Government has defrayed approximately 2.5 billion cedis of its GH₵5 billion debts owed to the Social Security and National Insurance Trust (SSNIT) in the form of bonds.

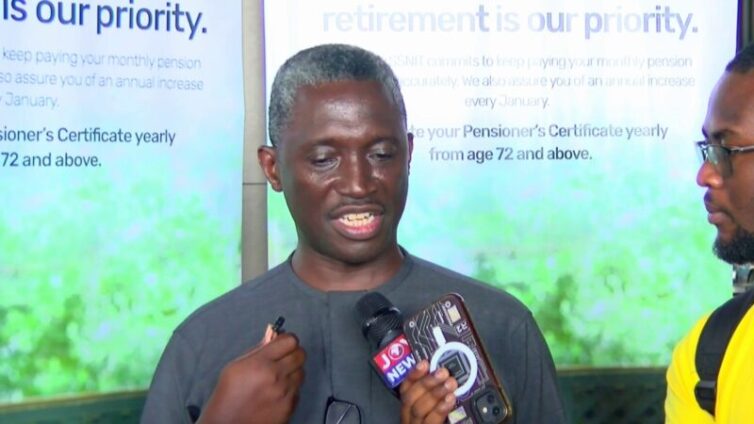

This was revealed by the Director-General of the Trust, Kofi Osafo-Maafo who says the payment followed a series of negotiations with government in a bid to thrust the scheme into a strong financial position.

Independent actuarial valuation of SSNIT’s viability suggested that delays by the government in settling its debts contributed to a decrease in investments.

As of December 31, 2021, SSNIT's records showed a total debt of GH₵9.3 billion, with a substantial GH₵6.9 billion owed by government.

The staggering figure represents about 75% of SSNIT's overall indebtedness, including overdue contributions and accrued interest charges.

The significant debt owed by the government places Ghana's pension fund in a delicate position, resulting in an annual decrease of 1.3% in SSNIT's investment returns.

But speaking at a stakeholder meeting with pensioners in Kumasi, Director-General of SSNIT said the government has defrayed about 2.5 billion of the debts.

“The government owes SSNIT and this is not a new thing. It’s probably span way over 10 years. Overtime and continuously we need to engage government and negotiate with them. And what we have had recently is that we’ve made some successes with that. The government most recently defrayed approximately 2.5 million cedis of the arrears in the form of bonds,” he said.

The trust is on a positive trajectory after making a net surplus of GH¢864million in 2023 from an initial deficit in 2021.

Mr. Osafo-Maafo explains the Trust anticipates similar results by the end of year, influenced by improvements in contributions collection, investment income and cost control.

“We are striving very hard to improve the net contributions, we are working hard to improve the net investment income and as well managing the business better,” he said.

Chief Actuary, Joseph Poku says the trust is working to ensure more contributions are generated to run the scheme in perpetuity.

“We are doing everything that we are suppose to do to ensure that we bring in new funds, have excess funds after paying the benefits put them in investments and make sure we manage those investments prudently to get more returns and add to the funds that are coming in,” he said.

Ashanti regional chair of the Pensioners’ Association, Adarkwa Tuffour emphasized on strengthening, safeguarding and improving it.

“SSNIT has been and continue to be the lifeline of thousands of Ghanaians, therefore we must safeguard, strengthen and improve the scheme. We must recognize and appreciate its value,” he said.

Latest Stories

-

Rafatu Inusah elected onto GOC Board

2 hours -

SAMSON’S TAKE: AG okays demo, how refreshing?

2 hours -

Trump questions Putin’s desire for peace after meeting Zelensky at the Vatican

3 hours -

Legend of The Week – George Darko

4 hours -

Kounde strike wins Copa del Rey final for Barcelona

9 hours -

Is NPP crying more than the bereaved in the Chief Justice saga?

10 hours -

“Elements within NPP worked against me for supporting ‘Ken must go'” – Cynthia Morrison

11 hours -

IMF Boss commends finance minister for strong commitment to economic reform

11 hours -

Cynthia Morrison advises Ghanaian women to diversify their skills to build wealth

11 hours -

UK deports 43 immigration offenders to Ghana and Nigeria

12 hours -

Piwak Natural Health urges Akosombo victims to rebuild with new donation

12 hours -

Ghana’s Para athlete Gilbert Ampiah wins bronze at Marrakech Grand Prix 2025

12 hours -

6 dead in Adansi Dompoase crash involving VIP bus and sprinter

12 hours -

Saturday’s heavy rainstorm caused outages within our network – ECG

13 hours -

Police arrest 3 over gold robbery at Wassa Afransie

14 hours