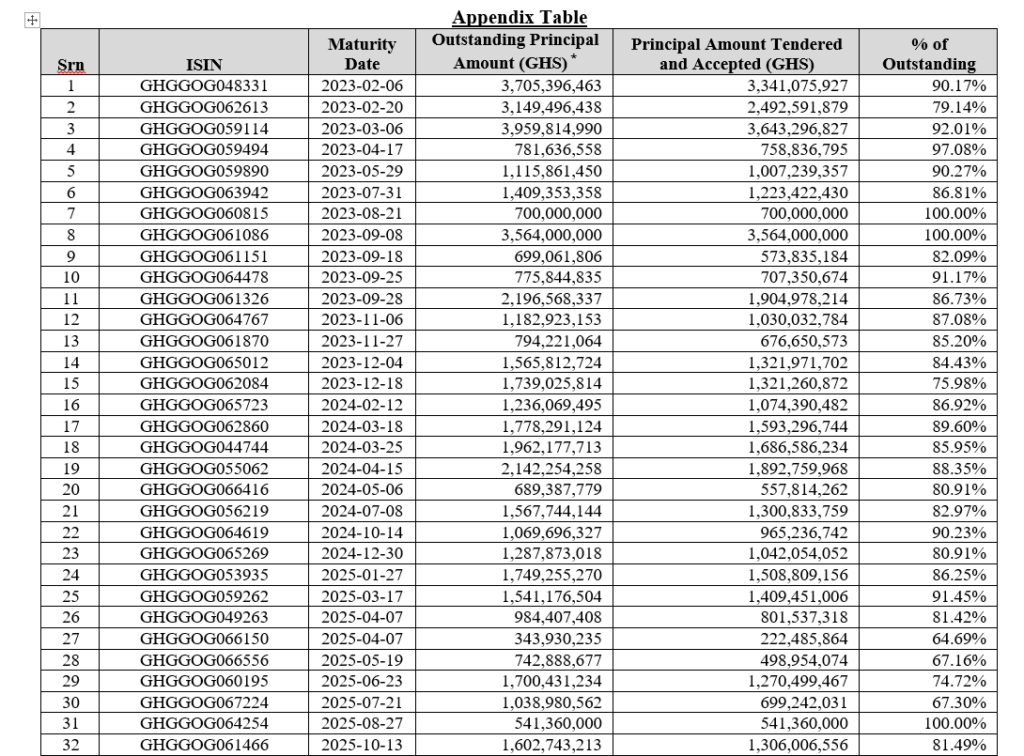

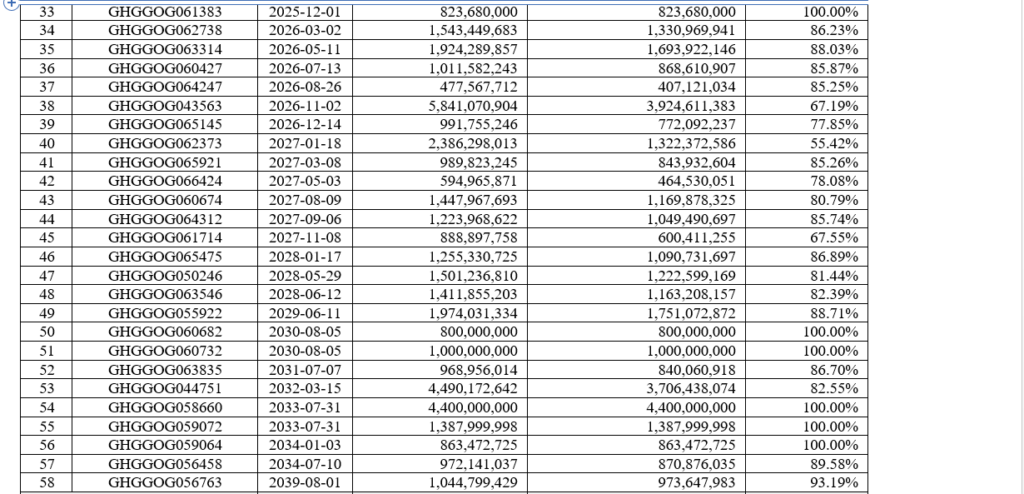

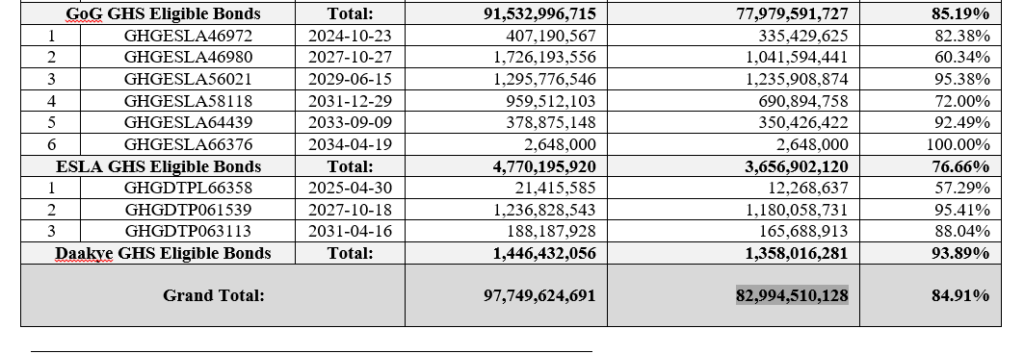

The Ministry of Finance has announced that approximately 85% of bondholders participated in the Domestic Debt Exchange Programme (DDEP).

This amounted to ¢82,994,510,128 (¢82.99 billion)

“The Government is pleased with the results, as a substantial majority of the Eligible Holders have tendered,” a statement from the ministry said.

It added that the result is a significant achievement for the government to implement fully the economic strategies in the post-COVID-19 Programme for Economic Growth (PC-PEG) during the current economic crisis.

To provide sufficient time to settle the New Bonds in an efficient manner, the statement explained that government is extending the Settlement Date of the Exchange from the previously announced February 14, 2023 to February 21, 2023.

“This Settlement Date extension is, however, only to process the settlement of the New Bonds. The issue date, interest accrual schedules and payment schedules for the New Bonds will be adjusted to reflect the actual Settlement Date”.

It added that as the exchange period has expired, no new tenders will be accepted, and no revocations or withdrawals will be permitted.

In addition, the Finance Ministry said since it has received expressions of interest from other stakeholders to participate in a similar exchange, the government is modifying the six-month “clear market” provision of the New Bonds as set forth in the Exchange Memorandum to clarify that such clear market provision will not limit the government from issuing Domestic Public Indebtedness in connection with liability management exercises involving exchanges or similar exercises that do not involve the issuance of Domestic Public Indebtedness for cash consideration.

“Except as set forth in this paragraph and the one before, the terms and conditions of the Exchange are not modified or amended”.

The statement pointed out that the "outstanding principal amounts presented in this press release differ from the Outstanding Principal Amounts in the Exchange Memorandum and have been adjusted to deduct: (a) amounts of Eligible Bonds held by persons that are not Eligible Holders and that were not eligible to participate in the Exchange; and (b) amounts held by persons that following the announcement of the Exchange converted their Eligible Bonds to treasury bills".

Latest Stories

-

ASFC 2025: ‘I look up to Neymar’ – Ghanaian youngster John Andor

29 minutes -

The dilemma of Mohammed Kudus: Prestige in Europe or big money in Saudi Arabia?

1 hour -

ASFC 2025: ‘We didn’t come to play’ – Ghana coach cautions South Africa ahead of semis clash

1 hour -

ASFC 2025: Ghana boys face last year champions Tanzania in semifinals

1 hour -

ASFC 2025: Ghana girls set up semis clash with defending champions South Africa

2 hours -

China tells Trump: If you want trade talks, cancel tariffs

3 hours -

Gwyneth Paltrow eating bread and pasta after ‘hardcore’ food regime

3 hours -

Strong Institutions, not Strong Men: UPSA forum urges tech-driven reforms to curb tax revenue leakages

3 hours -

Police fatally shoot man at Toronto’s international airport

3 hours -

Health of Brazil’s ex-president Bolsonaro has worsened, doctors say

3 hours -

Ghana is not broke, it is bleeding- UPSA’s Prof. Boadi calls for bold action on tax leakages

3 hours -

Harry and Meghan call for stronger social media protections for children

3 hours -

Rotaract District 9104 concludes inspiring District Learning Assembly & Conference 2025 in Takoradi

4 hours -

New GSS boss Dr Alhassan Iddrisu pledges accurate, timely data for national development

4 hours -

King Mohammed VI launches Kenitra-Marrakech High-Speed Rail Line

4 hours