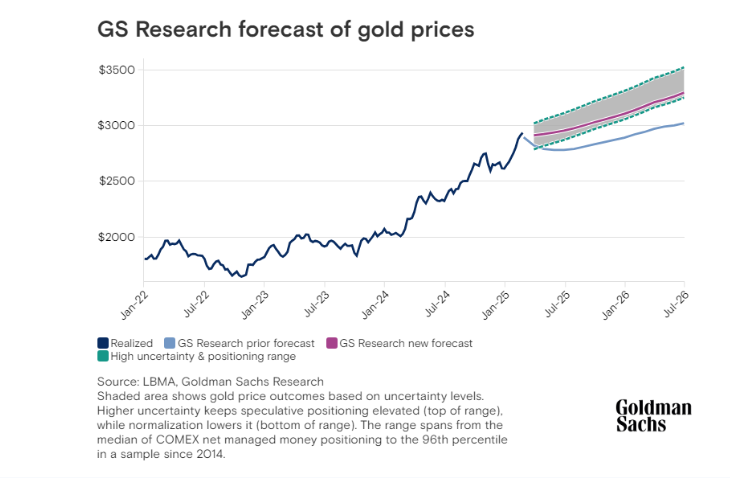

Leading global investment bank Goldman Sachs forecasts that gold prices will climb to $3,100 per ounce by the end of 2025.

This will come as a good omen for Ghana as the State will rope in more export revenue.

The increased forecast is underpinned by a higher-than-expected demand for gold from central banks.

Its previous projection was for gold to rise to $2,890. Presently, the precious metal is going for $2857.83.

The price of gold has surged more than 40% since the start of 2024, repeatedly shattering records

Goldman Sachs said central banks have been increasing their reserves of the commodity since the freezing of Russian central bank assets in 2022. This follows Russia's invasion of Ukraine.

Before then, the average monthly institutional demand on the London over-the-counter gold market stood at 17 tonnes. In December last year, that figure hit 108 tonnes.

In addition to the higher central bank demand, Goldman Sachs Research anticipates an extra boost to the gold price coming from increased purchases of gold ETFs as declining interest rates make gold a more attractive investment.

“Those factors may be somewhat offset by speculators reducing their net long positions on gold in futures markets, which is projected by Goldman Sachs Research to weigh on the gold price somewhat. Speculators' net long positions are high because of the demand for gold as a safe haven asset — a phenomenon that could be short-lived if markets become more confident about the economic and political environment”, analyst Lina Thomas said.

“That said, “if policy uncertainty — including tariff fears — stays high, higher speculative positioning for longer could push gold prices as high as $3,300 per troy ounce by year-end,” Lina Thomas added.

Latest Stories

-

We’re happy the NPP is resetting to support Mahama in rebuilding Ghana – NDC

46 minutes -

Don’t alienate Kufuor, Akufo-Addo from party, you need them to build strong opposition – NDC tells NPP

48 minutes -

The Rise and Fall of Bedroom Commandos: A National Tragedy in Three Rounds

49 minutes -

Data must be treated as “core infrastructure” to achieve SDG 8 – Government Statistician

1 hour -

Rugby Africa Cup: Final set for Men’s Rugby World Cup spot as Senegal & Algeria seal wins

1 hour -

Trump sues Murdoch and Wall Street Journal for $10bn over Epstein article

2 hours -

The entire National Cathedral project is a crime scene – Dr. Arthur Kennedy

2 hours -

Follow Jesus, Follow the Apostles – Bishop Suku Chea charges newly ordained ministers

3 hours -

Bawumia accorded thunderous welcome at NPP conference

3 hours -

Clergymen who soiled their hands in National Cathedral scandal will never be forgiven – Kofi Bentil

3 hours -

National Cathedral: Prosecute those who spent the money – Kofi Bentil

3 hours -

Global HR Icons headline Global Conference on Human Resources in Africa (GCHRA 2025)

3 hours -

Stop the charade, go ahead and prosecute all who misused our money on National Cathedral project – Kofi Bentil

3 hours -

Pick the leader first, let him choose his team – Kofi Bentil to NPP

3 hours -

NPP didn’t sideline Kufuor – Joe Wise

3 hours