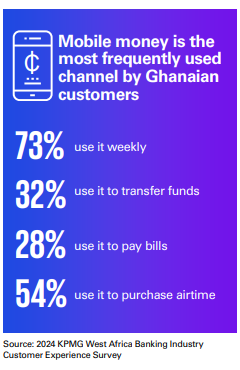

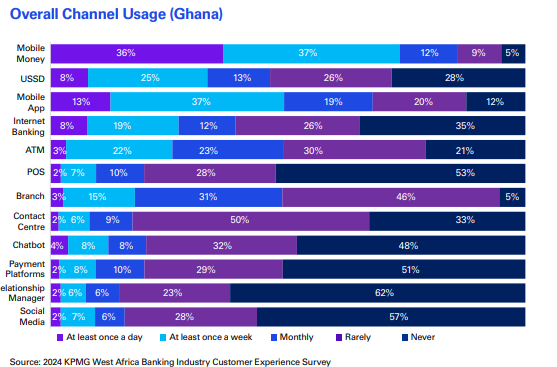

Mobile money is the most frequently used digital platform in 2024, the 2024 West Africa Banking Industry Customer Experience Survey has revealed.

This represented a 7-percentage point increase compared over the previous year.

According to the report, 73% of Ghanaian consumers use it weekly. Thirty two percent use it for transfer of money, while 28% use to pay bills and 54% use it to purchase airtime,

For the second consecutive year, retail banking customers ranked the ease of transferring money between their account and mobile wallet as the most important experience metric highlighting the importance of interoperability between systems.

The survey said mobile money interoperability continues to be a key driver of its adoption with the total value of mobile money interoperability transactions increasing by 23% as of October 2024.

Again, the USSD banking is also driving payment interoperability.

The survey revealed that 33% of retail banking customers use USSD banking services weekly as compared to 28% of respondents in 2023. However, concerns over service reliability persist, with customers reporting intermittent downtime of their USSD banking channels.

Mobile apps, the second most used channel after mobile money, saw a slight decline in usage, with 50% of respondents indicating weekly usage compared to 53% last year.

Availability of service, ease of use and variety of features of mobile apps ranked among the ten most important experience measures for retail customers. While customers appreciate the convenience and features of banking apps, concerns around reliability remain prevalent.

There was a decline in Automated Teller Machines (ATM) usage, with monthly usage dropping from 59% in 2023 to 48% in 2024.

Despite this decrease, customers generally expressed satisfaction with the availability of cash and the service uptime when using ATMs.

While overall usage declined, ATMs remained the second most-used channel among Gen X and Baby Boomers highlighting a generational divide in channel preferences, with older customers continuing to rely on traditional channels for their banking needs while the younger generations prefer digital channels.

Latest Stories

-

Porter remanded over stealing, destroying metal guardrails at Obetsebi Lamptey overpass

43 minutes -

5 remanded over GH¢2.3m and $191,900 fake notes

51 minutes -

Trump says Israel and Iran have agreed to ‘complete and total’ ceasefire

1 hour -

Cedi holds firm against dollar; one dollar equals GH¢12.15 at forex bureaux

1 hour -

OIC applauds King Mohammed VI’s leadership in safeguarding Al Quds

1 hour -

Joyful Ethiopians and Eritreans embrace at rare border reopening

1 hour -

Police officers charged with murder of Kenyan blogger

2 hours -

US Tennis star Katrina Adams launches “Own The Arena” book in Accra

2 hours -

US Supreme Court allows Trump to resume deportations to third countries

2 hours -

US says Kilmar Ábrego García will ‘never go free’ after judge orders his release

2 hours -

Ignore Kennedy Agyapong’s claims; MMDCEs support not sponsored – Bawumia’s spokesman

2 hours -

Daily insight for CEOs: Strategic Agility – Thriving amid constant change

2 hours -

Mother and children suffer severe burns, appeal for support for life-saving treatment

2 hours -

‘Flower Power; An Arewa Story from the South’ opens at Worldfaze in Accra

3 hours -

KNUST researchers highlight potential areas for future research in Heterotis (Supaku) culture

3 hours