As a business in Africa, you’ve probably had doubts about the people you’re dealing with. This includes partners, suppliers, customers and various third parties and vendors - especially during an era of the African Continental Free Trade Area Agreement (AFCFTA).

That’s why running checks to verify the entities you do business with is both a smart risk-mitigation strategy and a regulatory compliance requirement for many industries. But how do you get started, especially when you have to consolidate all the information you need to make a strategic decision?

Appruve Business is the easiest way to verify the legitimacy of any business. With Appruve Business, African businesses can trust business partners, do business intelligently and drive growth! Our data infrastructure allows high-growth businesses to manage risk and compliance at scale, with minimal friction via Web, mobile apps and APIs.

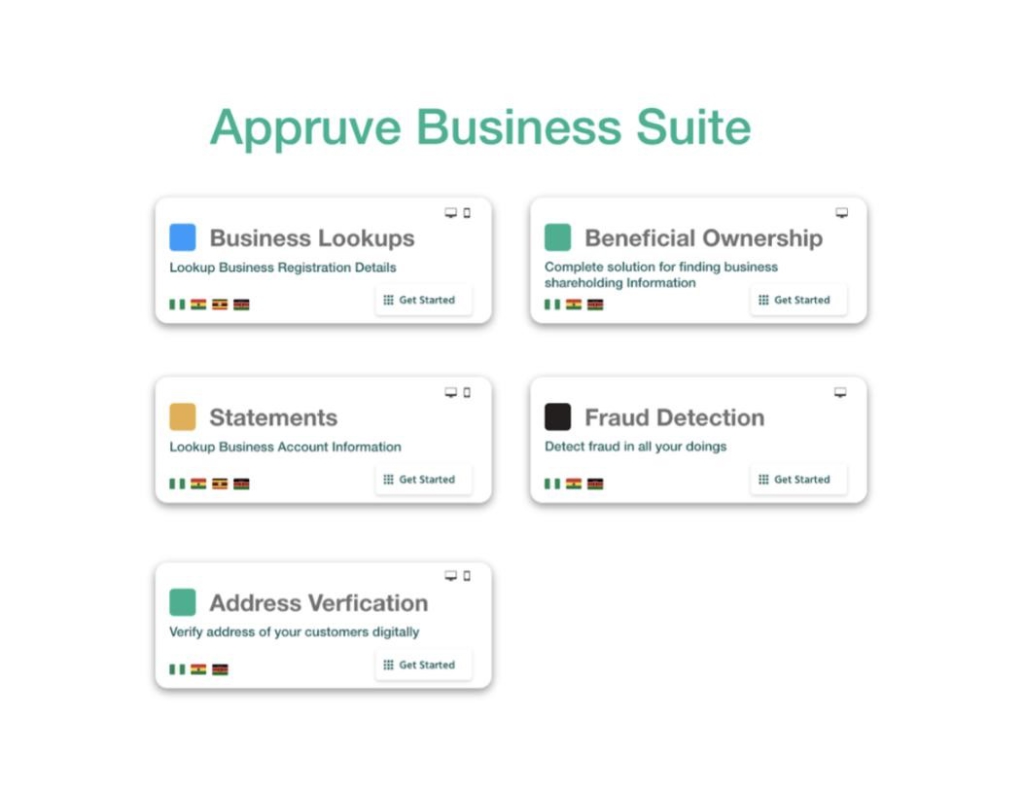

Features of Appruve Business

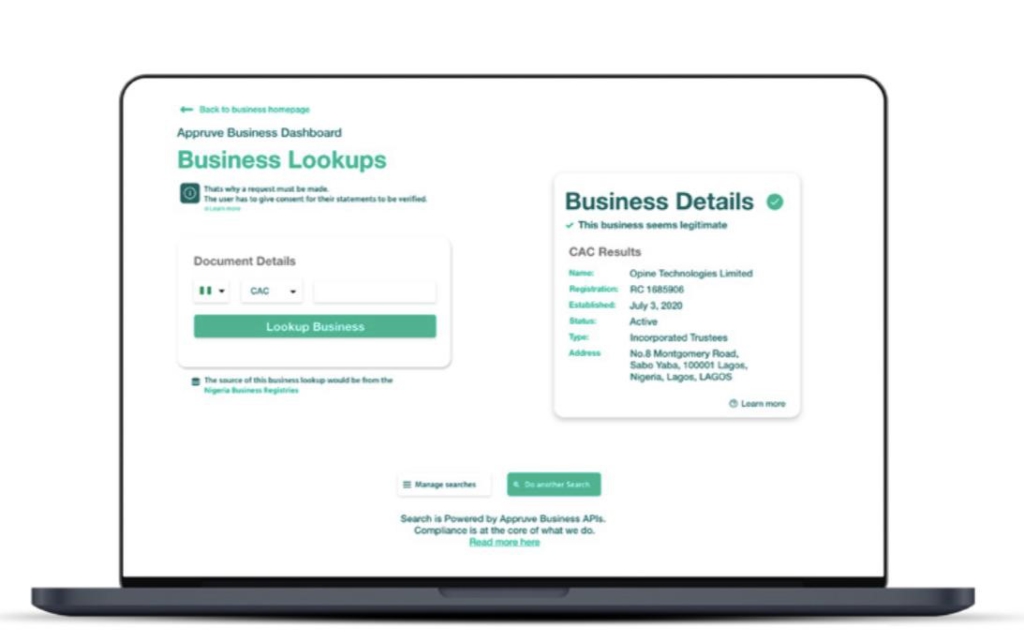

a. Business Lookup

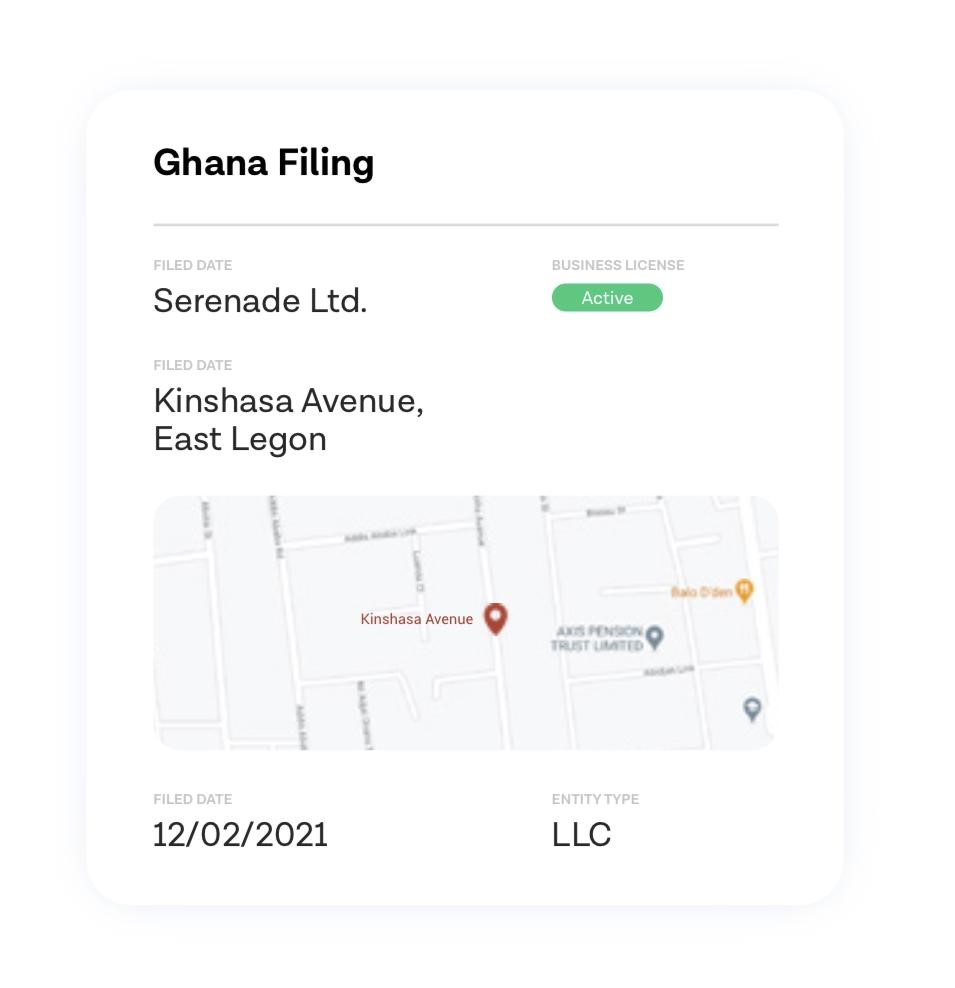

Verifying the identifier of a business is a crucial part of business verification. When verifying a business identifier, we will verify that the identification number is valid and that it matches the name passed to Appruve Business.

If the business identification number is unable to be verified or does not match the name provided, we will perform a series of lookups to identify alternate names that may be associated.

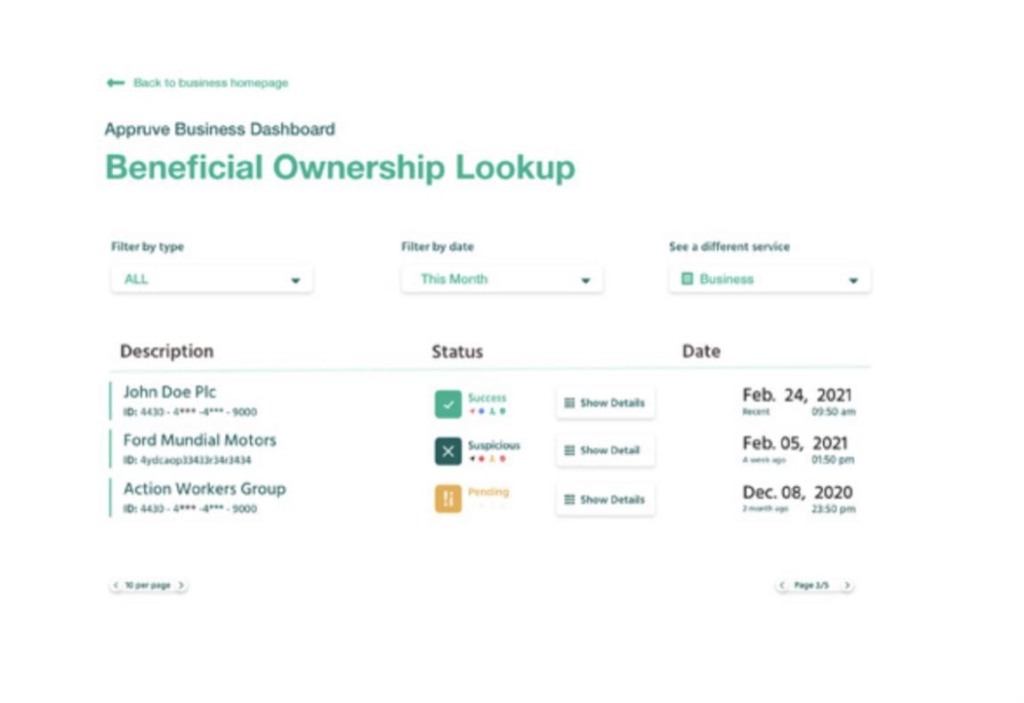

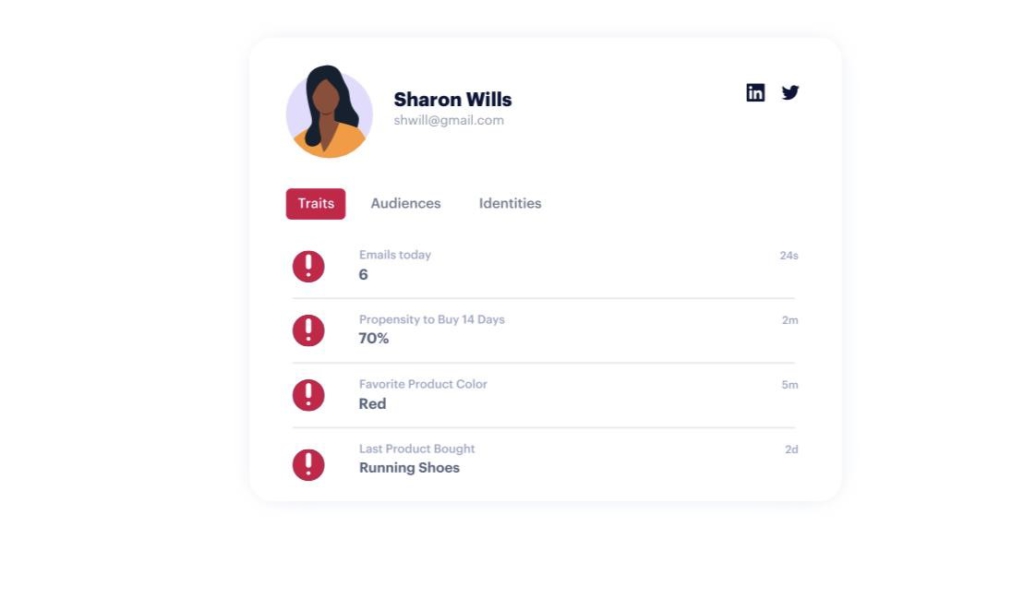

b. Beneficial Ownership Lookup

We provide a holistic picture of all the people associated with each business. Understanding the details of the ownership structure and executive team of a company is important in helping to maintain compliance with Know Your Customer (KYC) and Ultimate Beneficial Owner requirements, and understand the potential risk or fraud signals about each entity.

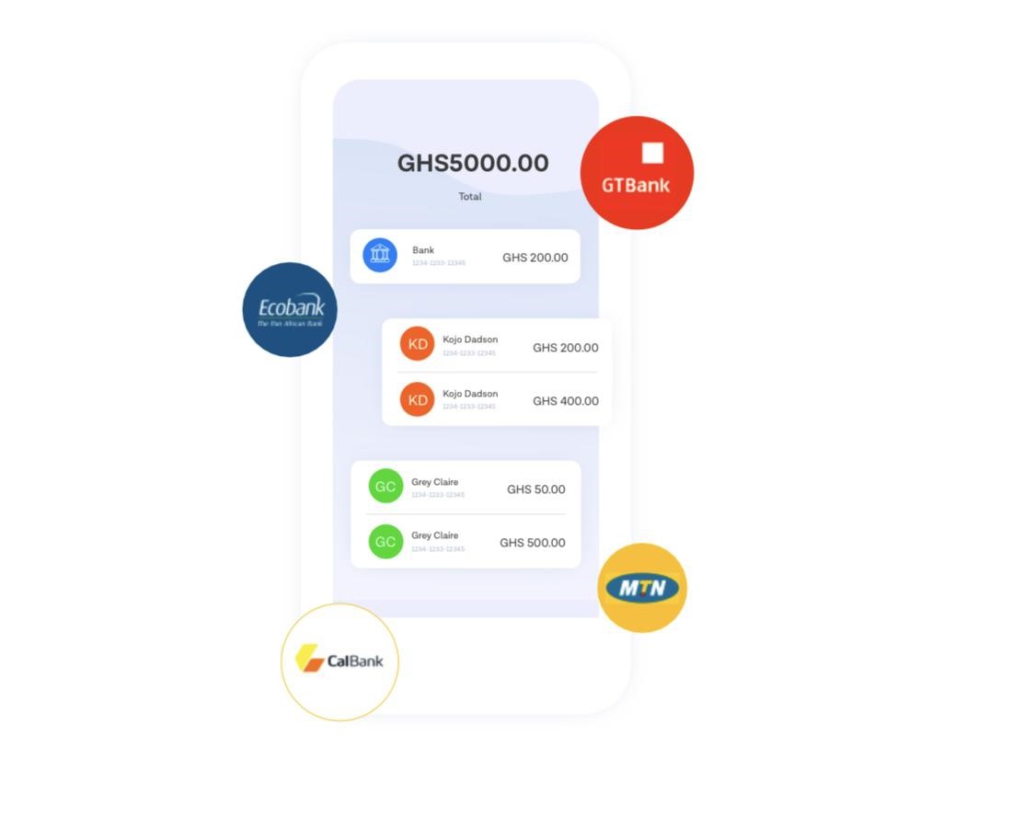

c. Financial Statement Request

Appruve Business allows you to get access to high-quality customer consented data

from financial accounts (bank and mobile money).

With Appruve’s financial data API we can help you achieve the following:

- Collect bank statements from your customers.

- Understand customer financial health, this can be leveraged for lending or investments.

- Verify guarantors information.

- Enrich data you have on your customers.

d. Address verification:

Appruve Business is connected to various addressing databases that allows you to verify the addresses associated with the business. We provide tools that allow you to probe into the location of the business.

e. Fraud Database Search

Appruve business is designed to source fraud intelligence from proprietary sources across African networks as well as global databases.

You simply search for an attribute associated with the business, such as a phone number, business name, bank or mobile money account, debit /credit card details, and we will return a full profile that matches or not.

f. Industry Risk Profiling

Leverage our proprietary machine-learning algorithm to identify exactly what your customers do, make, or sell. Easily map industry selections to popular standards for industry classification and generate a set of labels and prediction values that can be used to identify entities operating in high-risk industries.

Using an automated approach to verify businesses allows you to create more in-depth profiles. The data acquired would help your risk evaluation and vetting process, delivering a more thorough analysis and better protecting the business from risk and fraud.

With appropriate checks, your business can build the necessary trust to safely take on new partners, suppliers and third parties in Africa.

Appruve Business is currently available in Ghana, Nigeria, Uganda, Kenya, and South Africa. We are continuously working to grow our coverage. We have an array of products used in combination by our clients to deliver value. They include:

Appruve Financial

Appruve allows you to get access to high-quality customer consented data from financial accounts (bank and mobile money).

With Appruve’s financial data API we can help you achieve the following:

- Collect bank statements from your customers

- Understand customer financial health, this can be leveraged for lending or investments

- Simplify onboarding by connecting a financial account to your app

- Verify guarantors information

- Enrich data you have on your customers

Appruve Agency

Appruve Agency allows you to determine if your customer is submitting a genuine document in person (agent banking) or remotely (remote account opening).

- Document Analysis: Determine if the document being submitted by a customer is genuine or forged.

- Face Matching: Enable remote onboarding by requiring customers to prove ownership with their faces.

- Liveness Check: Appruve’s liveness check capabilities combine advanced fraud defence techniques including motion tracking, lip-sync and texture analysis to verify that the user is physically present.

- Address Verification: Appruve is connected to various addressing databases that allows you to verify addresses of both individuals and businesses.

- Bill format verification: Appruve agency makes it easier, by using machine learning to analyze the bill and presenting a confidence report.

About Appruve:

Being the first Sub Saharan African member of the Financial Data Exchange, also means we are compliant to global standards, such as openID Connect (OIDC), with the likes of Mastercard, Wells Fargo, Plaid and Bank of America.

Appruve is designed to be compliant with the General Data Protection Regulation (GDPR), SOC2 and most recent Financial Action Task Force (FATF) recommendations, allowing for an effective customer due diligence (CDD) process.

We ensure that compliance is also met across all countries we operate in, hence compliant with local central bank and data protection laws. We review regularly to meet the needs of the businesses and customers.

You can sign up at www.appruve.co to get free credits to begin testing or contact sales at sales@appruve.co

You may also join our community on slack appruve.slack.com

Latest Stories

-

‘We are chased every day’ – Cocobod boss paints bleak picture of mounting $33bn debt

3 hours -

Ken Ofori-Atta listed on INTERPOL Red Alert over “using public office for profit”

3 hours -

World Vision empowers health workers in Agortime Ziope with life-saving infection control training

3 hours -

Plan International Ghana launches She Leads Social Movement to sustain girls’ rights advocacy

3 hours -

Liverpool tell Barcelona Diaz is not for sale

3 hours -

Gov’t pledges action to empower girls, young women at She Leads Social Movement launch

3 hours -

Environmentalists push for waste-to-wealth innovations on World Environment Day

4 hours -

GRNMA strike: Sick pockets can’t take care of sick patients – Ashanti GRNMA

4 hours -

Traders appeal for designated spaces after Accra decongestion

4 hours -

F1’s return to Africa: will legacy, ambition, or diplomacy win the race?

4 hours -

Thomas Partey headlines fourth edition of All Star Festival

4 hours -

World Environment Day: GJESHA urges media, gov’t to step up fight against plastic pollution

4 hours -

Yamal scores twice as Spain beat France in nine-goal thriller to make Nations League final

4 hours -

Nestlé Supplier Day 2025: Fostering collaboration for sustainable growth

5 hours -

Don’t risk progress with new reforms – IERPP cautions BoG

5 hours