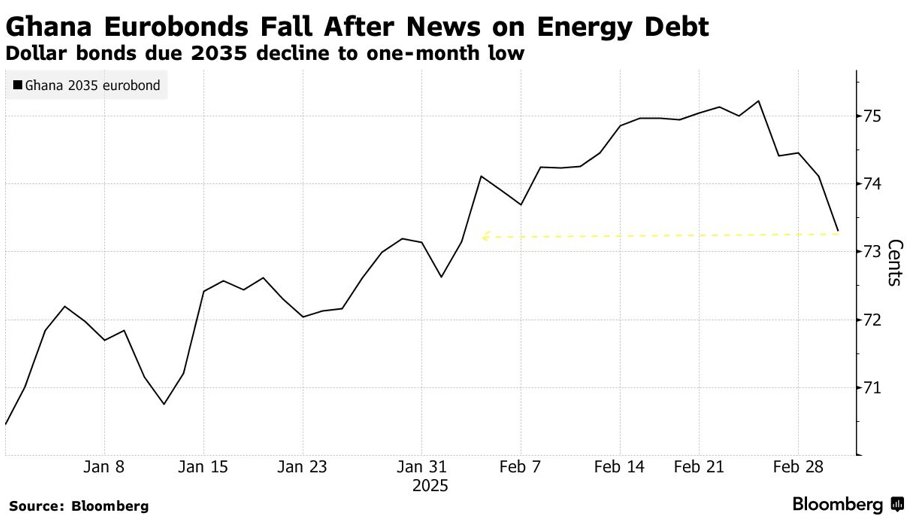

Ghana’s Eurobonds fell sharply on Tuesday, 4th March 2025 ranking among the worst-performing assets in emerging markets.

This followed Finance Minister Cassiel Ato Forson’s warning during the national economic dialogue in Accra, on Monday, 3rd March 2025 that the country’s energy sector debt could double to $9 billion by 2027 without urgent intervention.

When the cedi depreciates, Ghana’s debt burden increases, making repayments more expensive. Investor confidence in Ghana’s Eurobonds fluctuates based on economic stability, fiscal policies, and debt management strategies.

According to Bloomberg data, Ghana’s dollar bonds maturing in 2035 dropped by 1.1% to 73.3 cents on the dollar, reaching their lowest level in a month, while securities due in 2030 fell by 0.9% to 77.83 cents.

The Electricity Company of Ghana (ECG) has been a major contributor to the rising energy debt, Forson explained, as it can only account for 62% of the electricity it purchases due to distribution and collection inefficiencies. He also attributed the crisis to low electricity tariffs and lack of competition in power generation.

Despite restructuring most of its 737 billion cedis ($47.5 billion) public debt in October—including Eurobonds—Ghana remains in negotiations with 60 international banks to restructure $2.7 billion in loans. President Mahama has pledged to curb government spending, refine the IMF’s $3 billion programme, and rebuild investor confidence in Ghana.

Energy Minister John Abdulai Jinapor has indicated that the government will explore private sector participation in energy distribution and revenue collection. Within six months, a decision will be made on whether to pursue full privatisation or a concession model, where a private entity would manage operations for a fixed period before handing control back to the state.

Latest Stories

-

Ending galamsey requires national will, not new laws – Legal expert

29 minutes -

APSU-USA urges government to restore Catholic Church’s role in school management

1 hour -

Ghana ranked 9th in Africa with highest outstanding loans to China

1 hour -

OMCs to implement GH¢1.0 Energy Sector Levy from June 16, 2025

2 hours -

T-bills auction: Government fails to meet target; but rejects GH¢1.095bn of bids

2 hours -

NPP doesn’t give chance to non-performing candidates – Kennedy Agyapong

2 hours -

Roland Garros: Alcaraz completes epic comeback against Sinner to claim title

2 hours -

Obaasima donates over 2,000 sanitary pads to mark Menstrual Hygiene Day, empowering girls in Western Region

3 hours -

Tension in Effiduase as family rejects destoolment of chief who resisted controversial sale of COVID-19 cemetery land

4 hours -

Hamburg Sustainability Conference 2025 concludes with new global alliances and concrete commitments for a sustainable future

4 hours -

GPL 2024/25: Hearts of Oak beat Samartex to finish fourth

4 hours -

GPL 2024/2025: Bechem United clinch win in final home match against Young Apostles

4 hours -

GPL 2024/25: Asante Kotoko end season in fifth after Vision FC defeat

4 hours -

Economic Fighters League condemns ‘D-Levy’ as symbol of deepening inequality

4 hours -

2024/25 GPL: Dreams FC thrash Legon Cities 4-1 to end season on a high

4 hours