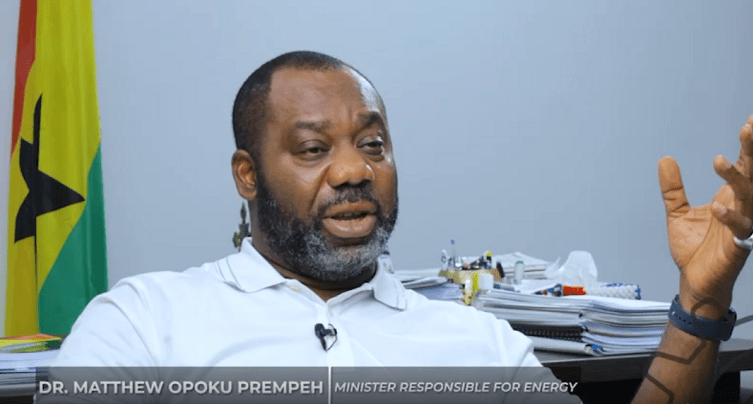

Dr. Matthew Opoku Prempeh, Energy Minister

The government has announced plans to introduce an automatic adjustment formula for the rates of the Special Petroleum Tax, Energy Sector Levies, and Excise Duty.

This is in a bid to streamline and enhance the efficiency of its tax system.

These significant changes are outlined in the Medium Term Revenue Strategy for the years 2024-2027.

The proposed automatic adjustment formula aims to create a more dynamic and responsive tax structure, ensuring that these key indirect taxes keep pace with economic changes and fluctuations.

This would help maintain government revenue while reducing the need for frequent manual adjustments.

Additionally, the government intends to address several other important indirect tax issues as part of its strategy:

- Alignment of Exemption Provisions: The government plans to align exemption provisions in the Value Added Tax (VAT) Act and the Customs Act. This alignment seeks to simplify and harmonise tax regulations, reducing confusion and improving compliance.

- Hybrid Tax System for Excisable Products: Consideration is being given to implementing a hybrid system of taxes for excisable products. This system would incorporate both ad valorem (percentage-based) and specific (fixed amount) rates, allowing for a more balanced approach to taxing such goods.

- Review of VAT Exemptions: The government is committed to reviewing VAT exemptions to make them more efficient and less distortionary. This review is aimed at ensuring that exemptions serve their intended purpose without creating unintended consequences in the market.

- VAT and Levies to Support Industry: To bolster the industrial sector, there are plans to review VAT and impose levies in a manner that is more supportive of industry growth and development. This strategic approach aims to stimulate economic activity and create a conducive environment for businesses.

- Shift Towards Consumption-Based Taxes: In a fundamental shift, the government aims to reduce its reliance on wage-based taxes and instead focus on consumption-based taxes. This shift aligns with global trends and is expected to promote savings while ensuring that the tax burden is distributed more equitably.

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Tags:

DISCLAIMER: The Views, Comments, Opinions, Contributions and Statements made by Readers and Contributors on this platform do not necessarily represent the views or policy of Multimedia Group Limited.

Latest Stories

-

Gold Board initiative yields $3 billion economic boost in 4 months – Kwakye Ofosu reveals

2 hours -

Kwakye Ofosu reveals money saved from paid TV ban at Jubilee House

3 hours -

14 Years of production: Ghanaians see oil as neither blessing nor curse — Research

3 hours -

Judge orders Columbia student Mahmoud Khalil released on bail

4 hours -

Dr. Peter Terkper declares GNAFF Presidency bid with bold vision

4 hours -

Teenage pregnancy declines in Akatsi North as leaders call for sustained action

5 hours -

NIB, NACOC destroy $350m worth of cocaine following court order

6 hours -

Keta-Akatsi Catholic Diocese honours health workers at 33rd World Day of the Sick

6 hours -

Suspect arrested for burglary and theft at Kasoa Nyayano

6 hours -

US resumes visas for foreign students but demands access to social media accounts

6 hours -

Indian High Commission collaborates with VRCC and UHAS to champion physical, mental wellness in Volta Region

6 hours -

This Saturday on Newsfile: Galamsey fury, NPP early primaries and effects of Israel-Iran war

7 hours -

African Heads of States, Caribbean and Global Business Leaders to gather in Abuja Nigeria for 32nd Afreximbank annual meetings

8 hours -

GES, Brilliant Educational Consult train teachers in Kumasi to boost their competencies

8 hours -

DIPPER Lab launches IoT Training Programme to equip students with practical tech skills

8 hours