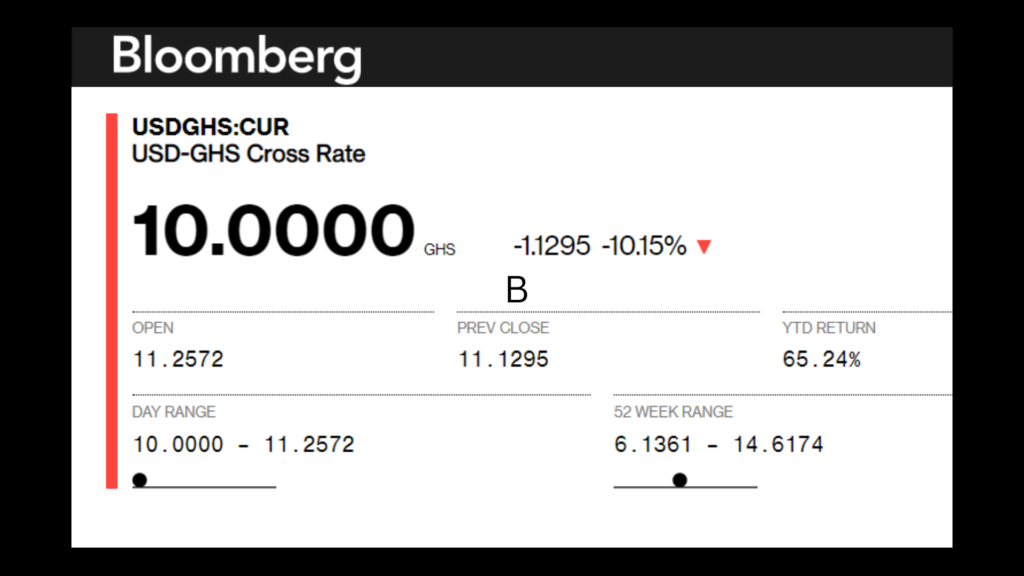

Bloomberg's currency dashboard has pegged $1.00 to ¢10.00, solidifying the cedi's position as the best performing currency against the dollar in the month of December 2022.

Within a span of two weeks, the cedi has regained more than 40% of its lost value since the arrival of the International Monetary Fund's team in Accra on December 1.

According to Bloomberg's currency dashboard, the forex market opened the day with $1 trading at approximately GH¢11.25 after closing at GH¢11.13 the previous day.

Through out the day, it's been a nosedive for the dollar giving the cedi an advantage to gain some additional 12%.

The IMF staff-level agreement, US Fed monetary policy easing, and investors turning bearish on the dollar for the first time since July 2021 have been outlined by some financial experts, as possible factors fueling the dollar's continuous depreciation against the Cedi. The 'greenback' shed more than 4% in the first 20 days of the fourth quarter, paving way for currencies such as cedi to find some comfort in a forlorn position.

According to Goldman Sachs' 2023 outlook, "markets are anxious for signs of a fundamental shift, and investors are increasingly fearful of missing out since corrections after a peak tend to be swift and steep,"

The cedi slumped by more than 54% against the dollar this year. However, it has strengthened by more than 40% since the start of December after Finance Minister, Ken Ofori-Atta disclosed government’s domestic debt exchange programme, followed by the latest IMF visit and the announcement of the Fund’s staff-level agreement of a bailout package worth some $3 billion.

After more than four months of negotiations, Ghana finally sealed a $3 billion programme with the Bretton Wood institution, pending the approval of its Executive Board.

According to Stéphane Roudet, Mission Chief for Ghana, his team “reached staff-level agreement with the Ghanaian authorities on a three-year program supported by an arrangement under the Extended Credit Facility (ECF) in the amount of SDR 2.242 billion or about $3 billion".

"The economic programme aims to restore macroeconomic stability and debt sustainability while laying the foundation for stronger and more inclusive growth. The staff-level agreement is subject to IMF Management and Executive Board approval and receipt of the necessary financing assurances by Ghana’s partners and creditors.”

Latest Stories

-

University of Ghana slams Auditor-General’s report, denies GH¢59.2 million payroll overstatement

4 hours -

Inside Mahama’s “Big Push” agenda: The $10 billion blueprint Ghana’s future depends on

5 hours -

Moody’s downgrades US credit rating citing rising debt

6 hours -

GAF commanders pledge entire month’s salary to Mahama Cares Fund

7 hours -

GoldBod’s magic trick: Turning $279m into $897m – Where did the extra come from?

7 hours -

IERPP cautions GoldBod: Ghana gold export math discrepancy explained

7 hours -

AMA to begin decongestion exercise on May 20, orders all persons affected to vacate areas by close of May 19

8 hours -

Makola Market traders educated on insuring goods against fire

8 hours -

Absa: Ghana cedi rallied too far

8 hours -

DW Global Media Forum offers journalists platform to break barriers, build bridges

8 hours -

Volta Regional Minister fulfils GH₵10k pledge to GJA Volta, inspires others to give back

9 hours -

OPIT ready to train a generation of African AI champions

9 hours -

UG debunks claim of overstating employee compensation by GH¢59m

9 hours -

Seven-member committee submits report on the death of Nigerian boxer Gabriel Oluwasegun

9 hours -

‘I gave 500 cedis, not dollars’ – Mahama jests amid Sammy Gyamfi dollars gift

10 hours