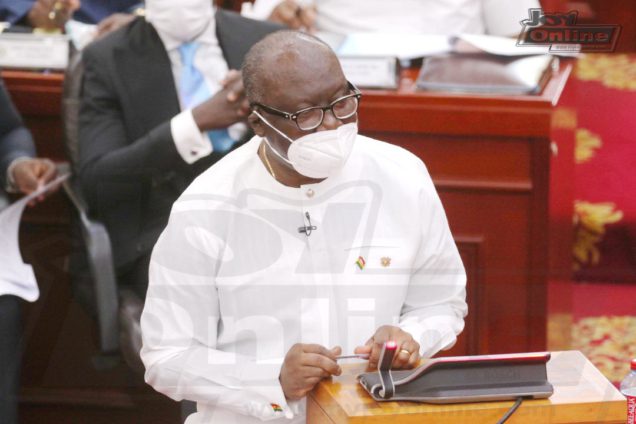

The country’s dollar debt had the worst start to 2022 in the developing world, with a 11% loss until January 19, 2021 when Minister of Finance, Ken Ofori-Atta, said the government is willing to cut spending as much as 20%, depending on revenue performance, to put the budget on a sustainable path.

Since then, the risk premium on Ghana’s bonds has narrowed 111 basis points.

While yields are still signaling a high default risk, the extra premium demanded on June 2049 and March 2061 securities is already back below 1,000 basis points, the threshold considered distressed. The yield on 2026 securities fell 26 basis points on Thursday to 11.97%, the lowest in three weeks.

“There will be a continuation in the performance of the bonds if we can see the fiscal targets set by the government are being met,” said Joe Delvaux, a money manager at Amundi in London. “Certainly the intentions are good and it’s one of the reasons why the bonds have been rallying, but it will come down to the question: can they deliver?”

The government aims to meet this year’s budget deficit target of 7.4% of gross domestic product, down from a projected 12.1% of GDP for last year. The proposed introduction of an e-levy on electronic transactions, including mobile money, will help boost tax revenue to 15.4% of GDP by end-2022 from a forecast 12% of GDP for 2021, giving investors some comfort that the default risk is receding.

“There has been engagement from a variety of clients, which I think shows investor willingness to re-engage with the trade here,” said Calvyn Kirsten, a London-based emerging markets trader at JPMorgan Chase Bank. “The market has gone very quickly from pricing a severely distressed scenario. Once the finance ministry does what it says, then that should be taken off the table.”

Still, achieving the budget targets won’t be easy due to high interest costs and public sector wages that account for almost two-thirds of expenditure. At current yield levels, Ghana would find it difficult to access the Eurobond market to roll over debt.

‘Ample’ Reserves

“The majority of investors are likely to remain wary about the government’s ability to cut costs,” said Mark Bohlund, a senior credit research analyst at REDD Intelligence. “There is very little room to make substantial cuts in response to the likely underperformance of the very highly-set revenue targets.”

On the other hand, Ghana has $10.8 billion of reserves and is able to service maturing debt without tapping the Eurobond market this year. The average premium investors demand to hold Ghanaian debt has narrowed from its 21-month high to 1,035 basis points, the least among 10 emerging nations with debt trading at distressed levels, according to data compiled by Bloomberg.

“We view valuations as attractive and we expect Ghana to regain market access next year,” said Richard Briggs, a London-based money manager at GAM Holdings who holds Ghanaian debt. “We know that the fiscal side in Ghana is challenging but foreign-exchange reserves are reasonably ample and their external financing needs are not huge.”

Latest Stories

-

Baltasar Coin becomes first Ghanaian meme coin to hit DEX Screener at $100K market cap

24 minutes -

EC blames re-collation of disputed results on widespread lawlessness by party supporters

39 minutes -

Top 20 Ghanaian songs released in 2024

60 minutes -

Beating Messi’s Inter Miami to MLS Cup feels amazing – Joseph Paintsil

1 hour -

NDC administration will reverse all ‘last-minute’ gov’t employee promotions – Asiedu Nketiah

1 hour -

Kudus sights ‘authority and kingship’ for elephant stool celebration

1 hour -

We’ll embrace cutting-edge technologies to address emerging healthcare needs – Prof. Antwi-Kusi

2 hours -

Nana Aba Anamoah, Cwesi Oteng special guests for Philip Nai and Friends’ charity event

2 hours -

Environmental protection officers receive training on how to tackle climate change

2 hours -

CLOGSAG vows to resist partisan appointments in Civil, Local Government Service

3 hours -

Peasant Farmers Association welcomes Mahama’s move to rename Agric Ministry

3 hours -

NDC grateful to chiefs, people of Bono Region -Asiedu Nketia

3 hours -

Ban on smoking in public: FDA engages food service establishments on compliance

3 hours -

Mahama’s administration to consider opening Ghana’s Mission in Budapest

3 hours -

GEPA commits to building robust systems that empower MSMEs

3 hours