The National Communications Authority of Ghana on June 8, 2020, declared its intent to classify Scancom Limited (MTN) as a Significant Market Power, exercising its mandate under Section 20 (13) of the Electronics Communications Act, 2008, (Act 775). Whereas this announcement has been met with a divided opinion, this article seeks to make recommendations to the National Regulator on actions to take to level the playing field.

MTN’s market position today was not achieved overnight, indeed, the successes of the operator have been achieved through consistent investments and development over the years; being the first to offer 4G services in the market, get listed publicly on the Ghana Stock Exchange, and several innovative and competitive products to consumers.

It is without question that MTN has also benefitted from its scale; it is the de-facto go-to mobile money platform in the country, it was the only company able to purchase the 800MHz LTE spectrum when it was initially offered and the only Telco to receive the green light for a spectrum resale of 2.6GHz LTE spectrum from the local ISP.

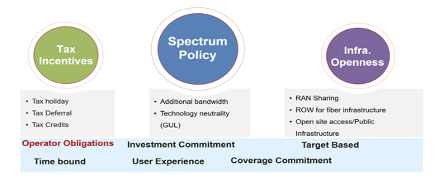

The time to level the playing field is now, however, as most industry watchers have cautioned, this must be done in a way not to punish MTN for its successes and investment in the development of ICT in the country. Whatsoever actions and strategies the Regulator eventually outlines, the other non-SMP (Significant Market Power) players in the industry must be obliged with commitments to match with the required investment, whatever opportunities are extended to them, after all as the saying goes, to whom much is given, much is expected.

The recommendations proffered are meant to address some key inequalities that are present within the industry as well as its escalation as a result of the Global Pandemic (COVID-19). Investments in the ICT industry has been proven to significantly contribute to a nation’s economy and increased competition in this sector will definitely drive investments; however, one cannot be oblivious to the current state of the global economy, hence steps will need to be taken to address these inherent challenges as well.

The need for sustained investment in ICT towards the overall growth of the economy cannot be understated. It is therefore imperative that the actions taken will continue to encourage more investments in order to improve national life.

Spectrum

Spectrum is the foremost asset of any mobile operation and serves as the foundation for the development of this industry. The policy managing this national asset must be aimed at driving fair competition whilst boosting investment; this is the balancing act every Regulator must perform. We recommend the under-listed guiding best practices for consideration;

- Technology Neutrality: Refarm existing GSM (2G) and UMTS (3G) spectrum to LTE(4G) to improve spectrum efficiency and ARPU and ensure fair competition (1800MHz/2100MHz).

- Clear Spectrum Roadmap: Release more IMT spectrum from multi-layer frequencies and clear idle spectrum for the development of Mobile Broadband (MBB), Fixed Wireless Access (FWA) & 5G. This will boost investor confidence

- Ensure Contiguous Frequency: Sufficient bandwidth in contiguous frequency blocks to prevent spectrum fragmentation and improve spectrum efficiency

- Equally Distribute Spectrum: Fair spectrum assignment coupled with spectrum cap regulation to avoid spectrum aggregation and unfair competition

- Rational Spectrum Price: Enrich national treasury but also enable operators to have sufficient financial capability to invest in network construction and deployment

- Ensure Market Momentum: Prevent operator(s) with significant market power to dominate spectrum and network resources to ensure market diversification

In recent times, as a response to the COVID-19 pandemic, the Government issued temporary licenses to the operators to support the growing traffic; the Government may consider converting these temporary licenses to permanent licenses going forward. According to industry watchers, the network traffic growth witnessed globally is not expected to go back to pre-COVID-19 levels and the additional bandwidth will be critical in ensuring the user experience while technology neutrality will ensure high spectrum efficiency and improved experience even on GSM (2G)/UMTS(3G) frequencies through GSM/UMTS/LTE refarming.

Taxation

Taxation is a vital source of income to our economy; accounting for almost 12% of GDP in 2017. In recent times, the Government has reviewed taxes downwards however the telecoms industry was not on this list.

Based on a 2015 study by GSMA and Deloitte (Digital inclusion and mobile sector taxation in Ghana), taxes account for almost 25% of the cost of mobile ownership in Ghana which is significantly above the regional average. High levels of mobile-specific taxation risk mobile sector growth as well as Ghana’s overall economic growth according to the same report. Increases in mobile and broadband penetration and sage can increase productivity by up to 0.5% and generate additional investment and subsequently economic growth. Reductions in CST (Communications Service Tax) and customs duty as an example, can increase penetration by up to 3 million connections and increase the usage, ultimately contributing to digital inclusion and the development of the digital economy.

By rebalancing mobile-specific taxes, the Government can promote digital inclusion, economic growth, and fiscal stability; tax incentives can be used as a tool to drive investments and support the industry to expand and stimulate the same, subsequently improving competition.

In this article, we will not proffer specific taxes to be reviewed, but incentivizing the industry and especially the non-SMP is critical in supporting the business since significant investments will be required by the non-SMP in order to utilize the opportunities that may be presented as the Government formulates strategies to level the playing field and boost competition. Tax credits, deferral and tax holidays are options that can be considered in the short term.

Infrastructure Sharing and Support

In the area of passive infrastructure sharing, the telecoms industry in Ghana has over the years been implementing (tower sharing, fiber swaps) this practice which has brought about some improvements in capital costs, reduce time to market, OPEX reduction and minimize duplication of infrastructure.

The news on National Roaming from the Government as cited in the reports carried by several online news portals in relation to the SMP declaration is most welcome and stands to benefit the industry greatly whilst enhancing accessibility and the socio-economic benefits that come with digital inclusion.

National Roaming, whilst good, is not without challenges; primarily being access to the competitor user base and the potential of targeting for acquisition, subscribers of competitor(s) by host network. Active Radio Access Network (RAN) sharing can be considered as an alternative to National Roaming to eliminate this risk since only the radio access network will be shared in this instance without the need for sharing core network infrastructure.

Additional recommendations to enhance infrastructure sharing by introducing waivers, simplifying/standardizing the process for right of way;

- Waivers for fiber right of way (ROW) considering telecoms as utility companies, utility corridor, and wayleaves can be used without cost, for the deployment of aerial/underground fiber, sites to improve capacity (with a small footprint), etc.

- Streamline fees for ROW. Today, there is no standard fee for ROW and differ based on local authorities; ~4000USD/km on average

- Open up Government own infrastructure sharing such as towers, power poles, and rooftops to be used by telecom operators

Operator Commitments

As the Government embarks on this strategy to ensure equality for the mobile industry players, it is imperative that the operators themselves are also willing to make the necessary investments to fully take advantage of these opportunities that may be presented to them.

We recommend that all the policies to be introduced should be condition-based – be it on the spectrum, infrastructure sharing, tax incentives, and so on.

- Reasonable deployment targets need to be set together with operators with time-based coverage requirements

- Tax based incentives should also be based on commitments and used to drive investments such as reduced/waived import duties on LTE(4G) rollout, new coverage rollout…

This will enable the Government to enforce and drive the industry players to make the timely investments that are needed not only to enhance competition but also boost the Ghanaian economy, especially in these times as we move towards a digital economy.

****

The writer is the Director of Operations, Institute of ICT Professionals, Ghana. For comments, contact him via info@iipgh.org

Latest Stories

-

Shamima Muslim urges youth to lead Ghana’s renewal at 18Plus4NDC anniversary

12 minutes -

Akufo-Addo condemns post-election violence, blames NDC

20 minutes -

DAMC, Free Food Company, to distribute 10,000 packs of food to street kids

2 hours -

Kwame Boafo Akuffo: Court ruling on re-collation flawed

2 hours -

Samuel Yaw Adusei: The strategist behind NDC’s electoral security in Ashanti region

2 hours -

I’m confident posterity will judge my performance well – Akufo-Addo

2 hours -

Syria’s minorities seek security as country charts new future

3 hours -

Prof. Nana Aba Appiah Amfo re-appointed as Vice-Chancellor of the University of Ghana

3 hours -

German police probe market attack security and warnings

3 hours -

Grief and anger in Magdeburg after Christmas market attack

3 hours -

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

4 hours -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

4 hours -

Top 20 Ghanaian songs released in 2024

4 hours -

Beating Messi’s Inter Miami to MLS Cup feels amazing – Joseph Paintsil

5 hours -

NDC administration will reverse all ‘last-minute’ gov’t employee promotions – Asiedu Nketiah

5 hours