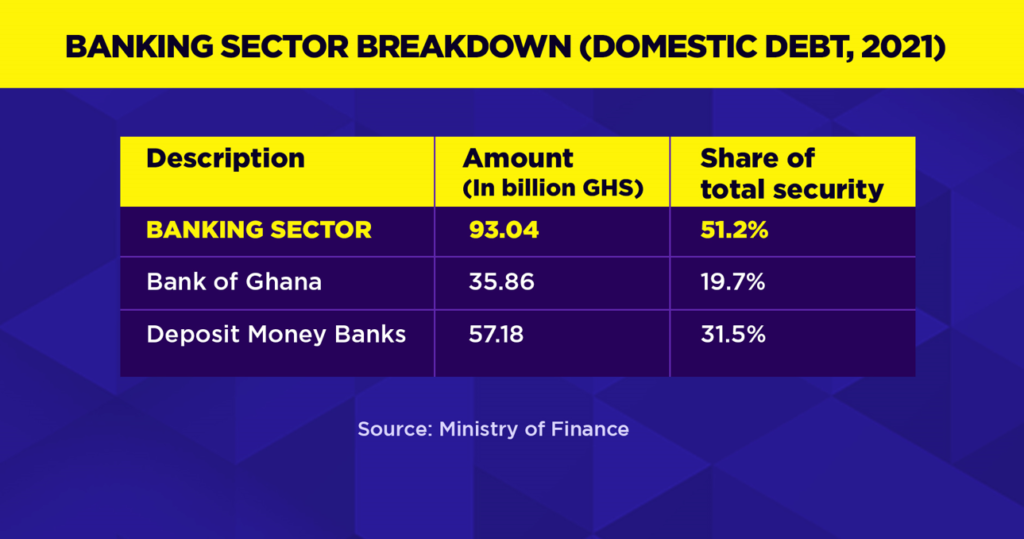

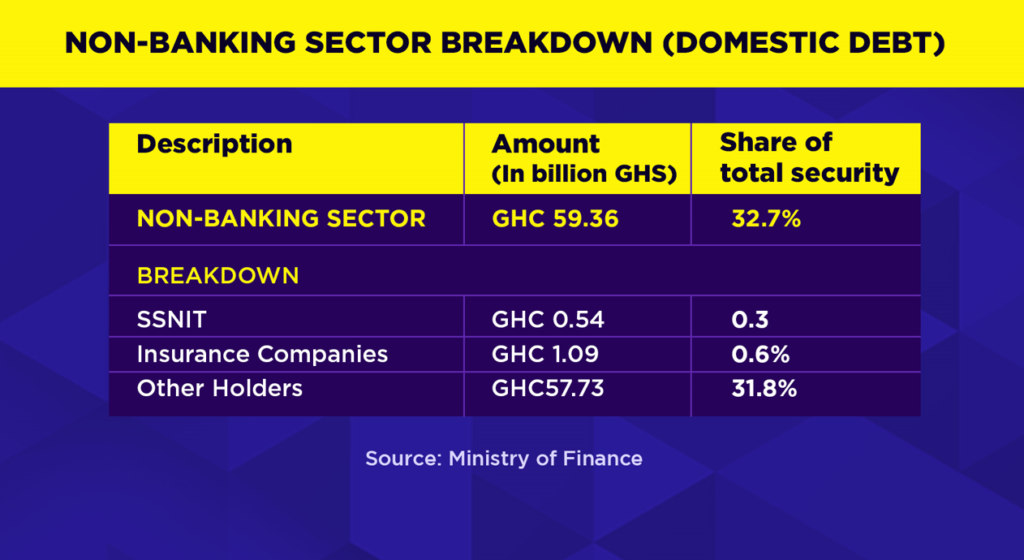

The Ministry has decided that bondholders like pension funds, banks and insurance firms will have to exchange their bonds for one that will earn zero interest next year.

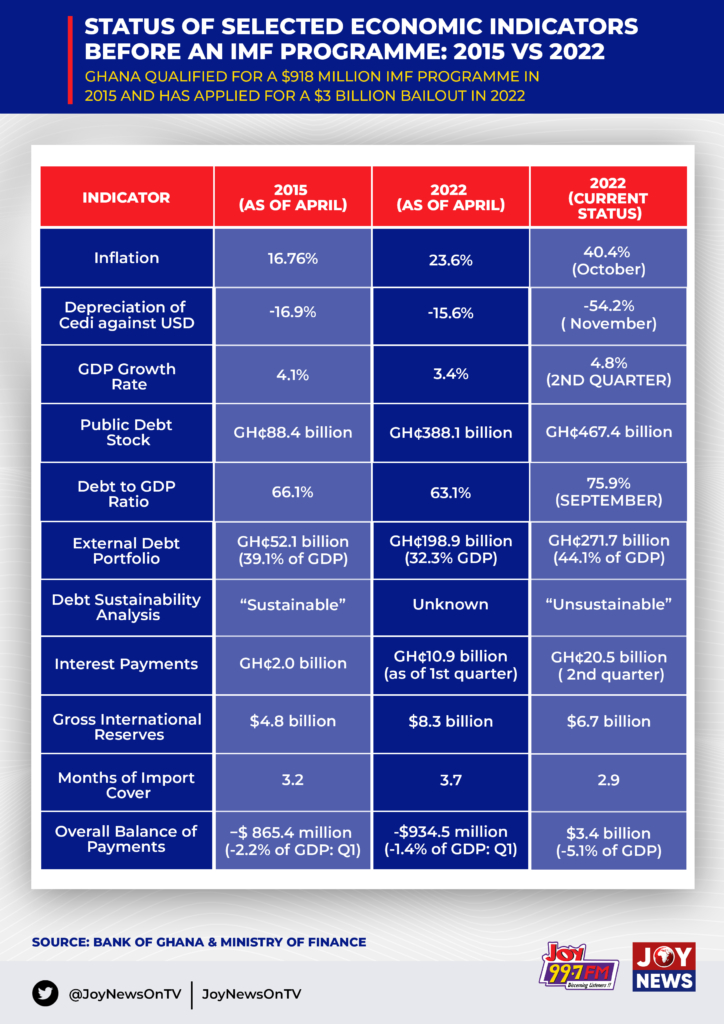

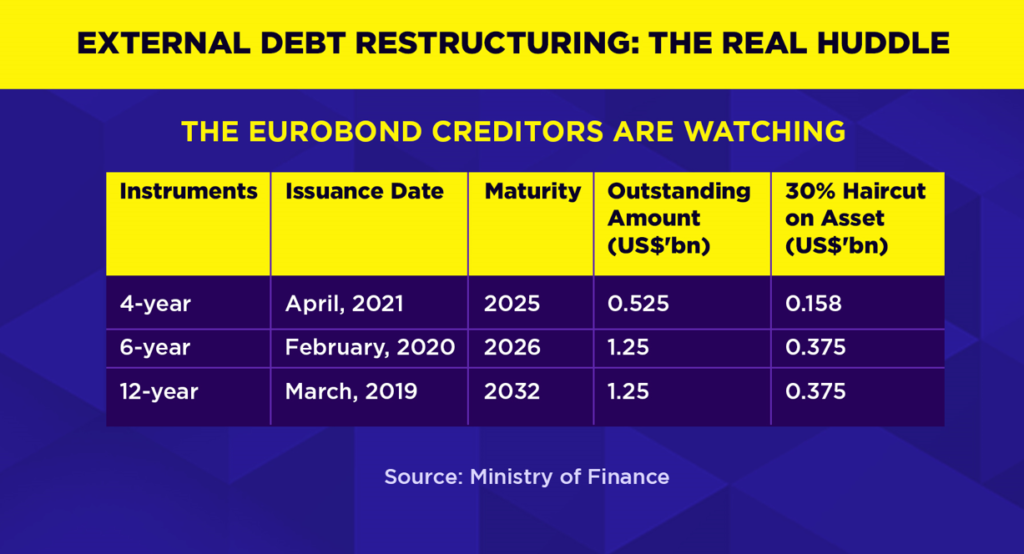

This forms part of measures to meet the IMF's debt restructuring requirement in order to qualify for a staff-level agreement as Ghana negotiates a bailout from the current crisis.

Reuters reported its sources as indicating that Ghana may reach a staff-level agreement on the deal by Tuesday, December 13, 2022.

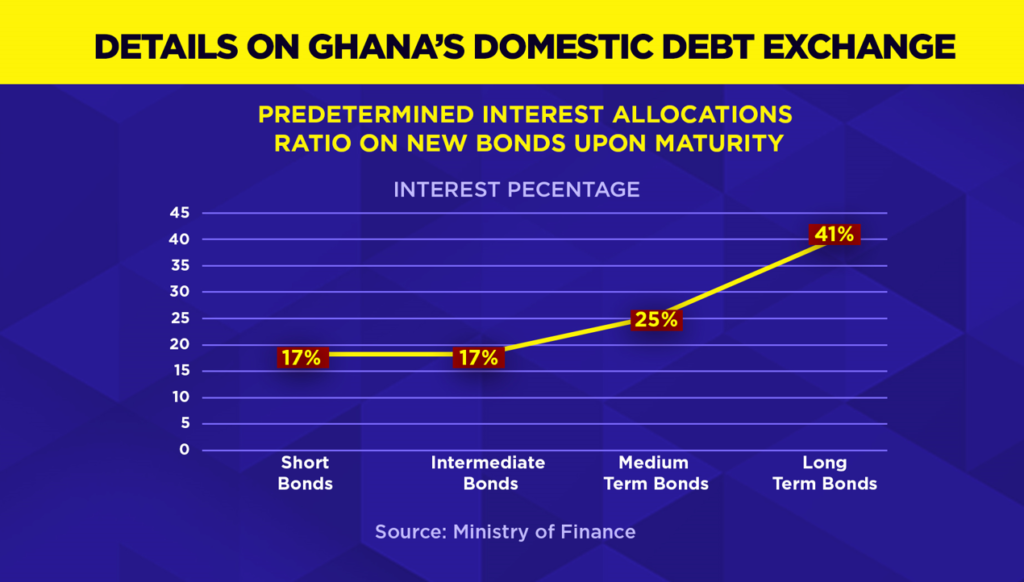

The new bonds will only begin to earn five per cent interest in 2024 and 10 per cent for the remainder of their tenure.

The maturity dates have also been extended with the first bonds only maturing in 2027.

There is friction in the investment community about the possibility of these suggestions to reflect positively on them.

You Are On Your Own

Deputy Finance Minister, John Kumah has cautioned that groups that resist will be open to default.

“..then you don’t get the carrots, the benefits, the buffers that have been provided then you are on your own. It means that you are open to default in terms of if the market is unable to redeem,” he told JoyNews' PM Express.

But that was not enough to prevent the tirade of investment groups that have cried foul.

Nearly a dozen key interest groups want out of the voluntary initiative.

Here is a list of the agitating factions:

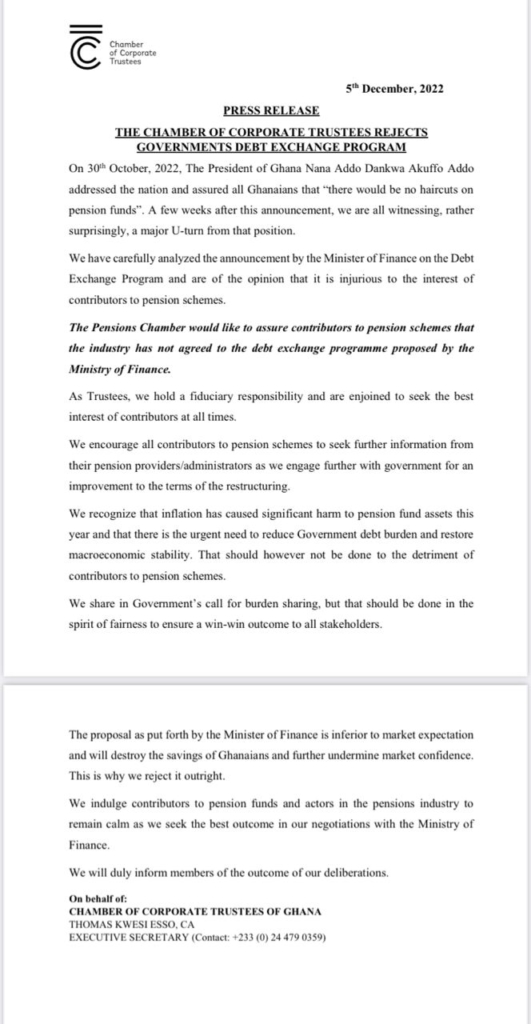

Chamber of Corporate Trustees of Ghana

The Chamber of Corporate Trustees of Ghana believes the structure will do more harm than good to investors under its umbrella.

Their fear is borne out of the President’s initial position that there would be no haircuts, a position which has changed a few weeks on.

“On 30th October, 2022, The President of Ghana Nana Addo Dankwa Akuffo Addo addressed the nation and assured all Ghanaians that “there would be no haircuts on pension funds”. A few weeks after this announcement, we are all witnessing, rather surprisingly, a major U-turn from that position.”

The Chamber further insists that the Domestic Debt Exchange programme will not auger well for pension contributors.

On the back of this, they explained that “the Pensions Chamber would like to assure contributors to pension schemes that the industry has not agreed to the debt exchange programme proposed by the

Ministry of Finance.”

Trades Union Congress (TUC)

The Trades Union Congress is part of the labour unions kicking against the imposition of cuts on pension funds as part of the debt exchange programme.

Deputy Secretary General of the TUC, Joshua Ansah, has sent out a warning to government not to touch pension funds.

“For me and the worker unions we’re really disappointed in the sense that if you’re a government and you’re dealing with stakeholders, an important stakeholder like the Trades Union and organized labour was not consulted in such a very important decision that was being made by the government.

“And because you’re the government you just sit down and bring any decision and you think that workers will be happy and take it like that? I don’t think it’s fair. That is one disappointment we have about this debt restructuring information that has been given by the finance minister,” he said on JoyNews' PM Express.

Ghana Medical Association (GMA)

The Ghana Medical Association (GMA) in a statement on December 6 said the debt restructuring will have a negative impact on its members’ pensions funds and healthcare delivery in the country.

“The GMA is also concerned about the negative effect of the debt exchange programme on Private Health facilities, private health insurance and mutual schemes that have invested heavily with Government of Ghana bonds. This we believe will impact negatively on patient care, medication supply and claims management,” the statement said.

The association believes such measures will “result in a significant loss in value of our pensions in real terms over the next 5-15 years and beyond.”

Ghana Registered Nurses and Midwives Association (GRNMA)

The Ghana Registered Nurses and Midwives Association (GRNMA) has also insisted that the move by government as unacceptable and rejected the programme.

Ghana National Association of Teachers (GNAT)

General Secretary of GNAT, Thomas Musah says it is also not interested in any exchange of domestic notes and bonds by government, be it ESLA Plc, Daakye Trust Plc.

This stance, GNAT says is non-negotiable.

It noted that the Tier-3 Pension Scheme and the Ghana Education Service Occupational Pension Scheme (GESOPS), run for its members were initiatives taken by the association to better the lives of its members in active service, and retirement.

National Association of Graduate Teachers (NAGRAT)

President of the National Association of Graduate Teachers (NAGRAT), Angel Carbonu is unhappy with the development.

He cautioned the government to expect industrial action from the Association if it proceeds with the plan.

“We enter into a contractual agreement that I am buying bonds at ‘X’ per cent. So, I have informed the beneficiaries that I have bought bonds on their behalf at this rate. All of a sudden, government who is the party on the other side of the agreement comes to say, for me, this is what I can pay, take or leave it.

“This will not be accepted, NAGRAT and other teacher unions do not accept this. We are members of the forum made up of the public sector unions and we want to assure our members that we will resist this move by the government,” he added.

Ghana Mine Workers’ Union (GMWU)

The Ghana Mineworkers’ Union (GMWU) has threatened to resist any attempt by the government to touch even a pesewa of its members’ pension funds as a result of the Debt Exchange Programme.

This, the union says, is in solidarity with the Trades Union Congress kicking against the programme.

According to the General Secretary, Abdul Moomin-Gbana, the union is willing to go to any length to ensure the full protection of workers’ hard-earned funds.

Speaking at the GMWU National Executive Council meeting and forum organised in Accra, December 8, Abdul Moomin-Gbana, he said the GMWU would not support the Debt Exchange Programme.

Ghana Insurers Association

President of the Ghana Insurers Association, Seth Aklatsi, says the government’s debt exchange programme threatens to entirely collapse the insurance industry in Ghana.

Speaking on JoyNews’ PM Express Business Edition, Seth Aklatsi said with the terms and conditions provided under the debt exchange programme, the Finance Minister might as well collapse the insurance industry himself.

Latest Stories

-

“They went too far” – Elon Musk says he regrets some comments he made about Trump

12 minutes -

BoG’s cumulative loss since 2007 redenomination hits GH¢82.79bn — Eight times its profit

20 minutes -

Today’s front pages: Wednesday, June 11, 2025

48 minutes -

26th TGMAs: King Promise thrills at ‘A Nite with Artiste of the Year’

49 minutes -

‘Algiers Awaits’ – AfCFTA Chief rallies Africa for trade renaissance

1 hour -

Gov’t moves to fast-track industrial growth with light industrial parks

1 hour -

Africa’s trade crisis must end – AfCFTA Chief rallies Ghanaian businesses ahead of IATF 2025

2 hours -

US-China talks end with plan for Trump and Xi to approve

2 hours -

Minority Caucus proposes solutions to deal with energy sector debts

2 hours -

Special Prosecutor calls for asset verification system, opposes public disclosure

2 hours -

We are taking difficult but necessary choices to clean up Akufo-Addo fiscal mess – Felix Kwakye

3 hours -

We can’t honour all past commitments – Gov’t on nurses’ conditions of service demand

3 hours -

Gov’t chose not to budget for nurses’ conditions of service – Kwakye Ofosu defends decision

3 hours -

Nurses’ strike: Gov’t not backtracking, we’re protecting economy from collapse – Kwakye Ofosu

4 hours -

‘Over GH¢2bn cost too high’ – Gov’t defends delay to implement nurses’ deal

4 hours