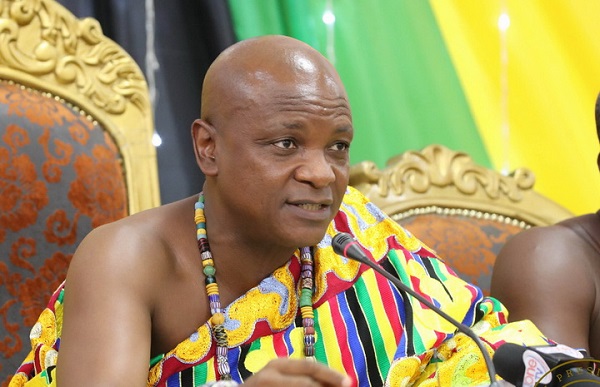

Togbe Afede XIV, the Agbogbomefia of the Asogli State and respected businessman, has voiced his concerns regarding the Bank of Ghana's (BoG) interest rates, emphasising their potential impact on the Ghanaian cedi's stability.

In his remarks, he asserted that the Ghanaian Cedi would continue to face detrimental consequences as long as interest rates remained "unnecessarily high."

The BoG recently highlighted forecasts indicating a potentially elevated trajectory, citing various factors such as potential adjustments in transport fares, utility tariffs, and higher fuel prices.

The Central Bank stated that some factors collectively contribute to economic pressures and could influence the country's financial landscape.

However, in a piece dated April 11, 2024, Togbe Afede XIV expressed his belief that the Cedi's stability would significantly affect other prices, including transport fares, utility tariffs, and fuel prices.

He underscored the interconnectedness of various economic variables and the repercussions of interest rate policies on overall economic stability.

According to the respected chief, the persistence of unnecessarily high interest rates exacerbates the challenges faced by the cedi, amplifying its vulnerability to adverse consequences.

Togbe Afede XIV urged the central bank to take proactive measures and reassess its approach to interest rate management to mitigate the negative impacts on the currency's stability.

“The truth is, all these variables are related. Whilst the policy rate is an important tool of monetary policy, its misuse, as in our case, can have damaging effects. As long as interest rates are kept unnecessarily high, our currency, the cedi, will continue to suffer adverse consequences, with pass-through effects on other prices, including transport fares, utility tariffs and fuel prices."

“Persistent cedi depreciation has been a key factor in our energy (including power) sector problems. We have always felt the need to adjust prices, not because consumers were not paying enough, but because the cedi has been depreciating," he said.

Currently, the demand for the dollar and the other major foreign currencies has surged, culminating in a sharp depreciation in recent times.

It is going for about GH¢14.50 to one US dollar GH¢18.00 to one British pound in the retail market.

Latest Stories

-

Trump sues Murdoch and Wall Street Journal for $10bn over Epstein article

9 minutes -

The entire National Cathedral project is a crime scene – Dr. Arthur Kennedy

29 minutes -

Follow Jesus, Follow the Apostles – Bishop Suku Chea charges newly ordained ministers

37 minutes -

Clergymen who soiled their hands in National Cathedral scandal will never be forgiven – Kofi Bentil

49 minutes -

National Cathedral: Prosecute those who spent the money – Kofi Bentil

56 minutes -

Global HR Icons headline Global Conference on Human Resources in Africa (GCHRA 2025)

59 minutes -

Stop the charade, go ahead and prosecute all who misused our money on National Cathedral project – Kofi Bentil

1 hour -

Pick the leader first, let him choose his team – Kofi Bentil to NPP

1 hour -

NPP didn’t sideline Kufuor – Joe Wise

1 hour -

Are the financiers of galamsey the same individuals funding party politics?

2 hours -

Brothers, is your libido worth your life? Let’s talk Blood Pressure, Herbal Mixtures, and Silent Deaths

2 hours -

Over 5,000 delegates expected at NPP National Conference

5 hours -

NDPC Chairman calls for local economic development at UN HLPF

5 hours -

US tech CEO suspended after Coldplay concert embrace goes viral

7 hours -

Self-acclaimed Ashanti Regional Chairman of Delta Force arrested

7 hours