- Introduction

In the heart of every member of the African diaspora beats a drum of relentless hope, a yearning for a future where Africa's prosperity is crafted by its own hands, unshackled from the constraints of external aid.

The dawn of such an era is upon us, heralded by the advent of the LUMI and the African Diaspora Central Bank (ADCB)—innovations that promise to reforge the economic destiny of Africa and her children, both at home and scattered across the globe. The LUMI, more than a currency, is a beacon of autonomy, underwritten by the sun's endless energy and the timeless value of gold.

It is the embodiment of our ancestors' dreams, a tool for economic liberation and a testament to the ingenuity of the African spirit. In its essence, the LUMI is a clarion call to the diaspora, an invitation to partake in the noble quest of building a self-sufficient Africa that thrives on the principles of unity, trade, and investment, driven by its own currency.

The establishment of the ADCB under the visionary framework of ECO-6 marks a pivotal stride towards an Africa that dictates its own economic terms, a continent where prosperity is shared and sustainable. This bold step forward is not just about monetary policy; it's about rewriting our story from one of dependency to one of empowerment, from aid to trade, and from financial aid recipients to global economic partners. As we stand on the cusp of this new economic dawn, let us, the African diaspora, unite in support of the LUMI and the ADCB.

Let us be the architects of our future, building bridges of prosperity that span continents and generations. Together, we can turn the tide of history and forge a legacy of economic emancipation that will make every diaspora heart swell with pride. This is our time to shine, to show the world the strength, resilience, and brilliance of Africa and her people. The journey towards Africa beyond aid begins with us.

- Background and Establishment of ADCB and LUMI

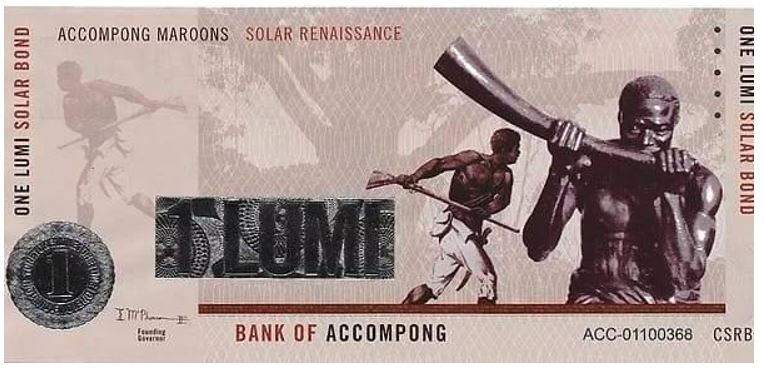

In the verdant landscapes of Jamaica lies Accompong, a symbol of resistance and self-determination, where the story of the LUMI currency begins. Rooted in the rich history of the Maroon community, the LUMI was born from a vision to unite the African diaspora in economic solidarity. This vision was codified into reality with the Bank Act of Accompong in 2014, establishing the LUMI as legal tender within the sovereign Maroon State of Accompong, marking a pivotal moment in the quest for a pan-African economic renaissance.

The African Diaspora Central Bank (ADCB), under the auspices of the Economic Community of the African Diaspora Sixth Region (ECO-6), embraced the LUMI, integrating it fully into its operations, thereby elevating the currency to a symbol of pan-African ambition. This strategic adoption by the ADCB was not just an economic decision but a profound declaration of unity, linking the vibrant history of the Maroons in Jamaica with the rich cultural tapestry of Africa, particularly the Ashanti Kingdom in Ghana.

The connection between the LUMI and Ghana is not merely symbolic but deeply rooted in historical ties and shared legacies of resilience. The Bank of Accompong’s choice of the LUMI resonates with the name "Acheampong," a nod to Ghanaian heritage, illustrating the deep, interconnected lineage of the African diaspora. President Akufo-Addo of Ghana himself noted the intriguing correlation between "Accompong" on the LUMI currency and the Ghanaian name "Acheampong," highlighting the shared heritage and the cultural bridge that the LUMI represents between Jamaica and Ghana.

This historic intertwining of the Maroons' legacy with the Ashanti Kingdom underlines a shared spirit of resistance and self-reliance. The LUMI, thus, stands as a testament to the enduring strength of the African diaspora, a beacon of economic independence, and a concrete step towards realizing the dream of a unified, prosperous Africa, powered by the creativity, resilience, and solidarity of its people across the globe.

Building upon the historical and cultural foundations that gave rise to the LUMI currency, its creation was driven by a compelling economic rationale that seeks to address and rectify the inherent weaknesses of fiat currencies, particularly within the African context.

The advent of the LUMI is not just a nod to shared heritage and solidarity but a strategic economic maneuver designed to foster stability, growth, and self-reliance across the African diaspora and the continent itself. Fiat currencies, by their very nature, are government-issued currencies that are not backed by a physical commodity, such as gold or silver. Instead, their value is derived from the trust and confidence that the populace has in the stability of the issuing government.

While fiat currencies have facilitated modern banking and economic transactions, they are inherently vulnerable to inflation, devaluation, and manipulation, often leading to economic instability in countries with less stable political climates or weaker economic structures. African nations, with their rich resources yet struggling economies, have been particularly susceptible to the adverse effects of fiat currency volatility, which can exacerbate issues like poverty, inflation, and hindered economic development.

In stark contrast, the LUMI's value is anchored in tangible assets: solar energy and gold. This innovative approach not only ensures that the currency has intrinsic value but also aligns it with sustainable and eco-friendly practices, addressing two critical concerns of the modern world—economic stability and environmental sustainability. By pegging the LUMI to these assets, the ADCB introduces a currency model that is less susceptible to the whims of international markets or the speculative nature of fiat currencies, providing a more stable and reliable medium of exchange for trade and investment.

Economic analysis suggests that such a commodity-backed currency can serve as a bulwark against inflation, as its value is less likely to be eroded over time compared to fiat currencies, which can be printed at will by governments, potentially leading to inflationary pressures. Furthermore, the LUMI's backing by solar energy not only capitalizes on Africa's abundant natural resources but also promotes renewable energy investments, driving towards a green economy. The strategic introduction of the LUMI by the ADCB, therefore, represents a paradigm shift towards a more resilient and sustainable economic model for Africa and its diaspora.

It envisages a future where economic transactions are not just exchanges of value but are also investments in the continent's sustainable development. By mitigating the risks associated with fiat currencies, the LUMI aims to catalyze a new era of economic empowerment, where Africa's wealth is generated, circulated, and preserved within its own borders and among its global diaspora, laying a solid foundation for a future where Africa truly rises beyond aid.

- The LUMI's Role in Economic Transformation

The LUMI stands as a groundbreaking beacon of progress, underpinned by the formidable duo of solar energy and gold, marking the dawn of an unprecedented economic renaissance for the African continent and its diaspora. This visionary amalgamation not only embeds the currency in assets of sustainable and universal acclaim but also heralds a daring march toward economic self-sufficiency and resilience for African nations.

The essence of the LUMI, deeply rooted in the renewable bounty of the earth and the enduring allure of gold, presents an attractive proposition against the backdrop of the erratic nature of traditional fiat currencies that have long swayed the tides of global commerce and finance. Africa's untapped solar energy capacity is nothing short of revolutionary, with the World Bank's projections of up to 1,000 GW lying dormant, waiting to be harnessed.

This sector's burgeoning growth trajectory, highlighted by the International Renewable Energy Agency (IRENA) with an anticipation of reaching 310 GW by 2030, signals a continent on the brink of an energy transformation. Emblematic of this shift is Morocco's "Noor Ouarzazate" solar complex, one of the globe's largest, emblematic of Africa's pledge to renewable energy. Nigeria, blessed with some of the most abundant solar resources in Africa, is ambitiously aiming to catapult its renewable capacity from a modest 923 MW today to an impressive 30,000 MW by 2030, mirroring the nation's Renewable Energy Master Plan.

Gold remains a linchpin in Africa's economic framework, with nations like Ghana, South Africa, and Mali leading the charge as top global producers. Ghana's ascension as the continent's premier gold producer, with a staggering output of 142.4 tonnes in 2019, underscores the metal's critical role in economic stability. The gold market's resilience is further evidenced by the record-breaking price surge to over $2,000 per ounce in August 2020, showcasing gold's unwavering value amidst financial flux. The fusion of solar and gold market dynamics robustly validates the LUMI's fundamental robustness.

By anchoring this currency in such pivotal assets, the African Diaspora Central Bank is engaging with sectors poised not just for exponential growth but also for formidable resistance against the storms of economic uncertainty. This strategic alignment promises a transformative impact on African economies, embodying more than monetary value—it champions the principles of sustainability, stability, and unity. West Africa, with its legacy of commerce and resource richness, is primed to spearhead this economic revolution. Nations grappling with the specters of currency fluctuation and inflation, such as Ghana, Nigeria, and Senegal, now gaze toward a future brightened by the LUMI's promise of equilibrium and expansion.

Ghana's gold-driven economy, for instance, stands to gain immensely, linking its prime asset directly to its monetary system. Nigeria's solar potential, vast yet largely untapped, heralds a golden opportunity for the LUMI to fuel renewable energy investments, spurring job creation and heralding a greener future. The LUMI transcends the mere stabilization of monetary policy; it is poised to shatter the age-old barriers constraining trade and investment within Africa. Offering a unified currency immune to the whims of international exchange rates, the LUMI paves the way for smoother, more predictable cross-border commerce. Such stability is invaluable for the region's SMEs, historically thwarted by currency instability and intricate exchange frameworks.

Furthermore, the LUMI confronts the enduring challenge of intra-African commerce, traditionally hampered by dependence on external currencies. By ensuring that transactions within the continent are conducted in a stable, shared currency, the LUMI not only safeguards Africa's wealth but also fosters regional cohesion, amplifying the continent's voice on the world stage.

- Impact on Trade and Investment

Global trade has been a critical driver of economic growth, with the World Trade Organization (WTO) reporting that merchandise trade volume grew by 2.6% in 2019, although projections for future years vary due to global economic uncertainties. Digital currencies and payment systems have the potential to streamline cross-border transactions, reduce costs, and increase transparency, thereby potentially boosting global trade further.

In Africa, the AfCFTA (African Continental Free Trade Area), which commenced in January 2021, aims to create a single market for goods and services, facilitating the movement of capital and people, and promoting industrial development and sustainable and inclusive socio-economic growth. According to the United Nations Economic Commission for Africa (UNECA), the AfCFTA has the potential to increase intra-African trade by over 50% through the elimination of import duties alone.

The introduction of a digital currency like the LUMI could further enhance these benefits by simplifying transactions across borders within the continent and with the African diaspora. By reducing reliance on foreign currencies and mitigating exchange rate volatility, a digital currency could lower transaction costs and enhance trade efficiency. Moreover, it could attract investment by offering a stable and secure means of financial exchange, encouraging diaspora remittances, and fostering closer economic ties. Case studies from other regions, such as the use of digital currencies in the Caribbean for cross-border trade and remittances, suggest that the LUMI could drive economic growth by improving access to financial services, reducing the cost of doing business, and enhancing transparency in transactions.

For Africa, where mobile money has already revolutionized financial inclusion, the LUMI could represent the next step in the continent's digital economic transformation, leveraging technology to further integrate African economies with each other and the global market.

- Supporting Africa's Agenda Beyond Aid

The concept of Africa moving "Beyond Aid" is central to the continent's development agenda, emphasizing economic self-sufficiency, sustainable growth, and a departure from the traditional aid-dependent development model. The introduction of a digital currency like the LUMI, under the auspices of the African Digital Currency Board (ADCB), could play a pivotal role in realizing this vision by leveraging technology to enhance financial inclusion, stimulate economic growth, and foster a more integrated African economy. The LUMI aligns with Africa's broader goals of self-sufficiency and development beyond aid by potentially increasing intra-African trade and investment.

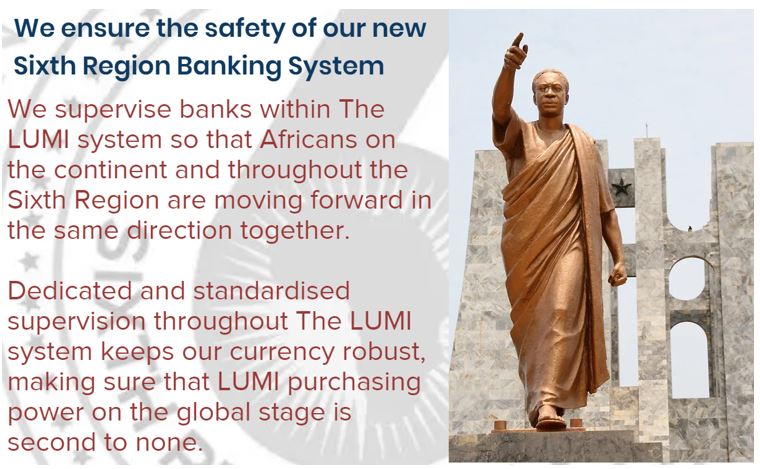

By providing a common digital currency that reduces the cost and complexity of cross-border transactions, the LUMI could encourage the use of local currencies, diminish reliance on foreign currencies, and thereby retain more capital within the continent. This initiative would support the African Union's Agenda 2063, which aims for a prosperous Africa based on inclusive growth and sustainable development. It emphasizes the importance of economic transformation and integration among African countries. The role of the ADCB in this context would be crucial.

By overseeing the implementation and regulation of the LUMI, the ADCB could ensure that this digital currency promotes financial stability and fosters economic growth. The ADCB could implement policies to mitigate risks associated with digital currencies, such as volatility, cybersecurity threats, and money laundering. By doing so, the ADCB would not only safeguard the economic interests of member states but also build confidence among users and investors, both within Africa and internationally.

Moreover, the LUMI could facilitate access to financial services for the unbanked and underbanked populations in Africa, a continent where a significant portion of the population lacks access to traditional banking services. By leveraging mobile technology, which has seen widespread adoption across Africa (as evidenced by the success of mobile money platforms like M-Pesa), the LUMI could enhance financial inclusion, enabling more people to participate in the economy and access credit, savings, and investment opportunities. Furthermore, by fostering a more integrated and self-sufficient African economy, the LUMI could attract foreign direct investment (FDI) not as a form of aid, but as capital invested in a dynamic and growing market. Investors looking for new opportunities would find a more stable and integrated African market, driven by digital innovation and intra-continental trade, an attractive proposition.

- Challenges and Opportunities

The introduction of LUMI, aimed at transforming Africa's economy through digital currency, faces challenges amidst its potential to reshape the financial landscape. As African nations contend with the burdens of loan repayments and the instability of their currencies, the prospect of LUMI offers both a challenge and a beacon of hope. The volatility of African currencies complicates debt repayment, exacerbating the economic difficulties faced by these nations.

Additionally, the widespread adoption of LUMI requires significant digital infrastructure and compatibility with existing financial systems, presenting logistical and technical hurdles, especially in areas with limited digital access. Moreover, the deployment of a digital currency across Africa necessitates comprehensive regulatory measures to ensure security, privacy, and compliance with anti-money laundering standards, adding a layer of complexity to its implementation.

Despite these challenges, LUMI presents unparalleled opportunities for economic stability and growth by offering a stable digital alternative to traditional currencies, potentially easing the burden of loan repayments and fostering economic stability. The initiative's stimulus package promises zero-rate interest loans to businesses, aiming to catalyze economic recovery and growth. Furthermore, LUMI's ambitious investment goal of over $100 trillion by 2063 aligns with Africa's development objectives, promising to significantly impact the continent's economic landscape and underscoring a commitment to prosperity and self-sufficiency. Additionally, LUMI could enhance financial inclusion, extending digital financial services to the unbanked and underbanked populations through mobile technology, thus broadening economic participation.

The Swifin platform amplifies these opportunities by providing a proven infrastructure for LUMI transactions, highlighting the currency's operational viability. This platform has successfully processed vast amounts of LUMI payments, demonstrating the potential for seamless integration into Africa's financial ecosystem. Furthermore, countries such as Hawaii, Dubai, Mauritius, Turkey, Malaysia, India, and the Kailaasa nation have expressed interest in integrating LUMI into their financial systems, signaling international acceptance and the potential for global expansion. This integration not only expands LUMI's reach but also fosters cross-border trade and investment, enhancing Africa's position in the global economy. The Swifin platform's role in facilitating financial inclusion and serving as a conduit for economic stimulus and recovery further underscores the transformative potential of LUMI, offering a direct channel for supporting businesses and stimulating market growth.

- The Future of the LUMI in Africa's Economic Landscape

The future of the LUMI within Africa's economic landscape holds transformative potential, signaling a new chapter in the continent's journey towards economic self-reliance and global significance. As a digital currency designed to transcend traditional financial barriers, LUMI is poised to act as a stabilizing force, not only within the African economy but also on a global scale. Its introduction comes at a pivotal moment, as economies worldwide seek innovative solutions to enhance financial stability, foster inclusive growth, and streamline cross-border transactions.

The LUMI's design inherently addresses several of the systemic challenges that have historically hindered Africa's economic progress, including currency volatility, high transaction costs, and limited access to banking services.

By providing a stable and reliable digital currency, LUMI can significantly reduce the continent's vulnerability to external shocks and currency fluctuations, which often exacerbate debt burdens and impede economic planning. This stability is crucial for attracting investment, encouraging savings, and facilitating trade, laying a solid foundation for sustained economic growth. Furthermore, LUMI's role in the global economy cannot be understated.

As digital currencies become increasingly mainstream, LUMI's integration into international financial systems offers a unique opportunity for Africa to assert itself as a key player in the digital economy. By fostering easier and more cost-effective cross-border transactions, LUMI can enhance Africa's trade relations with other regions, promote foreign direct investment, and facilitate diaspora remittances, all of which are vital components of economic development.

The potential of LUMI to redefine Africa's position in the global economic order is profound. Traditionally viewed as a recipient of aid and subject to the volatility of commodity markets, Africa's economy stands to gain autonomy and influence through the successful adoption of LUMI. This digital currency not only symbolizes a shift towards technological innovation and financial inclusivity but also represents Africa's commitment to forging its path in the global economic landscape.

Through the adoption of the LUMI, Africa can enhance its bargaining power in international trade negotiations, assert greater control over its economic policies, and reduce its reliance on external currencies for trade and debt repayment. This shift towards a more integrated and self-sufficient economic model could inspire a reevaluation of Africa's role in global economic governance structures, positioning the continent as a vibrant hub for digital finance and innovation. Moreover, the success of LUMI could serve as a model for other regions seeking to enhance economic stability and autonomy through digital currencies. As such, Africa could become a leader in the global movement towards digital finance, sharing insights and best practices derived from its experience with LUMI.

- Conclusion

The advent of LUMI heralds a new era for Africa, offering not just a solution to the myriad economic challenges the continent faces but also a beacon of hope for a future defined by self-reliance, prosperity, and global partnership.

LUMI, under the stewardship of the African Digital Currency Board (ADCB), embodies the transformative potential to liberate Africa from the constraints of aid dependency, positioning it instead as a formidable trading partner on the global stage.

Just as humanity stood united in the face of adversity, ready to reclaim its freedom, so too does Africa stand at the threshold of a new dawn. LUMI is our collective endeavor, a symbol of our shared vision and determination to craft a future where Africa holds the reins of its economic destiny. This digital currency is more than just a tool for financial transactions; it is a catalyst for change, a vehicle through which we can address the persistent challenges of currency volatility, financial exclusion, and economic fragmentation.

By embracing LUMI, we embrace the possibility of an Africa that is not only self-sufficient but also thriving and dynamic, an Africa that contributes to the global economy with its rich resources, creativity, and spirit of innovation. The potential of LUMI as a panacea for Africa's economic challenges is immense. By providing a stable, secure, and inclusive digital currency, we can unlock doors to unprecedented economic opportunities, fostering growth, and development that is inclusive and sustainable.

The ADCB's role in this transformation cannot be overstated; as the guardian of LUMI, it ensures that the currency's implementation and growth are aligned with the continent's broader economic goals and aspirations. As we stand on the cusp of this revolutionary shift, let us move forward with a sense of purpose and optimism. The road ahead may be fraught with challenges, but with LUMI as our beacon, we are equipped to navigate these waters, to build bridges where there were once barriers, and to forge a path toward economic liberation and prosperity. This is our moment, a call to action for every African nation and its diaspora, to unite in the pursuit of a common goal: to transform our continent from a beneficiary of aid to a powerhouse of trade and innovation.

Let LUMI be the instrument of our ambition, the key to unlocking Africa's potential, and the foundation upon which we build a future that reflects our greatest aspirations. Together, with LUMI lighting our way, we embark on this journey not just as individual nations, but as a united Africa, ready to claim our place on the world stage, not as dependents, but as proud, prosperous partners in global progress.

-

About the authors

Latest Stories

-

Trinity Oil MD Gabriel Kumi elected Board Chairman of Chamber of Oil Marketing Companies

23 minutes -

ORAL campaign key to NDC’s election victory – North America Dema Naa

41 minutes -

US Supreme Court to hear TikTok challenge to potential ban

46 minutes -

Amazon faces US strike threat ahead of Christmas

1 hour -

Jaguar Land Rover electric car whistleblower sacked

1 hour -

US makes third interest rate cut despite inflation risk

2 hours -

Fish processors call for intervention against illegal trawling activities

2 hours -

Ghana will take time to recover – Akorfa Edjeani

2 hours -

Boakye Agyarko urges reforms to revitalise NPP after election defeat

3 hours -

Finance Minister skips mini-budget presentation for third time

3 hours -

‘ORAL’ team to work gratis – Ablakwa

3 hours -

Affirmative Action Coalition condemns lack of gender quotas in Transition, anti-corruption teams

3 hours -

December 7 election was a battle for the ‘soul of Ghana’ against NPP – Fifi Kwetey

3 hours -

Social media buzzing ahead of Black Sherif’s ‘Zaama Disco’ on December 21

3 hours -

Afenyo-Markin still suffering from the massive defeat – Fifi Kwetey

3 hours