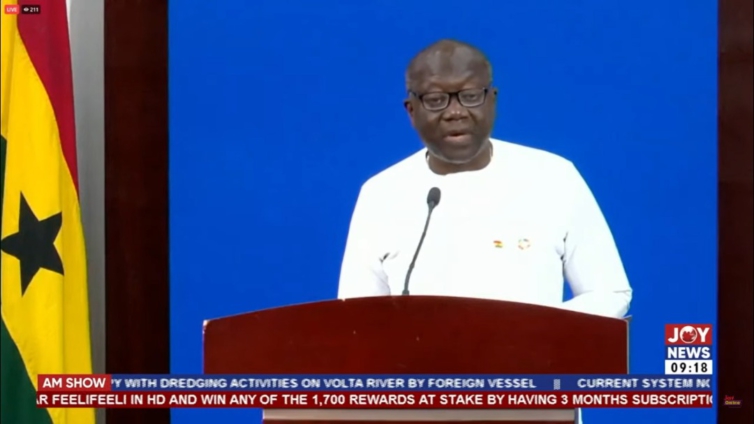

The government has invited eligible bondholders to exchange approximately ¢137.3 billion of its domestic notes and bonds, E.S.L.A. Plc and Daakye Trust Plc for a package of New Bonds.

This is part of the Debt Exchange Programme.

The terms and conditions of the invitation are described in the exchange memorandum.

A statement from the Finance Ministry said the invitation is available only to registered holders of Eligible Bonds that are not Individual Investors or that are otherwise authorized by the Government of Ghana, in its sole discretion, to participate in the Invitation.

Eligible Holders tendering their Eligible Bonds pursuant to the Invitation will also receive New Bonds of the Republic (Ghana) on the terms and subject to the conditions described in the Exchange Memorandum.

The statement further added that all offers to exchange Eligible Bonds made by Eligible Holders are irrevocable subject to withdrawal rights under certain limited circumstances. By tendering their Eligible Bonds, Eligible Holders represent and warrant that such Eligible Bonds constitute all the Eligible Bonds owned by them and consent to the blocking by the Central Securities Depository (CSD) of any attempt to transfer them prior to the Settlement Date or the termination of the invitation by the Republic.

Interest on the New Bonds will not accrue until 2024, starting at 0% coupon in 2023 which steps up to 5% in 2024, and 10% from 2025 onwards. The first interest payment on the New Bonds will however be made in 2024.

Offers may only be submitted starting today December 5, 2022, and end at 4:00 p.m. on December 19, 2022 (the “Expiration Date”).

However, Ghana may at its sole discretion extend the Expiration Date including for one or more series of Eligible Bonds.

Eligible Holders who deliver valid offers at or prior to the Expiration Date that are accepted by the Republic will receive at the Settlement Date in exchange for their Eligible Bonds accepted by the Republic, the same aggregate principal amount distributed across new bonds due in 2027 (the “New 2027 Bond”), 2029 (the “New 2029 Bond”), 2032 (the “New 2032 Bond”), and 2037 (the “New 2037 Bond,” and collectively the “New Bonds”).

All calculations by the government will be final and binding on Eligible Holders save in the event of manifest error.

Latest Stories

-

Asiedu Nketia says EC with Jean Mensa at helm ‘Must be reset’

3 hours -

‘The entire EC leadership must go; they are not fit for purpose’ – Asiedu Nketia

3 hours -

Banks record GH¢4.3bn profit in April 2025

4 hours -

Banks shareholders’ funds grew by 42.6% to GH¢43.9bn in April 2025

4 hours -

Banks NPL declined to 23.6%, but total NPL stood at GH¢21.7bn in April 2025 – BoG

4 hours -

‘This EC is not fit for purpose’ – Asiedu Nketia demands EC overhaul

4 hours -

Government must build a second CBM to enable vessels discharge quickly, eliminate Leycan bureaucracy – COMAC Chairman

4 hours -

At least eight killed and hundreds hurt as Kenya protesters battle police

5 hours -

Ghana lacks capacity for 6-month strategic fuel reserves – COMAC Chairman

5 hours -

Small-scale miners urge fairness in commendable anti-galamsey fight

6 hours -

Murray wants to shield kids from ‘damaging’ social media

6 hours -

KNUST hosts workshop to tackle gender-based violence and sexual harassment on campus

6 hours -

Gov’t reinstates September 21 as Founders’ Day, declares July 1 as public holiday

6 hours -

Gov’t to recruit 50k teachers, 10k non-teaching staff in 2025 – Minister

7 hours -

KATH inaugurates Africa’s first National Cleft Centre to combat cleft stigmatization

7 hours