Ghana has received proposals from two bondholder groups on the country’s commercial debt (Eurobonds), Mr Ken Ofori-Atta, Finance Minister, announced on Wednesday, November 15.

This, he said, has increased the country’s confidence in reaching a Memorandum of Understanding (MoU) with external creditors, to get a second tranche of US$600 million from the International Monetary Fund (IMF).

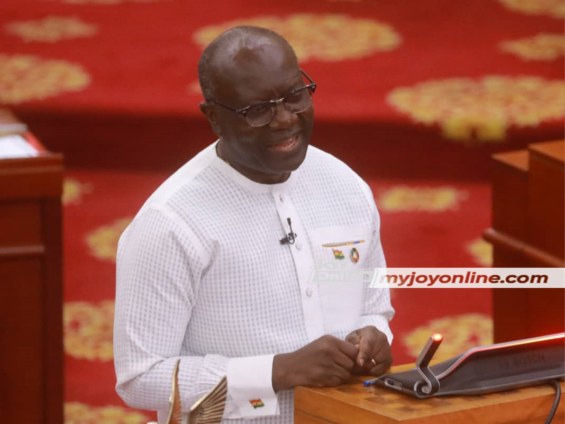

Mr Ofori-Atta said this when he presented the 2024 budget to Parliament on Wednesday, November 15.

He said the Government was reviewing those proposals, with the expectation of converging towards a solution in compliance with the comparability of treatment principle.

“It is envisaged that, in the coming weeks, extensive negotiations with both groups will commence and ensure that we achieve the targets set under the IMF/World Bank Debt Sustainability Framework. We are hopeful of a year-end resolution,” he said.

“An agreement in principle on the restructuring parameters is expected to be reached in the coming week. This will be formalised in an MOU between the Government and the Official Creditor Committee (OCC),” he noted.

This development is in respect of the country’s defined parameters for a haircut between 20 and 40 per cent, a maximum five per cent interest rate and maturity not to exceed 20 years.

The completion of the external debt restructuring, the Minister said would further improve the country’s debt trajectory, enabling Ghana to reach its target of 55 per cent debt to Gross Domestic Product (GDP) by 2028.

“Total public debt has declined from 73.1 per cent of GDP at the end of 2022 to 66.4 per cent of GDP as of September 2023. The completion of external debt restructuring is expected to further improve Ghana’s debt situation,” he said.

A Staff Level Agreement (SLA) by the IMF Mission indicated that Ghana had met all six of the Quantitative Performance Criteria (QPCs), two out of the three Indicative Targets, and six of the seven Structural Benchmarks in September 2023.

The targets include a floor on net international reserves, a ceiling on primary balance on a commitment basis, a ceiling on contracting non-concessional loans/guarantees, zero collateralized borrowings, and no accumulation of external debt service arrears.

The two indicative targets met were a floor on social spending and a floor on non-oil public revenue, and zero net accumulation of payables extension, largely due to the ongoing negotiations with Energy Sector Independent Power Producers (IPP) on legacy debt.

The six structural benchmarks met included the preparation and publication of an arrears clearance and prevention strategy, the preparation and publication of a financial sector strengthening strategy, and the preparation and publication of a strategy for the review of earmarked (statutory) funds.

The others were, the preparation and publication of a medium-term revenue strategy, a strategy for indexation of Livelihood Empowerment Against Poverty (LEAP) benefits and BoG approval of capital-building buffer plans for banks.

The unmet structural benchmark was SB on the preparation and publication of an updated Energy Sector Recovery Plan, expected to have been completed at the end of June 2023.

Ghana requested a debt treatment under the G20 Common Framework for Debt Service Suspension Initiative (CF-DSSI) on December 13, 2022.

Bilateral creditors established the Official Creditor Committee (OCC) on May 12, 2023, under the auspices of the Paris Club to restructure the bilateral debt.

“Action is needed from the creditors’ side; Ghana has done its fair share, and it’s for creditors to take the next steps, and we’re not going to ask the Government to do more adjustment because creditors haven’t asked either,” says Mr Abebe Aemro Selassie, Director, African Department, IMF.

Latest Stories

-

Local Government Minister proposes sanitation levy to address Ghana’s waste management crisis

2 hours -

Central University Vice Chancellor calls for Fee Voucher System to support private universities

2 hours -

Heritage Month Cooking Competition showcases Ghana’s culinary richness

3 hours -

His finest hour yet: The Bawumia concession and lessons in leadership

5 hours -

EC reschedules nomination for Nkoranza North and South District Level Elections

5 hours -

Energy Minister must recover stolen ECG containers or be held accountable – Ntim Fordjour

5 hours -

CLOGSAG suspends strike over Births and Deaths Registry appointment

6 hours -

Ing. Ludwig Annang Hesse is new president of GhIE

6 hours -

One artiste can’t take Ghana to the top, we must collaborate – Edem

6 hours -

Presidency hasn’t ordered NIB to investigate Akufo-Addo’s travels – Felix Kwakye Ofosu

6 hours -

Edem explains how 2023 motor accident made him lose gigs

6 hours -

Smoke detectors and modern technology: A game-changer in Ghana’s fight against market and home fires?

6 hours -

Provisional results for 2025 WASSCE First Series released

6 hours -

M&O Law Consult’s Emmanuel Mate-Kole awarded for ‘Excellence in Strategic Law Firm Leadership Management’

6 hours -

50 female entrepreneurs graduate from Access Bank Ghana’s Womenpreneur Pitch-A-Ton

6 hours