Research firm, IC Research is raising its 2024 annual inflation forecast by 340 basis points to between 19.3% and 21.3%.

This is due to the upside risk to inflation in the second half of 2024, subject to downward pressure from food harvest in quarter 3, 2024.

The new projection is higher than the Bank of Ghana’s year-end inflation target of 13.0% – 17.0%..

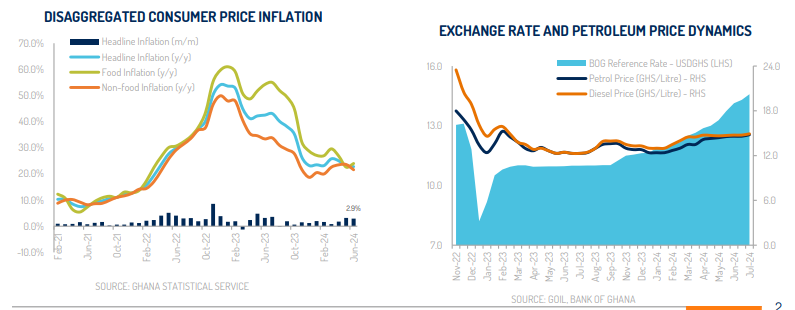

IC Research said the June 2024 inflation print revealed emerging signs of divergence between food and non-food inflation akin to what was observed between May and July last year.

This it explained could embed some stickiness in the annual inflation in the second half of 2024, especially having enjoyed a favourable base in the like period of 2023.

“While we stress that it may be premature to judge the risk of protracted divergence, we are equally minded by the impact of seasonality on food prices. We note that the annual closed fishing season commenced on 1st July 2024 with a one-month observance for artisanal fishing and two months for industrial trawlers. This could sustain the price pressure for fish & other seafood in July [2024] before easing slightly in August 2024.”

“For non-food inflation, the implementation of new utility tariffs and higher ex-pump petroleum prices with effect from 1st July 2024 will pose a double whammy of upside risk to annual and monthly inflation. During the recent utility tariff review for July – September [2024], the sector regulator indicated that the electricity tariff hike of between 3.45% and 5.84% will still leave a revenue under-recovery of GH906.2 million to be recovered in subsequent quarters. In our view, this raises the upside risk to inflation in second half of 2024, subject to downward pressure from food harvest in late quarter 3 2024.”

inflation declined for the third consecutive month in June 2024, edging down by 30 basis points to 22.8% year-on-year.

On a sequential basis, headline inflation also came in 30 basis points lower at 2.9% month-on-month in June 2024.

Latest Stories

-

NDC’s mischievous campaign and propaganda will soon expose them – Afenyo-Markin

20 minutes -

African banks to remain exposed to domestic, global operating environments risks – Fitch

23 minutes -

Premier League: Wolves agree deal for Pereira to become new boss

25 minutes -

Fitch expects outlook for sub-Saharan African sovereigns to be neutral in 2025

25 minutes -

NDC’s Joseph Yamin allegedly leads mob to seize bullion bars at PMMC Assay Centre

32 minutes -

Ghana’s external position moderately stronger -IMF

43 minutes -

Many NDC MPs will become redundant in the new parliament – Afenyo-Markin

46 minutes -

Maintain a tight monetary policy stance – IMF to BoG

50 minutes -

Ghana needs to ‘review’ Olympic preparations of its athletes – Patrick Boamah

51 minutes -

Charles Kumi wins 2024 Man Ghana Bodybuilding contest

55 minutes -

David Ocloo resigns as assistant coach of Asante Kotoko

1 hour -

Josh Acheampong to sign new at Chelsea until 2029

2 hours -

Akufo-Addo hails peaceful 2024 election as testament to the resilience of Ghana’s democracy

2 hours -

SIC Insurance Plc poised for success as it holds its AGM

2 hours -

“You need to think smarter” – KK Fosu on Fameye’s stage mishap

2 hours