The preconception many local fans have about clubs in the Ghana Premier League (GPL) is that they don't make the needed investment to compete in all fronts.

The point could be true as sponsors have been a challenge for clubs and the league as a whole, making football fanatics focus on leagues in Europe.

To an average football fan in Ghana, watching Lionel Messi make one of his trademark runs in La Liga or the UEFA Champions League brings more gratification than watching a bunch of mostly unknown players in the local leagues.

Also, sponsorship has been a huge problem that has constantly affected the attractiveness of the GPL.

Some GPL clubs have spent more cash on facilities and players in an effort to dominate the local scene, making them attractive to young talents in the country.

However, what is the worth of some of the best GPL clubs? How do they match up to the best in Africa in some aspects?

Methodology

In the total valuation of the top ten GPL clubs, focus was placed on one key aspect which is sporting potential.

Sporting potential considers the capability of clubs to deliver on-field success which in turn can drive match day, commercial and broadcasting revenues.

The assumption here is that a more valuable squad has a better chance of delivering wins on the pitch.

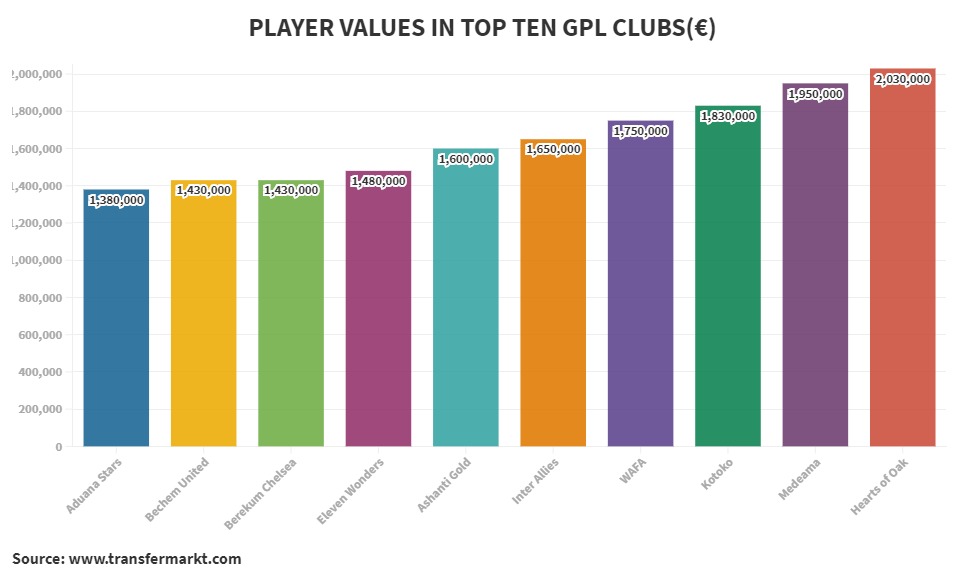

To capture this, we will take a look at the total player values of clubs among the top ten clubs in Ghana according to Transfermarkt.

Sporting potential

Using the graph above, it can be noticed that Hearts of Oak (€2.03 million) and Asante Kotoko (€1.83 million) are among the top three in the standings which is no surprise.

Hearts and Kotoko are undoubtedly, the two biggest clubs in Ghana following a remarkable number of GPL and other trophies won between them. As such, they are attractive to a number of good players in the league.

Mensa Donsu, a midfielder for Medeama SC, said it best.

“I don’t think any player will turn down an offer from Hearts or Kotoko. Kotoko and Hearts are Ghana’s two biggest clubs and any player will love to play for any of them in the future,” he told Ahomka FM.

Medeama have also been high on the metric, placing second with €1.95 million. The Mauve and Yellows places a particular focus on developing young local talents and shipping them off to European clubs. The latest on the move is Nana Kofi Babil who secured a one-year loan deal to Austrian side SCR Altach.

It is interesting to note that Aduana Stars, the home of Yahaya Mohammed, places bottom of the log in player value. The revelation signals the need for the Ogya boys to develop more talents or spend more money on quality.

The figures look all well and good but how does Ghana match up to the top clubs in Africa?.

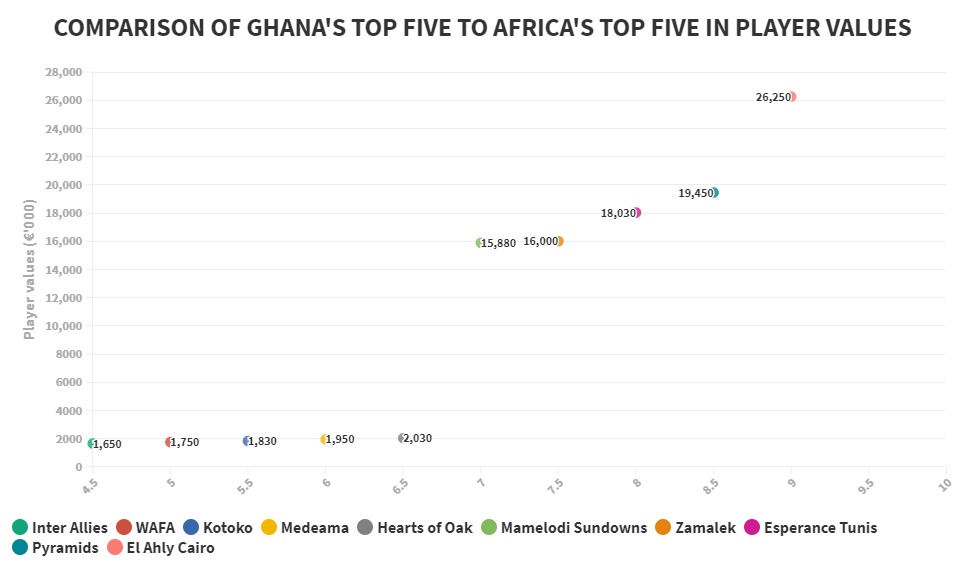

It can be seen from the plots that the gap is mind-boggling. The addition of the first five clubs in Ghana will not match up to that of Mamelodi Sundowns, one of the biggest clubs in the Premier Soccer League (PSL).

In fact, it will take an addition for all top ten GPL clubs (€16.53 million) to surpass Mamelodi Sundowns’ total player value (€15.88 million).

The same case can be made for Zamalek (€16.00 million) where we would need to combine player values of all top ten GPL clubs to surpass them.

It can be confidently concluded that Esperance and the two other African clubs above them have higher player values than that of GPL’s top ten clubs combined.

Another interesting point to note is, El Ahly, an Egyptian outfit (€26.25 million) is worth approximately 6.8 times more in player values than Hearts and Kotoko combined (€3.86 million).

The huge deficit in player values can be attributed to the perceived low quality of the league. Also, the exits of big talents to other clubs in Africa and Europe has not helped.

Alternative metric

This metric is harder to quantify in monetary terms but should be considered greatly by clubs in their quest to improve their value. It basis on popularity.

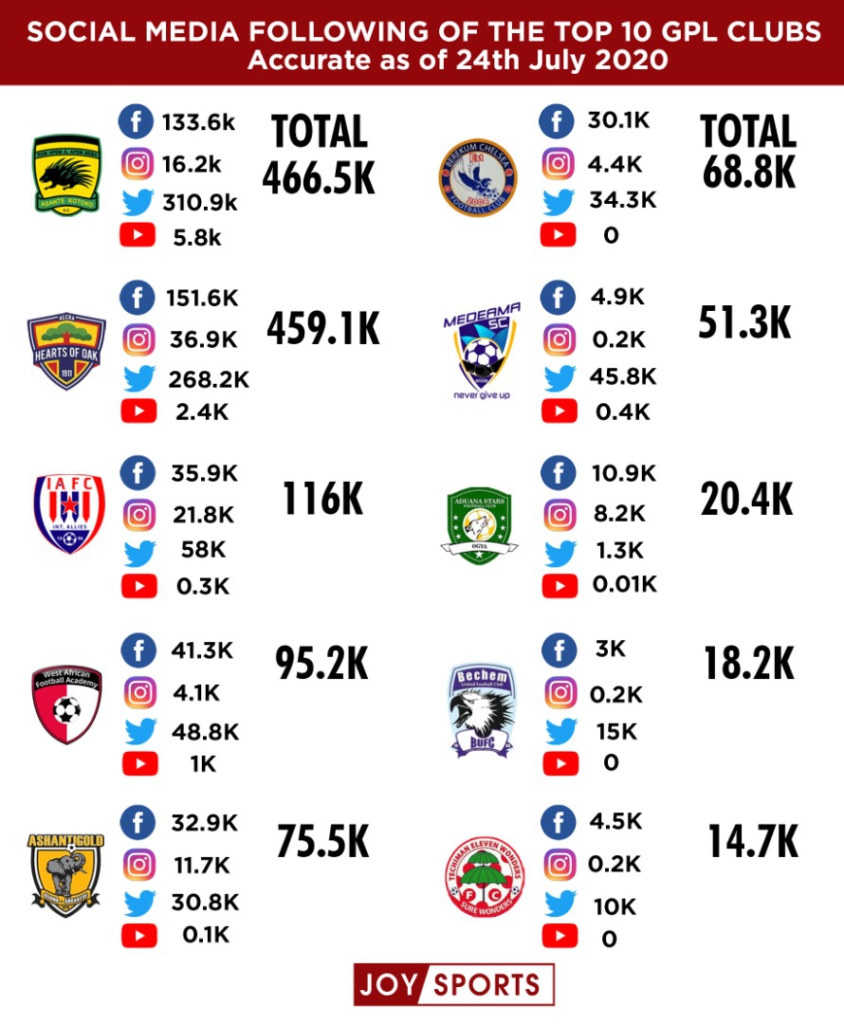

In this indicator, four social medial pillars were taken into account, namely: Facebook, Twitter, Instagram and YouTube.

In most cases, success on the pitch affects popularity on the social media front. The followers and subscribers of clubs in those pillars serve as an indicator of how popular teams are and their ability to attract sponsors from those outlets.

There are two key things to note. The numbers were rounded up since figures change by the minute. Also, Facebook followers were used for club pages instead of likes.

Hearts and Kotoko show their dominance on this metric, with over 400,000 followers and subscribers each. Kotoko, who have amassed about 466.5k followers, edges Hearts of Oak slightly. The Phobians have 459.1k in social media numbers.

To put things into perspective, the top two clubs have at least 300,000 more in social media numbers than third-placed Inter Allies (116k).

In addition to the earlier point, one would have to add the figures of the other eight (460.1k in total) to surpass Hearts of Oak (459.1k).

In the case of Asante Kotoko (466.5k), they have a higher social media total than that of the bottom eight added together.

Eleven Wonders, perhaps, need the most work here with their followers and subscribers totaling just below 15000, approximately 31 times less than Hearts of Oak. They are approximately 32 times less in social media numbers than Kotoko.

It goes to show that the rest of the teams do not put huge emphasis on social media, a medium gradually becoming a source of income for athletes and clubs.

How do these figures compare to the social media kings in Africa?

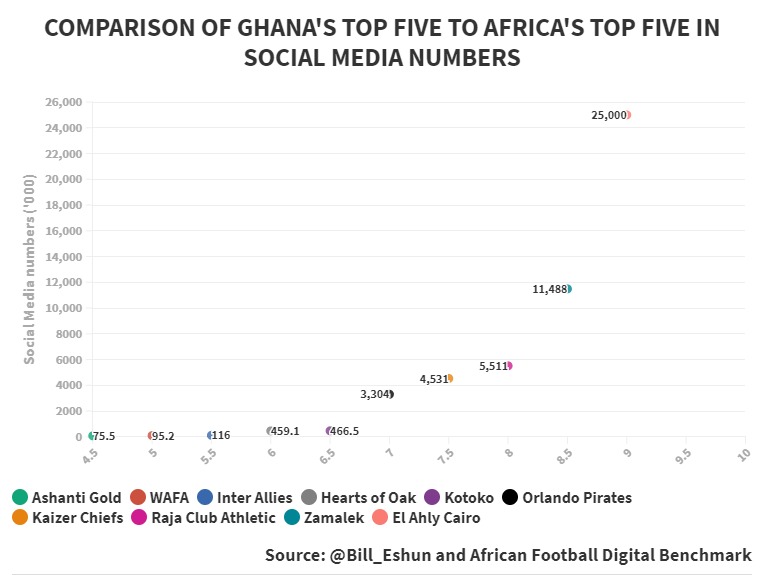

There are also a few things to note here. The figures of the top five in Africa were picked from an analysis done by African Football Digital Benchmark done earlier in 2020. Also, the numbers were rounded up.

The gap here is staggering. It can be easily concluded that Orlando Pirates (3.3 million) have higher numbers in social media than all top ten GPL clubs combined (1.39 million).

In a more shocking development, El Ahly Cairo (25 million) has approximately 27 times more social media numbers than Hearts of Oak and Kotoko combined (925.6k).

Ghana are well behind on the social media subject and need to catch up.

Limitations

Revenues were not included in the valuation process. Revenues are most important part of identifying the value of a club. It can be divided into three main aspects; Match day, commercial and broadcasting revenues.

The total value of revenues are readily available for clubs in Europe because they publish those figures on a yearly basis in their financial statements (Income Statement specifically). In Ghana, however, those revenues have not been published and had to be excluded from the valuation process.

In the social media aspect, a deeper look into fan engagement (retweets, likes, comments, shares and views) would have given a better scope to deduce a value. The task of gathering these figures for an extended period of time proved impossible hence the avoidance of its valuation in monetary terms.

In addition, there is the possibility that clubs may have a lot more fans which are not tech savvy or have just decided against following them on social media. The numbers attributable to them are hard to find and in some ways, it accounts for the low numbers on the social media front.

The way forward

Investment is important to the success of any club and with the right amount of it (monetary or effort), success can be achieved on the pitch to boost revenue for further investment.

It can be perceived to be a cycle. Investment requires funding, funding helps clubs acquire better facilities or players to boost their chances of getting results on the pitch. Good results bring popularity which in turn opens doors for more revenue to be spent to improve the team further.

It is clear that some Ghanaian clubs are making investments but it is not enough if they hope to earn the spot as one of the best in the continent.

It can also be argued that the league itself does not have sponsors to help clubs thrive. The Ghana Football Association has to do its part to help but the clubs can control some factors on their own.

On the aspect of player development, clubs must put more effort into scouting hidden gems and training them well. As they develop, they would need to be paid well to stay and clubs should respond. Some players, admittedly, will be sold to help the club get money and it cannot be avoided.

Facilities must also be improved to help produce better players who could walk into any other team in Africa.

On social media, clubs must be more aggressive and provide good content. The quality of the content can make or break any entity in terms of following and subscribers.

It will certainly be a long process with a few ups and downs but if done right, Ghana can rub shoulders with other great clubs in Africa.

For more updates on sporting news, follow #JoySports on Twitter (@joysportsgh) and Instagram (@JoySportsGH)

Latest Stories

-

6 dead in Adansi Dompoase crash involving VIP bus and sprinter

17 minutes -

Saturday’s heavy rainstorm caused outages within our network – ECG

1 hour -

Police arrest 3 over gold robbery at Wassa Afransie

2 hours -

Against all odds: Zinabu Issah clinches silver for Ghana at WPA Marrakech 2025

3 hours -

ASFC 2025: Ghana girls complete host-and-win mission after beating Uganda

3 hours -

NPC President congratulates new GOC Executives

3 hours -

Stonebwoy displays maturity amid Aisha Modi’s attacks: a masterclass in brand integrity and respect

3 hours -

Afro-Arab Group CEO commends Kwahu Business Forum

3 hours -

CAF President Motsepe vows action against rising stadium violence

3 hours -

You’ll be prioritised for jobs in next NPP government – Bawumia to dismissed workers

4 hours -

Lola Hair and Beauty College officially launched to promote TVET

4 hours -

Minority condemns sacking of TTH CEO, demands Mahama reprimand Health Minister

4 hours -

Extraordinary photos from the funeral of Pope Francis

5 hours -

Pope Francis laid to rest after Vatican funeral service

5 hours -

Our polling station executives and grassroots are our greatest assets, I thank them – Bawumia

5 hours