Ghana’s sovereign bonds were already trading distressed prior to Russia’s invasion of Ukraine, the Africa Development Bank’s 2023 Africa’s Macroeconomic Performance and Outlook has revealed.

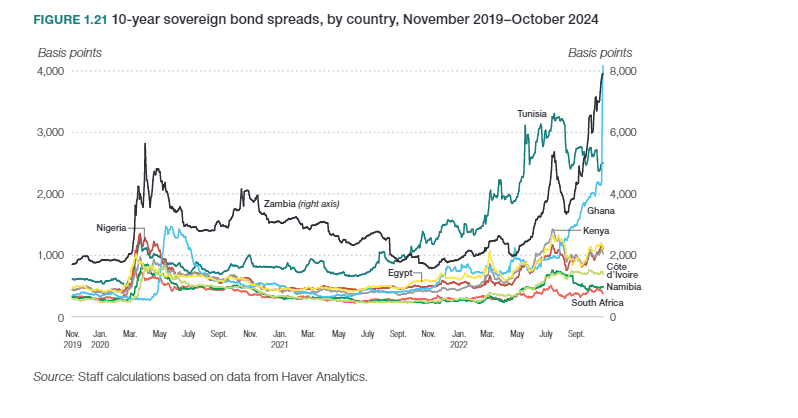

This it said was due to fiscal concerns and widening spread which has expanded further by more than 1,500 basis points since August 2022.

The report said the debt vulnerabilities are likely to linger as countries such as Ghana continue to grapple with the economic shocks from the COVID-19 pandemic and Russia’s invasion of Ukraine.

At the end of September 2022, 23 African countries were either in debt distress (8 countries) or at high risk of debt distress (15 countries), up from 20 in 2020’ it added.

“Debt vulnerabilities in many of Africa’s debt-distressed economies preceded the pandemic. Strikingly, these vulnerabilities have increased over time and since 2020 have been exacerbated by pandemic-related effects. These vulnerabilities have increased since 2016, with more countries progressively sliding into debt distress or high risk of debt”.

Furthermore, the report pointed out that since January 2022, all 23 countries that were either in debt distress or at high risk of debt distress recorded an increase in sovereign spreads of more than 700 basis points.

The announcement of interest rate hikes by the US Federal reserve in July 2022 led to sharper increases of more than1,000 basis points in some countries, highlighting increased debt vulnerability.

Persistently tight global financial conditions pose the threat of more countries sliding into debt distress or high risk of debt distress.

Ghana's public debt hit ¢467.4bn in September 2022

Ghana’s public debt hit ¢467.4 billion at the end of September 2022.

This pushed the country’s debt to unsustainable levels.

Prior to that the country had announced in July 2022 that it was seeking an International Monetary Fund-support programme to help stabilise the economy.

Latest Stories

-

A/R: 15 arrested for illegal mining in major police crackdown

52 seconds -

Republic Bank Ghana to double GH₵3bn loan advances with ‘Republic Verse’ initiative

15 minutes -

NDC’s push to remove Chief Justice threatens democracy – Miracles Aboagye warns

20 minutes -

OSP appeals acquittal of Juaben MCE nominee in alleged bribe case

36 minutes -

Empowering Africa’s Digital Future: How Artificial Intelligence is driving sustainable network infrastructure

1 hour -

Republic Bank Ghana PLC records GH₵210.67m profit in 2024

1 hour -

Influence of market queens creating food shortages and causing high food prices – Dr. Ofosu-Dorte

1 hour -

Surging travel in Europe spikes concerns over tourism’s drawbacks

1 hour -

Federal Government hands over houses to 1994 Super Eagles heroes after 31 years

1 hour -

Air India crash attributed to pilot seat malfunction

2 hours -

GCAA and South Korea sign letter of intent to advance Ghana’s drone sector

2 hours -

Republic Bank Ghana promises improved lending to customers, prospective home owners

2 hours -

Ghana ranks among top 6 African economies in Intra-African trade – Afreximbank Report

2 hours -

Allied Health Professions Council warns against unlicensed practice

2 hours -

Energy Minister engages petroleum sector stakeholders on laycan concerns

2 hours