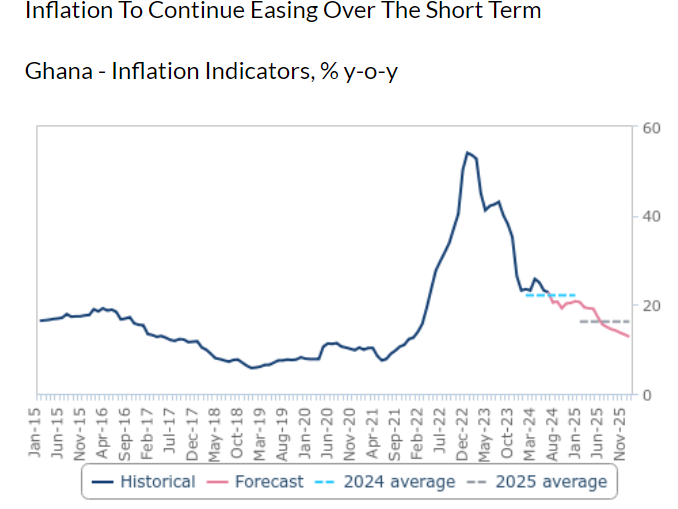

Inflation will continue to ease over the short-term ending 2024 at 20.8%, Fitch Solutions has disclosed in its Ghana Inflation 2024 Consumer Outlook.

At the same time, food prices will continue to decline. Here is more in this report.

According to the UK-based firm, inflation will average 22.1% in 2024.

Inflation fell to 20.9% in July 2024, from the peak of 54.1% in December 2022.

“Into 2025, inflation will continue on a downtrend, averaging 16.2% year-0n-year. Although inflationary pressures are easing, they remain higher than what consumers were used to pre-pandemic, when inflation in Ghana averaged 12.4% year-on-year over 2015-2019. This highlights how consumers will continue to face inflationary pressures in the short term”, Fitch Solutions stated.

Slowing food inflation to benefit consumer spending

However, the UK based firm said continued slowing of food inflation will be beneficial for consumer spending on other goods and services, given that food and non-alcoholic drinks account for more than 42% of total household spending in Ghana.

Nonetheless, key household spending segments, such as housing and utilities and transport prices, are seeing their inflationary pressures rise.

“Key household spending segments, such as housing and utilities as well as transport prices, are seeing their inflationary pressures rise. Transport inflation has grown from 5.6% y-o-y in January 2024, to 18.1% y-o-y in July 2024, with housing and utilities growing from 22.6% y-o-y, to 28.6% y-o-y over the same period, and thus posing potential downsides to spending”.

Latest Stories

-

‘We pampered them too long; now they’re biting,’ Franklin Cudjoe says of nurses’ strike

46 minutes -

EC to update Parliament on Ablekuma North deadlock this week

48 minutes -

Share a Coke magic of finding your name on the iconic bottle returns

50 minutes -

See list of 25 private schools added to the free SHS programme

52 minutes -

Coding is no longer enough: Why Africa needs AI literacy in every school

58 minutes -

Ghana risks economic strain if Israel-Iran tensions escalate – Collins Adomako

1 hour -

Bridging the AI Education Gap: How African schools can leapfrog into the future

1 hour -

Today’s Front pages: Monday, June 16, 2025

1 hour -

Minority raise concerns over delayed disbursement of common funds

1 hour -

Appolonia City provides hot meals for BECE candidates in major CSR initiative

1 hour -

Dubai’s AI Operating System: A strategic blueprint for governments and future of African economies

2 hours -

Telecel Ghana Foundation brings healing and hope to James Camp Prison for Father’s Day

2 hours -

Help us improve our food systems – NAFCO appeals to WFP

2 hours -

Ahiagbah calls for Health Minister’s resignation over GRNMA strike

2 hours -

Attorney General’s NSA update serves public interest – Franklin Cudjoe

2 hours