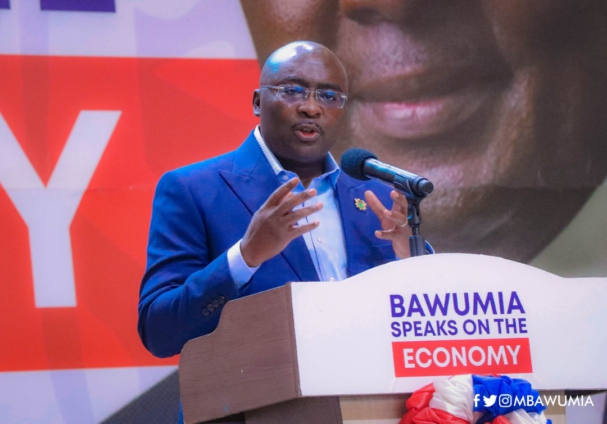

Prior to his speech today, Vice President Dr. Mahamud Bawumia had not said a word about government's controversial tax measure, the 1.5 percent Levy on electronic transactions. Not a single word.

The Levy introduced in the 2022 budget read by Finance Minister Ken Ofori-Atta has been touted as a game-changer by government functionaries as it struggled to go through Parliament. Government said it expects to raise about 6.9 billion cedis from the tax, which has now, according to Deputy Finance Minister Dr. John Kumah been revised to 4.5 billion cedis.

The first time it was tabled in Parliament, it was a free for all fight by Members of Parliament with the opposition NDC MPs bent on voting against the Levy.

Several months later, it was not clear when Parliament would consider the Bill because the NPP Majority in Parliament who were also insistent on the Bill's passage simply did not have the numbers required to ensure its passage. This, is largely due to the absence of Dome-Kwabenya MP, Sarah Adwoa Safo.

But I digress, this is not about the timelines of the E-levy passage. But suffice to say that the e-levy has now been passed at a revised rate of 1.5% from the originally announced 1.75%.

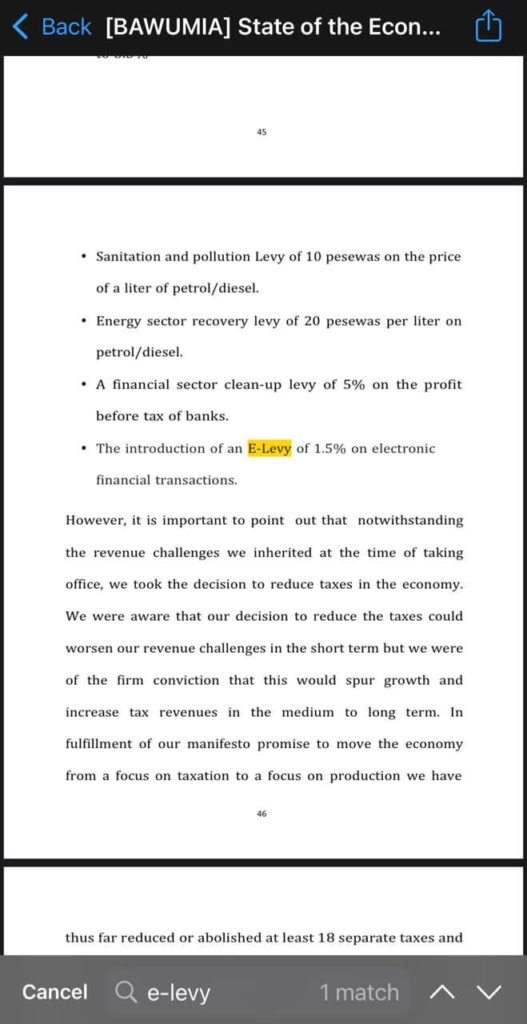

In his speech, THE STATE OF THE ECONOMY, Vice President Bawumia mentioned e-levy in his 129 pages long speech, or the 2-hour speech, did he talk about the tax measure? Guess... Once. Only one time.

And no, it was not a word of support like many government officials including the President has been on since it was announced to rally support from the tax which many Ghanaians are visibly against.

On page 46 of his 149-paged speech, e-levy found expression once, as stated above only as part of government's revenue mobilization measures.

So what exactly has accounted for the deafening silence of Dr. Bawumia on the e-levy? Touted as the economic messiah and poster boy of the party prior to winning the 2016 election and in government, it was expected that he'd have lent a word in support.

The Vice President did not speak, even when the NPP majority in Parliament were struggling to push through the Levy in Parliament with the Finance Minister and other government officials crisscrossing the country holding townhall meetings to rally popular support.

Could it be due to his earlier stance on taxing 'MoMo'?

Speaking to Kwame Sefa Kayi on Peace FM in 2020, Dr. Bawumia made a strong case against any move to tax Mobile Money (MoMo), saying its implementation would adversely affect the poor and further discourage the digitisation agenda of the government.

“My view is that we should not tax mobile money because a lot of the people who are using mobile money transactions are very poor people. For example, someone just sends GH¢5 on mobile money, and why would you want to tax that?” he said.

So does Dr. Bawumia support e-levy or not? And what exactly is accounting for the loud silence? And on a day when he mentioned it, it was ONCE in a 2-hour speech, and it wasn't in support.

Latest Stories

-

Tesla executives questioned Musk after he denied killing $25,000 EV project, sources say

57 minutes -

Oreo maker sues Aldi in US over ‘copycat’ packaging

1 hour -

US steel and aluminium tariffs doubled to 50%

1 hour -

Ghana’s legal education debate: Are we expecting too much too soon?

2 hours -

Alcaraz storms through to semi-final with Musetti

2 hours -

Black Queens wrap up Abidjan training tour with defeat to Côte d’Ivoire

2 hours -

Inzaghi leaves Inter Milan ‘by mutual agreement’

2 hours -

‘Man Utd didn’t need the money’ – Fernandes rejects Al-Hilal move

2 hours -

Cybercrime ringleader, 10 others remanded in custody

2 hours -

Gov’t to expand student loans to all tertiary institutions – Education Minister

2 hours -

WaterAid Ghana, Guinness Ghana commission water project in Upper West Region

2 hours -

Energy levy: ‘You can’t continue pouring water into a leaking bucket’ – COPEC warns

2 hours -

Rising Star: Yvonne Dadson’s groundbreaking research earns international recognition

2 hours -

Suicide bomber killed in Uganda on Christian holy day, army says

3 hours -

Journalists urged to champion nutrition and public health advocacy

3 hours