The Minister of Finance-designate of Ghana’s new government was very supportive of the positions of Civil Society Organisations (CSO) in some of our advocacy campaigns when he led the parliamentary opposition.

On the issue of SML, one of the most wasteful decisions taken by the previous government, for instance, CSOs and the parliamentary opposition literally sang from the same hymn sheet.

And some of us, especially those on the activist front, backed many of his positions to the hilt, in reverse fashion.

Now that he is in government, the spotlight is on him. He has just endured hours of grilling by the parliamentary vetting committee today.

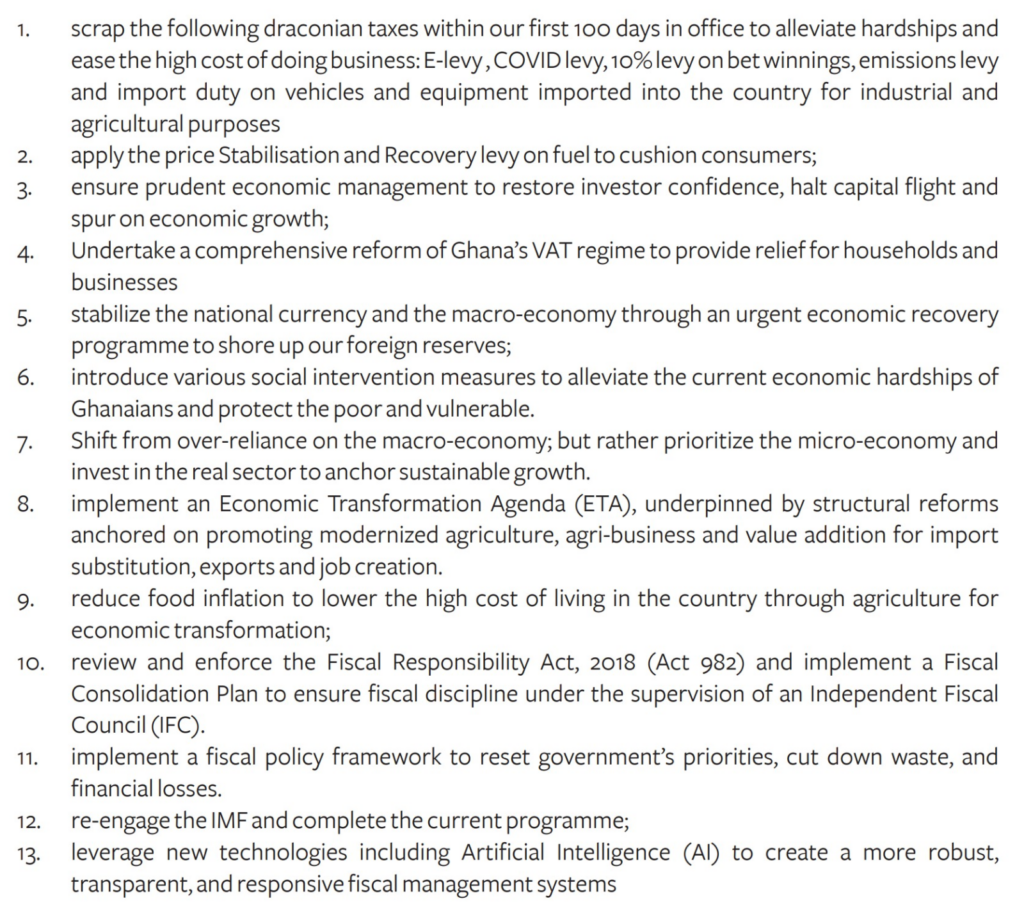

I want to touch on only one set of the issues that came up: the ruling NDC party’s manifesto pledge to kill the following taxes: a) e-levy b) COVID-19 levy c) betting tax d) emissions levy e) and import duties on industrial and agricultural equipment and vehicles.

1. The e-levy is a distortive tax. It is undermining the digital sector. Worse, by distorting consumer and business behavior, we believe it is starting to cross-cannibalise other taxes in the digital sector, such as communications services taxes, which have been declining in value in real terms over time. It is usually good for political parties to keep their promises to voters. Of course, one can argue that the exception to this is when the promises are patently absurd.

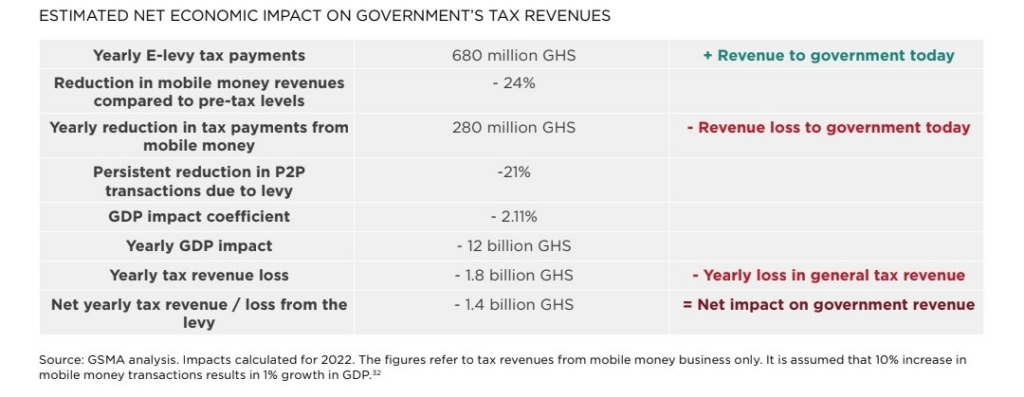

2. Abolishing e-levy is not absurd. Doing so is supported by many rigorous analysts. The most detailed assessment of e-Levy’s impact that I know is the one by the GSMA, described in the hyperlinked reference above, which showed that in 2022, e-Levy LOST the government 1.4 billion GHS. The reader should pay serious attention: e-Levy is already LOSING Ghana money by undermining growth in the digital sector and thus cannibalising other revenue sources as summarised below.

The Finance Minister designate says the e-levy will go within 120 days. No one will miss it. Right from its inception, activists debunked basically every justification made in support of the ungodly e-levy.

3. At any rate, the new government must conduct another review of the public revenue framework for the digital economy as a whole and determine how it makes more money from the sector without undermining productivity in the sector.

4. Removing betting tax divides analysts. Some say that because gambling is harmful, a tax on betting is not only necessary (because the government desperately needs the money) but smart. My sense is that the evidence tilts towards removing it.

5. The most rigorous assessment I have seen of the effect of gambling tax hikes was one conducted in the United Kingdom context, and the conclusions have been that they are counterproductive. Professor Matthew Rockloff of Central Queensland University and Dr. Philip Newall of Bristol University present compelling evidence that gambling taxes simply increase the cost of addiction and do nothing to curb the urge to gamble.

The betting companies just find other inducements to get gamblers to keep gambling but now with harsher financial effects on addicts.

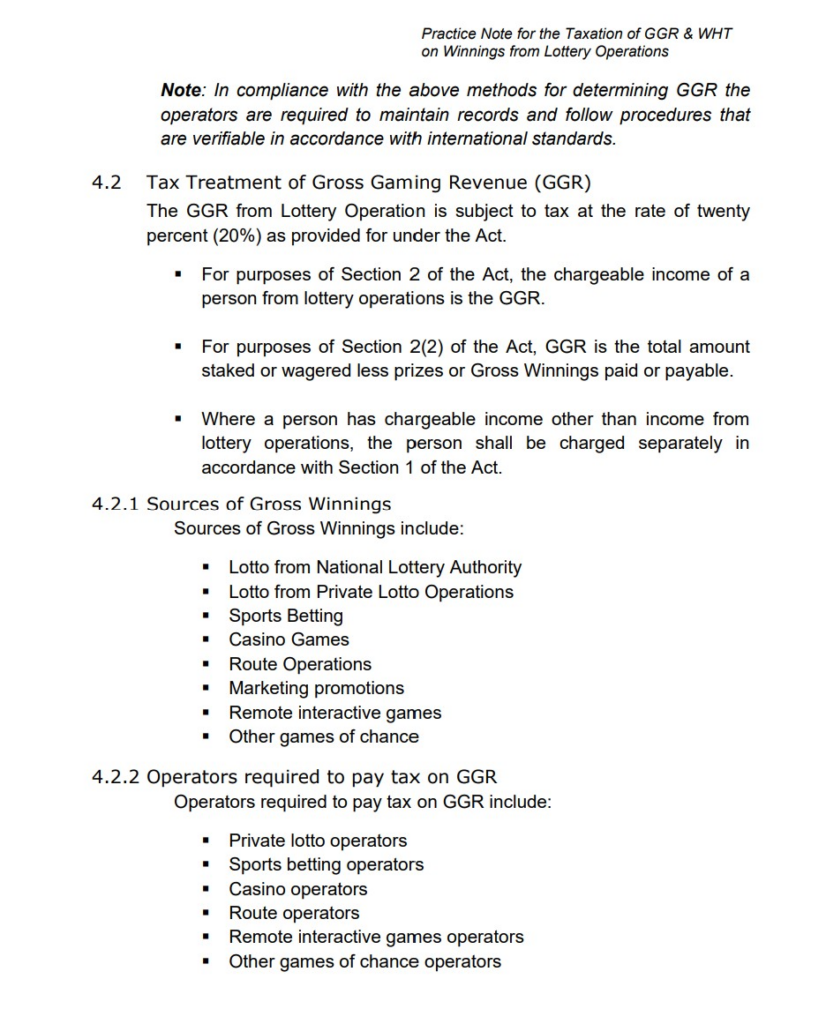

6. There is no reason why removing betting tax, and forgoing the ~$3 million it generates per year, should lead to revenue losses because the government can simply tighten the regime for the betting companies themselves. In the UK, for instance, the government has even gone to the extent of introducing a levy on the companies to pay for anti-addiction therapy.

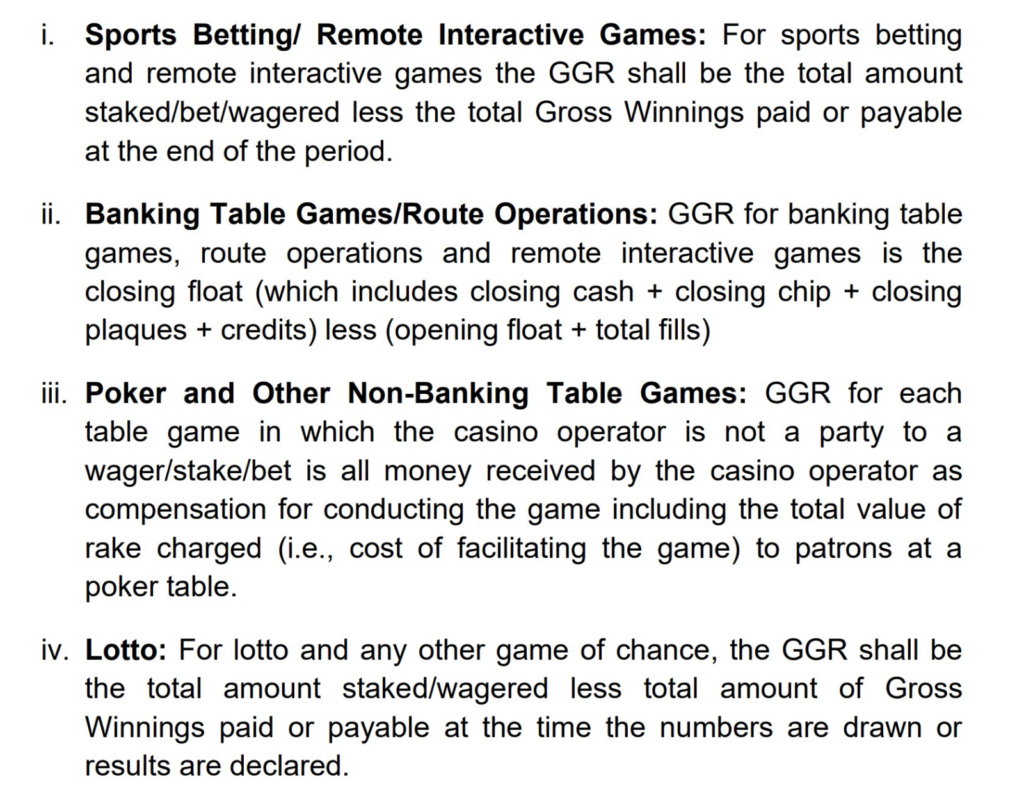

7. In the case of Ghana, it is important for readers to recognise that there are two tax regimes in this sector, and that the NDC government is only proposing to eliminate the smaller regime: the 10% withholding tax on winnings. Untouched will be the 20% tax on the “gross revenue” (GGR) of the betting companies. There has been no commitment not to increase this 20% tax level to say 25% or even 30%.

In Kenya, where betting tax on the companies is 15% of gross revenue (lower than Ghana’s 20%), monthly tax revenues from the betting industry is said to be close to $12.5 million every month. The nearly $150 million a year from the betting industry in Kenya makes taxes on bettors in Ghana (roughly $3 million a year) pale into insignificance.

Nor has the new government tied its hands when it comes to reviewing current concessions such as the arrangement that allows betting companies to carry forward losses they make when gross winnings exceed gross revenue. Such concessions can enable aggressive marketing by allowing the betting companies to lure new bettors with ridiculously juicy odds and high payout ratios.

In short, there are multiple opportunities within the existing tax regime to extract money from gambling for the government without persisting the 10% withholding tax on winnings. Nobody would miss this tax.

8. The NDC government is completely unclear in its reasons for wanting to remove the emissions levy. Here, the problem is lack of clarity about intent. Some analysts, myself included, questioned the measurement model especially on industrial taxpayers. In respect of vehicles, opinions vary as to the likely impact of emissions levy. How carbon taxes within a fiscal framework is a globally contested issue. To be frank, the government needs to quickly do the serious work needed to situate the decision within a clear set of policies, including Ghana’s climate-finance objectives.

9. As far as I am concerned, the COVID-19 levy was merely a stealthy move to raise the VAT rate. For that reason, my analysis in respect of VAT reforms below applies to this levy as well.

10. Removing import duties on vehicles and equipment imported for agricultural and industrial purposes could become distortive. Here is how. If I import a Kia truck for my sachet water distribution business and use it every Friday for that purpose but, in the rest of the week, it does some light corporate-trotro duties (minibus transport or rentals), do I deserve a tax waiver? If I bring in a giant articulated truck to transport corn from the North once a month and, the rest of the time, it also carries vehicular spare parts around, is that “agricultural” enough? Is “spare parts” cartage industrial enough? You get the picture.

11. These kinds of tax policies leave too much discretion to the tax authorities who sometimes abuse it. All said, it is not clear whether this is a good or bad tax waiver. That determination belongs to a more comprehensive assessment of the entire tax exemptions logic in Ghana and should thus probably not have been a manifesto pledge.

12. To further buttress the point, it is to be noted that the practice of exempting specified equipment from duties has been a longstanding element of Ghanaian tax policymaking with limited effect.

For example, the below list is a verbatim extract from the schedule to the 1995 customs and excise law regarding items exempt from duties:

Machinery, apparatus, appliances and parts thereof, of the following kinds:

(a) Agricultural and horticultural;

(b) Marine;

(c) Mining and dredging;

(d) Railway and Tramway;

(e) Industrial including timber; and

(f) For use in generating electric current.

Similar exemptions and waivers have consistently been made over the years. Yet, Ghanaian governments rarely conduct any clear impact analysis to understand why previous concessions do not appear to have benefitted industrial and agricultural sector players before proceeding to introduce new variants of the same logic.

13. As for reviewing VAT and removing the COVID-19 levy, which the NDC also promised to do, every government goes through the same motions, often several times during their term. In my modest view, these “reviews” usually end up generating more uncertainty for business. The constant menu, calculation, and burden changes have become a strain on businesses with high transaction turnover, such as retailers. Until we know exactly what the plans for VAT reform are, we can’t say one way or another if this is a good manifesto policy.

Should the nominee for Finance Minister get approved, a foregone conclusion given the degree of parliamentary control by this government, he has some serious work to do in addressing some of the issues raised above.

Latest Stories

-

CFAO partners with Lovol to power Ghana’s heavy equipment market

52 seconds -

‘I don’t know what you call rich’ – Bryan Acheampong on support for Wontumi’s GH¢50m bail

10 minutes -

Dr. Who? Ghana’s Epidemic of Degrees without Diagnosis: Satirical Musings on Ghana’s Curious Obsession with Titles

13 minutes -

Glaucoma Laser treatment launched at St. Thomas Eye Hospital

25 minutes -

Hindsight: What does the law say about Nations FC’s walk-off?

27 minutes -

Mahama outlines the bold vision behind establishment of the GoldBod

32 minutes -

Highway robbers make off with over 1.7 million CFA, jewellery, and phones at Gomoa Potsin

33 minutes -

Put Ghana first: Asantehene tells Mahama appointees during courtesy call

38 minutes -

Why Otto Addo should maintain these players in the Black Stars going forward

41 minutes -

Ghana Voice Actors Community officially launched in Accra

57 minutes -

Dr Sodzi Sodzi-Tettey honoured with Doctor of Science Degree by UHAS for contributions to health and leadership

59 minutes -

UHAS-Nkabom Project: A $9.8m vision to transform public health, tackle unemployment, and end malnutrition

1 hour -

TGS brings health and financial hope to Ngalekyi fishing community

2 hours -

Prof Zottor urges journalists to lead public nutrition awareness in Volta and Oti regions

2 hours -

Karpowership champions reliable, inclusive power solutions for industrial growth

2 hours