The IMANI Centre for Policy and Education (“IMANI CPE”) and the Deutsche Gesellschaft für Internationale Zusammenarbeit GmbH (GIZ) on April 5, 2022, held this year’s first IMANI-GIZ Reform Dialogue Series (RDS) on the theme “Ghana’s Macroeconomic Environment: An Enabler or Hammer to Investment?”.

The dialogue sought to engage relevant stakeholders in Ghana’s investment ecosystem to discuss how a conducive macroeconomic context creates the right investment climate.

The macroeconomic environment is the set of factors that affect investment and growth in an economy. Basic indicators of the macroeconomic environment include inflation rate, exchange rate, fiscal balance, and the external current account balance, among others.

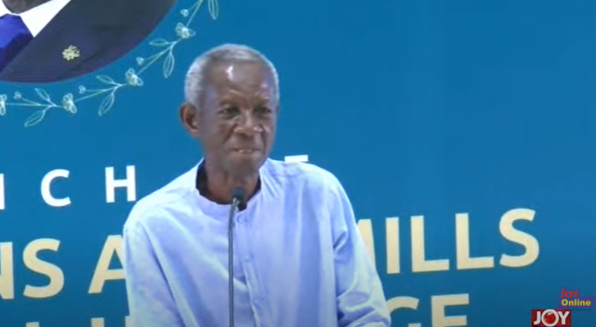

Panellists at the event were Kwame Pianin a seasoned economist and investment consultant; Dr Priscilla Tsumasi Baffour, Senior Lecturer, Department of Economics, University of Ghana; Dr Sam Mensah, Founder and Executive Chairman, SEM Group; and Dr. John Ampontuah Kumah, Member of Parliament for Ejisu and Deputy Minister of Finance.

Various issues emerged which are relevant for consideration by duty bearers.

Mr Kwame Pianin opened the dialogue with a brief presentation on the topic. He noted that economic issues are so broad thus requiring various stakeholders from industry, academia and the international community to speak about them and to offer different perspectives for consideration by policymakers. He noted that the monetary policy rate is a key indicator of how the Bank of Ghana perceives the economy.

Speaking about the policy rate and other macroeconomic variables, he noted that when the Central Bank increases its policy rate, it is indicative of the fact that the central bank is not comfortable with the fiscal stance of the government.

He noted how structural imbalances between expenditure and revenue continue to affect the economy, arguing that as it stands now, the Ghanaian economy is not resilient given it is failing to generate enough reserves. He indicated that Ghana needs a cost-benefit analysis of the significant expenditures by the government citing areas like Free Senior High School (‘Free SHS').

Mr Kwame Pianin further remarked that “where the [Ghanaian] economy is now is not pretty” and the environment cannot be described as enabling. Going further. Mr Pianim also explained that some of the problems are attributed to external shocks.

He questioned the excessive focus of the government on the revenue side of the economic equation with the oft-touted mantra that Ghanaian citizens are not paying enough taxes. Instead, he argued that citizens pay different indirect taxes, especially value-added tax (VAT).

Mr Pianim stressed that the main area of focus for policymakers should be the expenditure side and recommended that government should use quality predictive models and analysis in their economic decision-making. He finally remarked that “we should not waste the [current] crisis” but instead use it to create a better and sustainable macroeconomic environment.

Dr Priscilla Tsumasi Baffour noted that Ghana’s export basket is not so diversified which exposes the economy to many international shocks such as the ongoing COVID-19 pandemic and Russia-Ukraine War.

She also indicated that the economy accumulates a lot of fiscal deficits which drive the current high public bebt [estimated at 80.1% of GDP as of December 2021, according to Bank of Ghana statistics]. Dr Baffour noted that with the current high levels of inflation, the depreciating cedi and high cost of capital, the economy cannot be said to be doing well.

Dr Baffour suggested that Ghana needs to increase its revenue,spend wisely on items that maximise returns while cultivating the discipline and political will to reduce expenditure on consumption related programmes and projects.

Dr Sam Mensah noted that the macroeconomic economy has been an enabler but from time to time it turns out to be a hammer. He noted that policies are time-inconsistent which creates a major problem for the sustainability of the economy.

He advised that Ghana relooks at her institutions of economic governance. He cited the Fiscal Council and complains that it is not time consistent as it is coterminous with the government’s term of office. He also raises other issues on the NDPC, stressing the need for time consistency of the institutions of economic governance.

He noted that despite the monetary and fiscal policy measures recently, the investment climate has not been enhanced enough. This is because the weaknesses evident in the economy are structural and thus, there should be a long-term view of addressing the macroeconomic problems.

Hon Dr John Kumah noted that the macroeconomic environment is meant to be an enabler, but the Ghanaian economy is not yet there but on the path. He noted that the government is reducing the deficit, revising expenditure targets by 30% for discretionary expenses, and has placed a moratorium on the importation of vehicles, among others.

He noted that last year GRA met its revenue target with excesses and this is expected for the 2022 fiscal year also. However, external factors like COVID-19, the Russian-Ukraine crisis and other external factors have adversely affected the economy. He also noted that the Fiscal Responsibility Act is very good in guiding and monitoring the government.

Dr John Kumah also noted that the Bank of Ghana through its monetary policy tools have been implementing policies to address the economic problems. He noted that government has to do more with regard to the efficiency of its expenditures.

Some experts and policy analysts also contributed to the discussions. Mr Kofi Bentil noted how the nature of the Ghanaian constitution makes it absolutely impossible for the NDPC to be successful in achieving its mandate.

Also, Dr Humphrey Kwesi Ayim Darke of AGI noted that government should focus on targeted interventions. He believes that the lack of effective M&E has made the investment in the area of planting for food and jobs go down the drain as farmers exported their produce at a discount to neighbouring countries. He also stressed that the huge losses reported by the state-owned entities (SOEs) need to be addressed.

Professor Godfred Bokpin noted that the fiscal council needs to be looked at as it currently has an advisory role which is not being beneficial. He believes that there is opacity and full disclosure of government fiscal information is needed. He also advocated for the independence of the fiscal council as it currently fails the independence test. It is also noted that the fiscal council is yet to be reconstituted after the previous Council.

In providing their concluding remarks, the panellists provided specific recommendations which they believe will enhance the investment climate.

Mr Kwame Pianin recommended that the government should follow a cost-cutting approach, coupled with the need for the Fiscal Council to be involved by giving a nihil obstat over all the big-ticket expenditure of the government. He called for all Ghanaians to be involved in the efforts to enhance the investment climate.

Dr Priscilla Tsumasi Baffour concluded that the cost of borrowing should be reduced as it feeds into the cost of credit. Also, the spread of the exchange rate is also too high and the Bank of Ghana should critically look at this.

Moreover, she noted that there should be infrastructure that supports investment covering land title issues, legal rights, concerns for transparency, and reduction in corruption. She also recommended the diversification of the economy and the reduction of social expenditure. Dr Sam Mensah admonished the government to maintain a stable fiscal environment to encourage investors to come into Ghana.

He also advocates for the improvement of economic decision making and management. He argues that the concern is not about creating new institutions but reconfiguring the institutions to have autonomous decision making and change the term of office not to align with the political term (this relates to the Fiscal Council, the NDPC and other related institutions).

Latest Stories

-

Cooking competition takes centrestage at Joy FM Family Party In The Park

20 minutes -

Album review: ‘Wonder’ by Nana Fredua-Agyeman Jnr

2 hours -

Bouncy castle, sack race, and smiles galore: Joy FM Family Party takes over Aburi Gardens

2 hours -

Watch: Kwan Pa Band thrills patrons at Joy FM Family Party in the Park

2 hours -

Akufo-Addo partly to blame for NPP’s defeat in 2024 election – Frank Agyekum

3 hours -

Rapid urbanisation endangers children’s mental health – Psychiatrist warns

3 hours -

Kedland International School hosts maiden Festival of Nine Lessons and Carols

3 hours -

I didn’t speak against holding wrongdoers accountable – Rev. Kwadwo Bempah clarifies ORAL comment

4 hours -

RSS Developers to hold 3-day open house event on home purchasing from Friday, Dec. 27

4 hours -

Elikem Treveh: How TEIN UMaT students contributed significantly to NDC’s victory in Tarkwa Nsuaem constituency

4 hours -

Joy FM Family Party in the Park kicks off with excitement at Aburi Botanical Gardens

5 hours -

Australian mining giant files $277m claim against Ghana over gold project dispute

5 hours -

JP U-15 Cup 2024: Fadama Ajax wins maiden edition

5 hours -

Lured for Love, Caged for Cash: How an 80-year-old American seeking love was kidnapped in Ghana by a Nigerian gang

6 hours -

Star Oil Ltd @ 25: Driving Growth and Profitability with a Vision for Renewable Energy and a Sustainable Future

6 hours